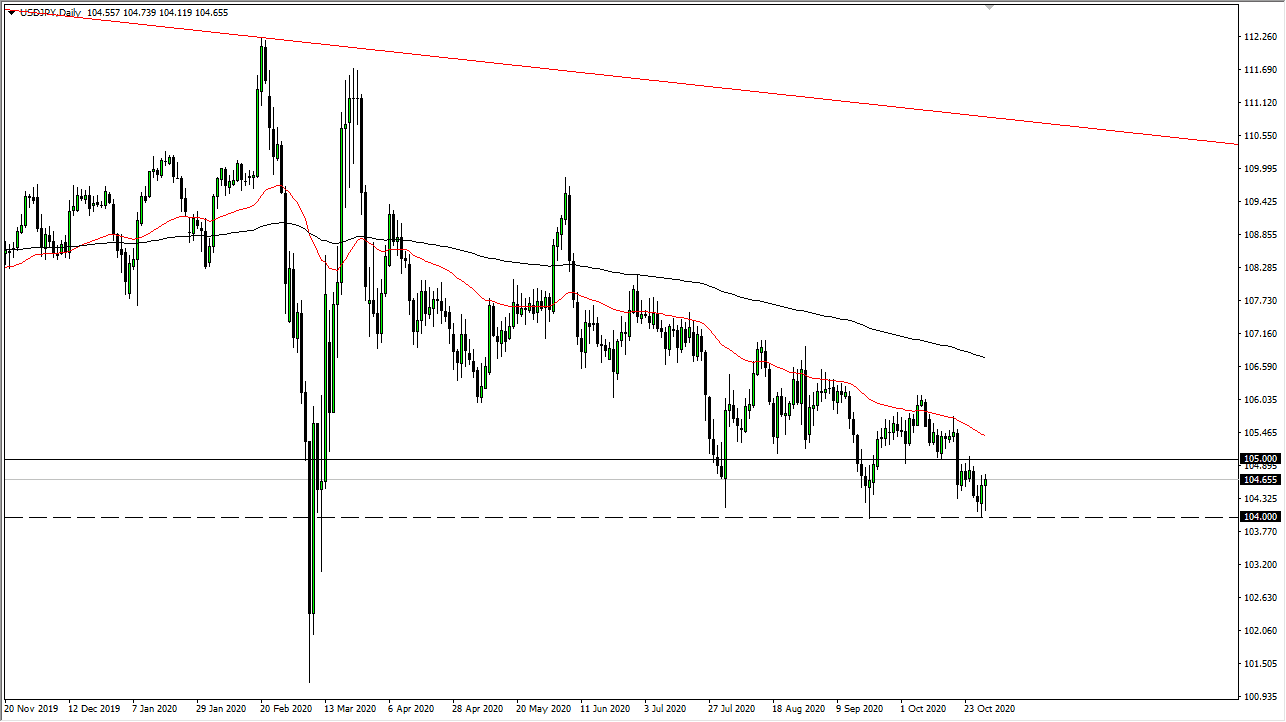

The US dollar has fallen during the trading session on Friday, reaching down towards the ¥104 level yet again. The market found buyers and we turned around to find signs of support. The resulting candlestick ended up forming a hammer, and suggests that we may get more of a bounce. The market is likely to see a lot of choppiness, but we still have plenty of negativity in general as the Japanese yen continues to attract a certain amount of attention.

The US dollar could get hit due to stimulus anticipation, but this pair is somewhat risk driven as well. The more fear people feel, the more this pair will drop. Furthermore, if we break down below the ¥104 level, a massive selling opportunity will open up, perhaps reaching down towards the ¥102 level. IThe market is likely to hear a lot of noise, and you therefore continue to fade rallies as they occur. The market is likely to continue to find resistance above - not only at the ¥105 level, but also the 50 day EMA. I am looking for signs of exhaustion so that I can start fading this market.

I have no interest whatsoever in trying to buy this market, even though I like the US dollar on the whole. After all, the Japanese yen is often bought in times of concern, so if you are looking to buy the US dollar you will probably have a better opportunity shorting EUR/USD, AUD/USD, NZD/USD, and so on. As far as buying the US dollar against the Japanese yen, it might be difficult to do at this point in time. I think it is easier to simply wait for either break down below the ¥104 level, or signs of exhaustion that can be advantageous. I have no interest in buying, as I believe there is a significant amount of resistance between the 50 day EMA and the 200 day EMA.