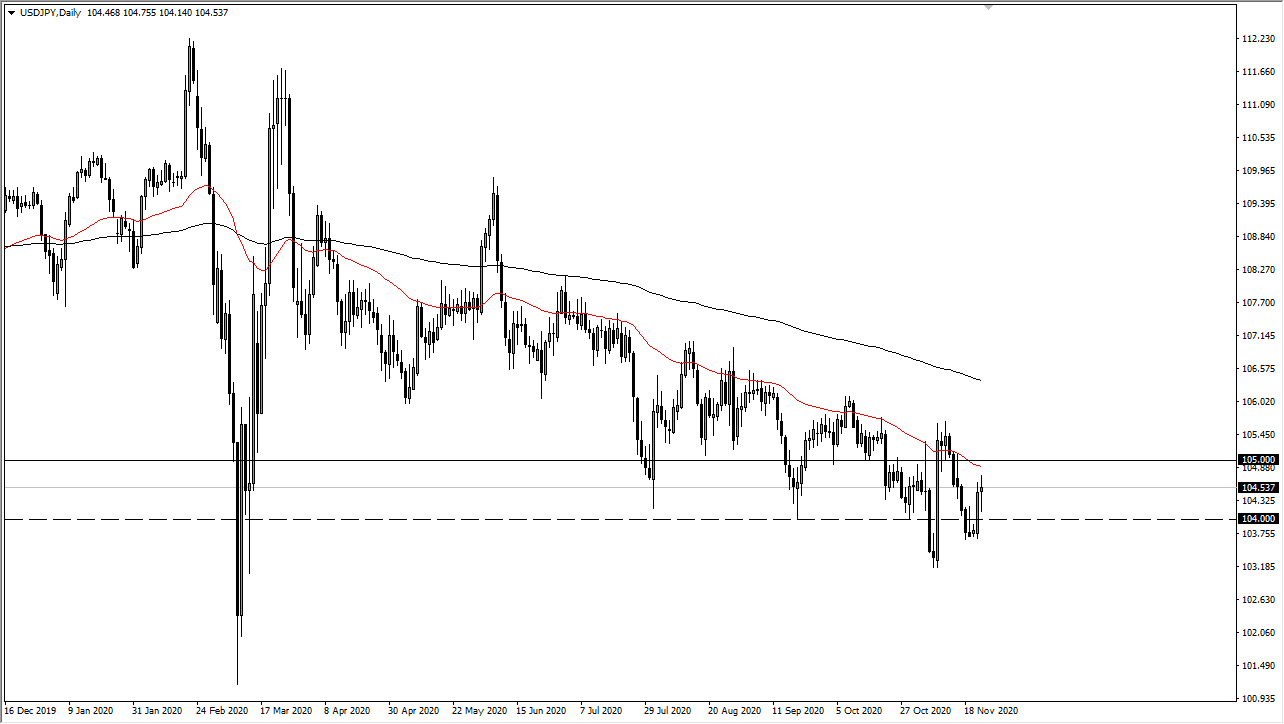

The US dollar was all over the place during the trading session on Tuesday as we continue to see a lot of choppiness against the Japanese yen. The candlestick is somewhat neutral, which is telling, considering just how bullish the candlestick was during the previous session. Keep in mind that we are in a longer-term downtrend, and that is the prism through which you should be looking at this market.

The 50-day EMA above, colored in red on the chart, sits just below the ¥105 level. That continues to be an area in which we should see a significant amount of resistance, so I will be looking for short-term selling opportunities near that region. Even if we break above there, there is going to be a significant amount of resistance extending all the way to the black 200-day EMA on this chart, which is closer to the ¥106.50 level. When you look at the overall behavior of the markets, you can see that between the 50- and 200-day EMA we have seen a lot of resistance, and it does not look like there will be a break through there anytime soon.

I am looking for short-term opportunities as we head into the holiday, so liquidity will become a minor issue. But I do like the idea of fading signs of exhaustion, perhaps towards the ¥103.75 level followed by the ¥103.25 level. After that, it could open up the possibility of a move towards the ¥102 level.

As far as buying is concerned, I do not see an argument for doing so - although one can say that it is more of a “risk on move” if the Japanese yen got sold off. We are seeing stock markets skyrocket due to the vaccine trade, but we are a bit out into the future before we see the vaccines actually distributed. Furthermore, the Federal Reserve is likely to keep monetary policy loose for at least two or three years, which will continue to weigh on the greenback. Selling the rallies should continue to be the best play for the market to be traded against. I have no interest in buying anytime soon.