The US dollar has fluctuated during the trading session on Wednesday, as the US election has caused volatility. This has essentially killed any desire to put a lot of money to work, because a lot of traders out there are exhausted. One must look at the longer-term charts to discern what may or may not happen.

In the short term, we have real danger of a sudden spike in price. But we are in a downtrend for many reasons, despite the fact that there was an election. Most of what we are looking at right now is the fact that there will probably be stimulus coming out the United States. But the stimulus size will probably be disappointing to some traders, so we may get a pop higher in the US dollar in the short term. The market still has plenty of things to work against it, so at the very least we will probably see a continuation of the longer-term move.

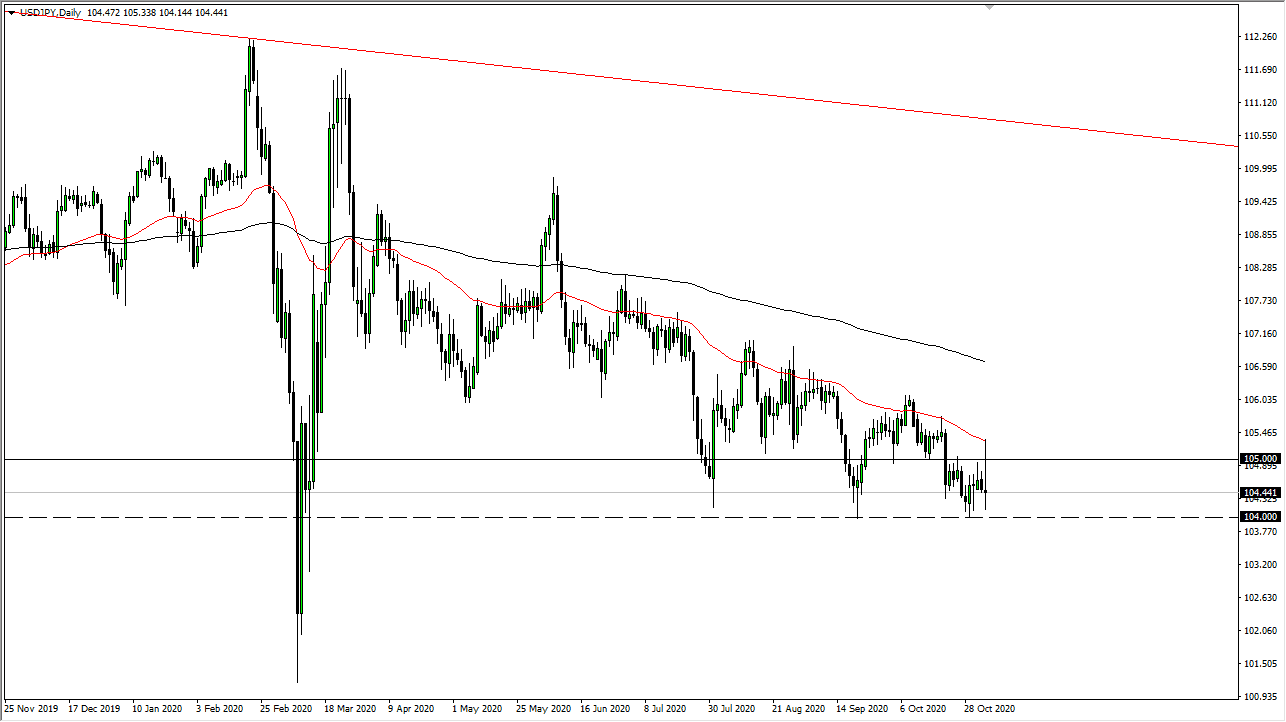

Just above, the market spiked all the way to the 50-day EMA, before turning around and showing signs of weakness. The resulting candlestick for the day looks rather poor, as we said above the ¥104 level. The ¥104 level has been significant support more than once, and then after that it looks like we could go down to the ¥102 level. If you take a look at the chart, you can make an argument for a descending triangle that measures for that move as well, so we are seeing the possibility of a move down to the Japanese yen for no other reason than safety. Expect a lot of volatility, but there is no reason to fight the overall trend. We will continue to fade the rallies, and any shot towards the 50-day EMA continues to be an opportunity to go short. The US dollar will have issues, especially as there is still uncertainty when it comes to the elections and there are probably court battles coming. Nonetheless, the longer-term trend will reassert itself, so that is what you should focus on.