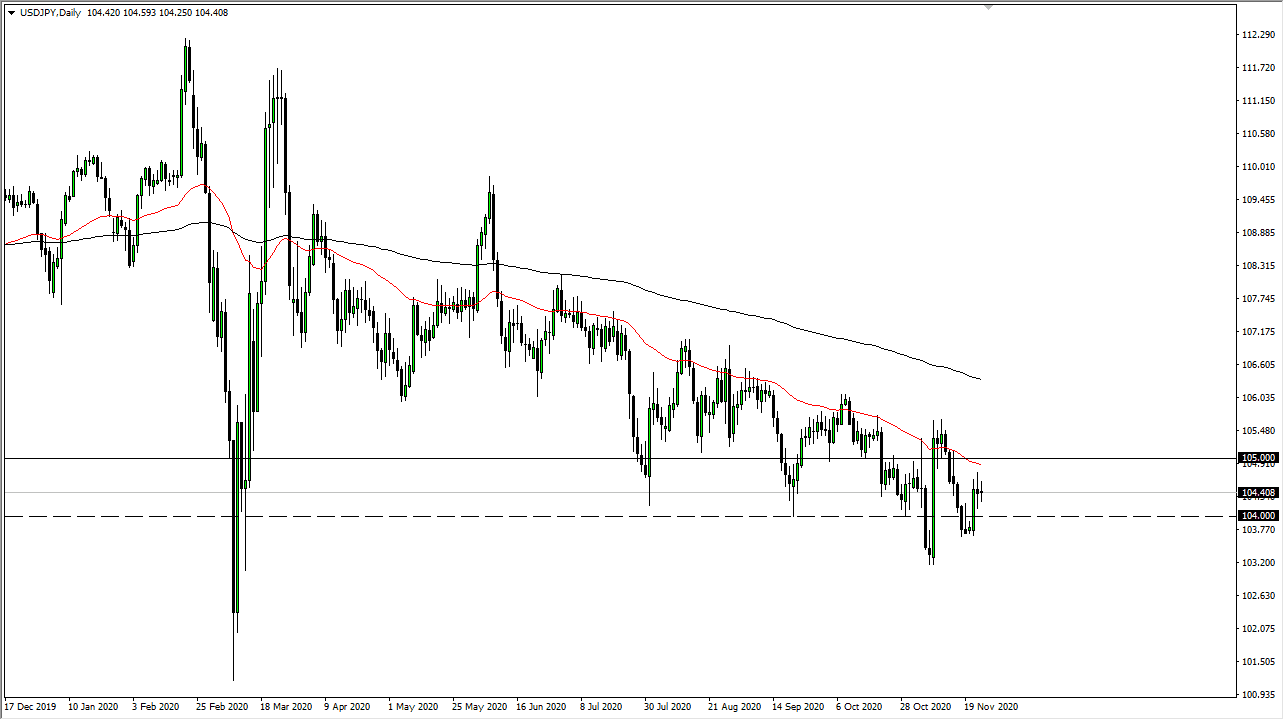

The US dollar fluctuated during the trading session on Wednesday against the Japanese yen, but as we head towards the Thanksgiving holiday, traders are starting to drift away from their trading screens. This is a market that will eventually find clarity. We had a massive shot higher, then a neutral candlestick, followed by another group candlestick on the daily timeframe. This suggests to me that the next move is probably lower, but you still need to be a bit cautious as the volume will be very thin over the next day or two. The last thing you want is a headline that sends the market racing in one direction or the other, and to be on the wrong side of that move.

The market will likely continue to drift towards the downside and fading short-term rallies should continue to work. But even if we did break higher, the 50-day EMA above will continue to offer resistance just below the ¥105 level, and then the area between the 50-day EMA and the 200-day EMA seems to be massive resistance. This does not even take into account the idea of the ¥105 level being resisted due to the psychological factor.

To the downside, the ¥103.50 level will cause a bit of support, but there is even more support down at the ¥103.25 level. After that, we could look at a “flush" down to the ¥102 level. That will happen in due time, but we need to be very cautious about the occasional rally, and I think rallies are to be sold into. After all, the US dollar is struggling in general, and the Japanese yen has the backing of bonds that pay more than the American ones. We also could see the Japanese yen become desirable if there is a “risk off" move as well. I like the idea of shorting and have no interest whatsoever in buying.