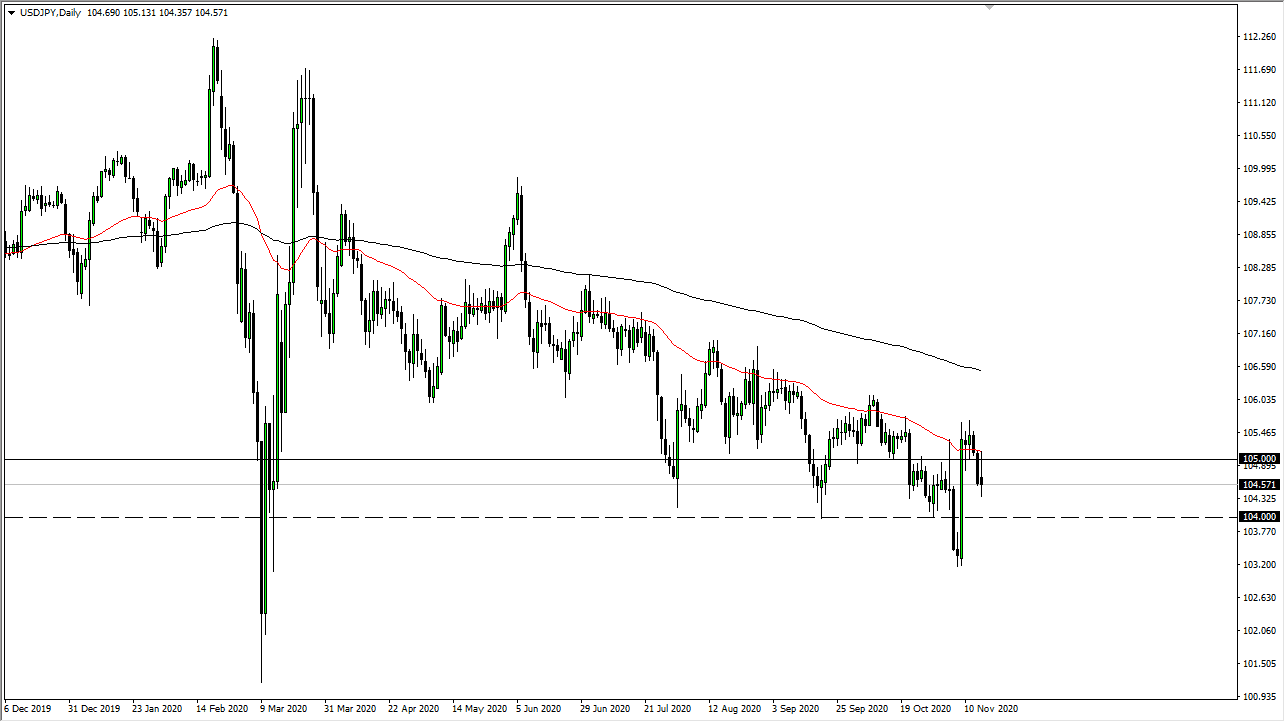

The US dollar tried to rally during the trading session on Monday but continues to see a lot of noise near the ¥105 level. The market looks like it is a bit heavy, and the fact that the 50-day EMA offered a significant amount of resistance is worth paying attention to as well. The candlestick shape is an inverted hammer, which also begs attention. I expect a lot of noise in this pair, but that is nothing new as we have been choppy for some time.

If we break down below the candlestick, the market goes looking towards the ¥104 level next, and then possibly the lows again near the 103.25 handle. This is a market that continues to find sellers on short-term rallies, so we should continue to go lower. The 50-day EMA is resistance which extends all the way to the 200-day EMA. The market is likely to see a lot of negativity in general, mainly due to the Japanese yen being considered a safety currency, but perhaps even more so because the central bank in the United States continues to be very loose with monetary policy and I think it is going to continue to get even more so.

I do not have any scenario in which I am a buyer right now, because I can give you multiple reasons why we will go lower. But I have no interest in trying to buy this market, as it is so negative and has been such a downtrend for so long that it would take something rather significant to turn things around. Looking at this chart, it is very likely that we will continue to go lower given enough time. However, you need to look at short-term charts in order to get short again, as the exhaustion should give you a bit of a “heads up” going forward. But it is difficult to imagine that it will be easy to simply hold on to a position for bigger moves.