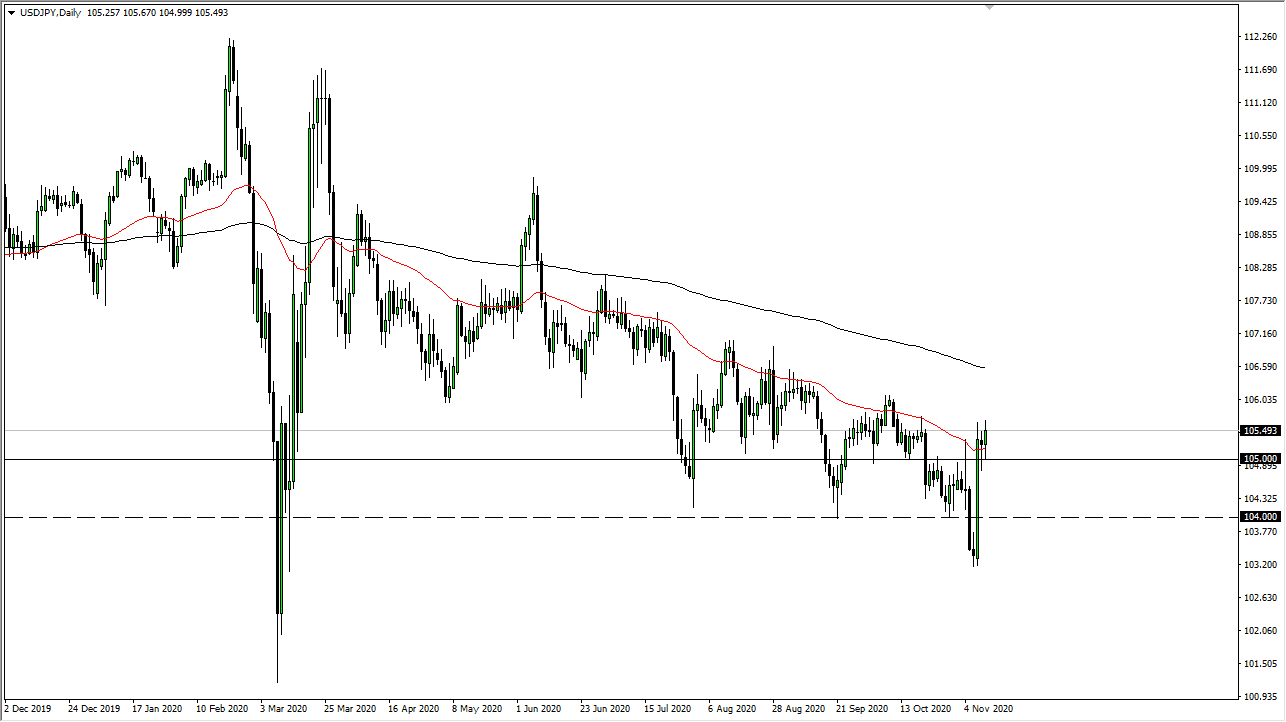

The US dollar initially pulled back against the Japanese yen to reach down towards the ¥105 level. The market is likely to see the ¥105 level as crucial, since it is a large, rounda and psychologically significant figure. It is also an area where we have seen both support and resistance, which in the past we have bounced from rather hard and showed signs of life again, but then gave back some of the gains. The ¥106 level continues to be an issue for buyers to get past, and it will be interesting to see how this plays out.

The money candlestick was extraordinarily bullish, and it does suggest that there could be something more to this turnaround. However, we have not confirmed an uptrend yet, so I'm still looking for potential selling opportunities. I do not have that right now, and I certainly do not have reasons to simply go long either. What we are looking at here is a market that is trying to figure out what to do next, and our job will be to simply follow what happens. It looks as if we are going to continue struggling, but eventually we should get some clarity. If and when we do, the market will be likely to see a big move.

If we break down below the candlestick from the Tuesday session, then it opens up a move down to the ¥104 level, perhaps even down to the ¥103.50 level in the short term. The market is in a downtrend, so do not be overly surprised to see that happen. Buying the pair is a bit difficult, but we have certainly had a “shot across the bow” when it comes to a potential trend change. I will be on the sidelines trying to figure out where to go next in what could be an explosive move. But there is a significant amount of resistance between here and the 200-day EMA, so I still have a negative bias overall, at least in the short term.