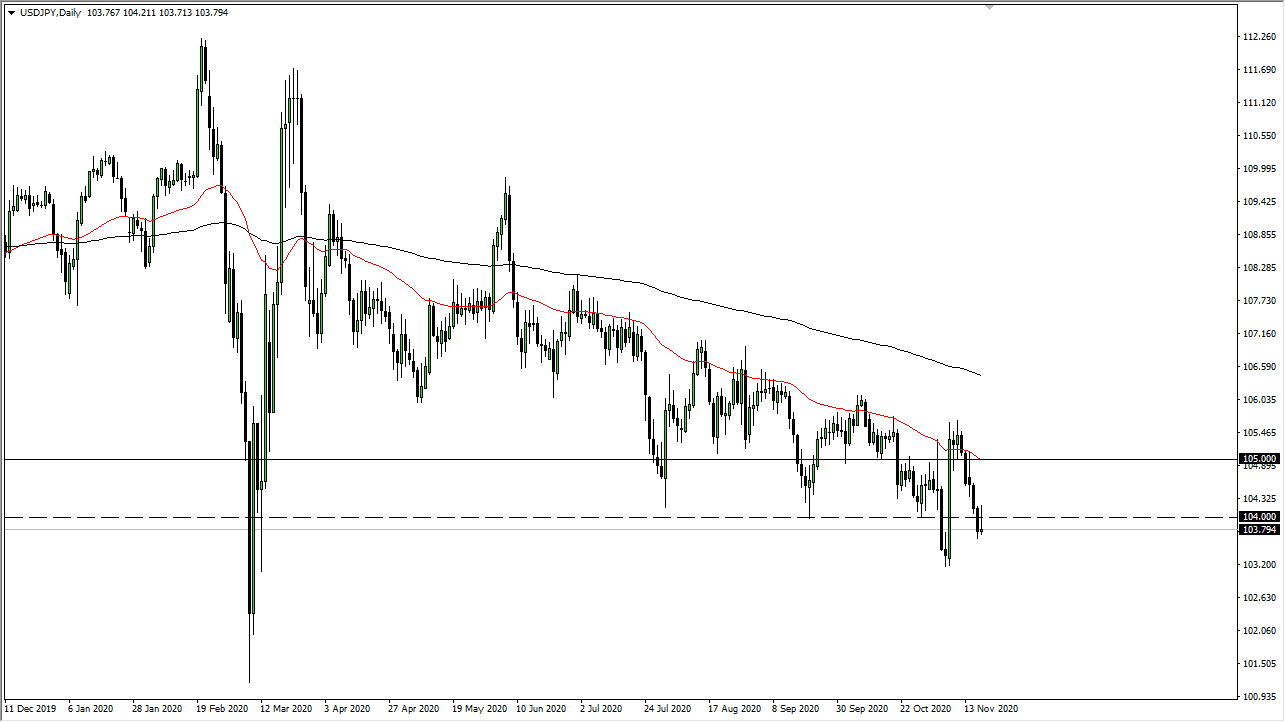

.The Japanese yen has been very strong for quite some time, and therefore I think it is obvious that the trend is trying to continue. The 50 day EMA above is at the ¥105 level, which is an area that also will attract a lot of attention. All things being equal, I think that simply fading the market is the best way to go going forward.

Looking at this chart, I think that if we break down from here, we could see the ¥103.25 level test it again. After all, that was where we bounce from previously and therefore it will be a bit of a magnet for price. Eventually, think we could even break down below there and perhaps go chasing the ¥102 level. All things being equal, it makes quite a bit of sense that we would continue to see downward pressure, because there is so much uncertainty out there when it comes to the coronavirus and the overall global economy. Beyond that, the Federal Reserve is likely to flood the markets with liquidity going forward, so that could also put downward pressure on the US dollar in general. All things being equal, this is a market that I see absolutely no interest in trying to short, and therefore I look at the short-term rallies like we saw during the day as opportunities to get short yet again.

I do not expect massive moves, and I do not expect sudden once. I believe that this is going to be more or less a grind lower, as all currencies are somewhat bearish. That being said, the Japanese yen continues to get a “safety bid” if nothing else. The argument for buying this pair makes no sense to me, at least not anytime soon. I think we would have to break above the 200 day EMA which is all the way at the ¥106.50 level to consider doing so but the advantage to that would be it should kick off a major reversal. Simply fading rallies continues to be my strategy for this market, taking profits somewhat quickly.