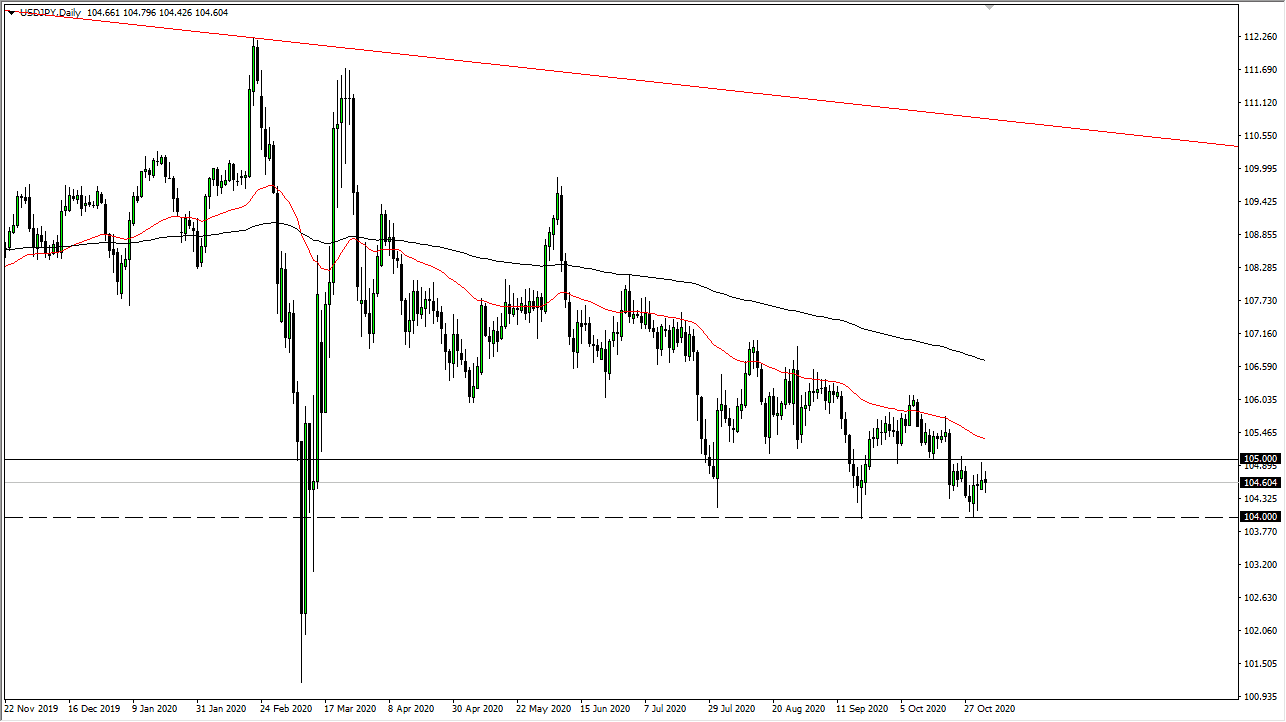

The US dollar has fluctuated during the trading session on Tuesday, as the markets awaited a reaction to the US elections. The market continues to hear noise in general and a clear-cut trading range. The ¥105 level has been resistance, just as the 104 level underneath has been significant support. Forming a neutral candlestick during such an uncertain day does not surprise me. I think it is only a matter of time before we have to make a bigger move.

That bigger move could be a breakdown below the ¥104 level, which signifies that we could go down to the ¥102 level eventually as it is the recent bounce that we had formed. The market also has to pay attention to the moving averages above. The 50-day EMA has been significant resistance, extending all the way to the 200-day EMA. The market is facing a “zone of resistance” so it would be very difficult to get above there. That's why for now I am a seller only, as I would be looking to fade signs of exhaustion.

I do not think this market will be easy to trade in at all times, but it certainly has a negative bias. The US dollar could fall due to the potential of a drawn out election, or perhaps due to the massive amounts of stimulus that are almost certainly coming. Because of this, I think we are looking at a scenario that is a “lose-lose situation” when it comes to the greenback. Fading rallies continues to be the best way going forward and I think that eventually we will get a snap lower, perhaps due to a major “risk off” scenario. Not until we break above the 200-day EMA would I be a buyer, which is something that I do not see happening anytime soon. If we do get down to the ¥102 level, I would expect a significant fight down in that area, not to mention the fact that it could also bring in the attention of the Bank of Japan.