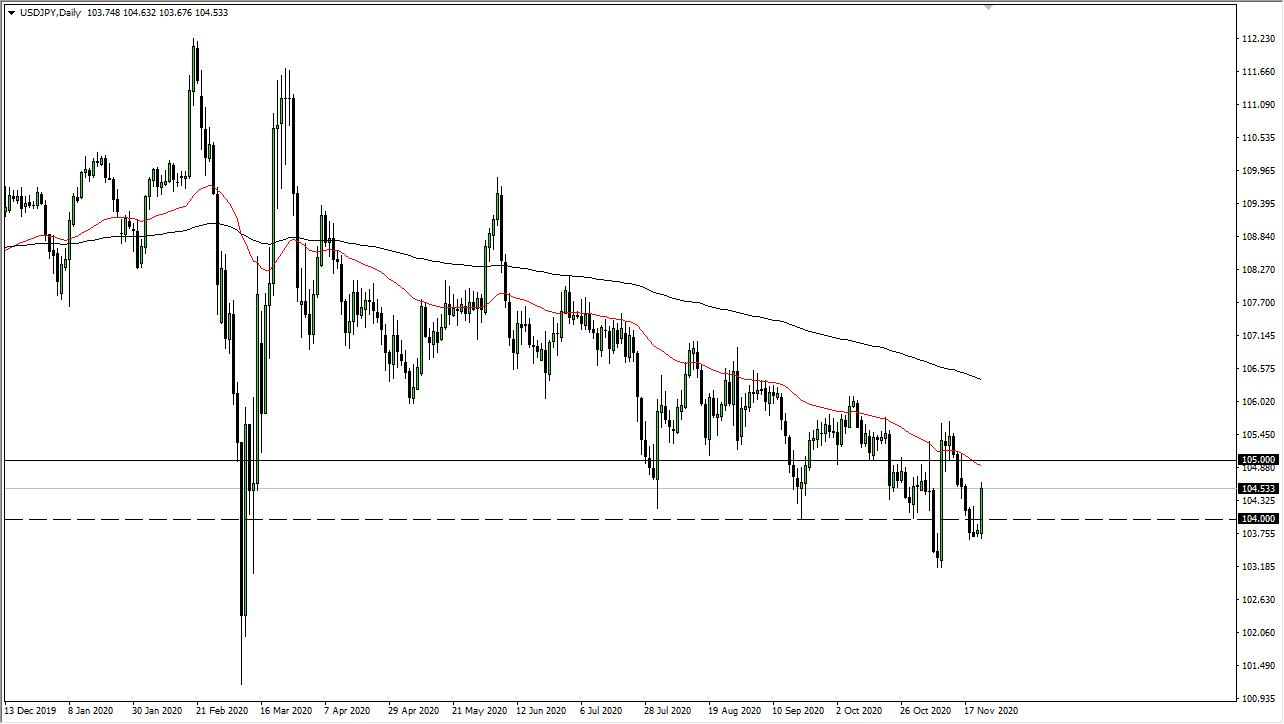

The US dollar rallied quite nicely against the Japanese yen during the trading session on Monday, as there was a surge into the greenback due to Brexit headlines that had people covering the euro and the pound. This had a “knock on effect” against the Japanese yen, but we are still very much in a downtrend and not much has changed, despite the fact that we saw a nice rally in a short amount of time.

The market has failed every time we get close to the 50-day EMA, so we should start looking for selling opportunities above, or perhaps on shorter-term charts. I do not have a scenario in which I'm willing to buy this pair anytime soon, due to the fact that the US dollar has been sold off quite drastically and the pair has been in a downtrend for quite some time. Also keep in mind that the Federal Reserve is likely to continue to loosen monetary policy, which will work against the value of the greenback.

On the other hand, the Japanese yen is also considered to be a safety currency, which will come into play as well. Pay attention to the 50-day EMA, as we have seen it offer a “wall of selling” against the greenback multiple times over the last several months. Because of this, the market is likely to continue to find plenty of selling pressure above. Rallies will continue to be sold into, possibly off short-term charts.

We will likely continue to see support underneath, but given enough time, we will go looking towards the ¥103.25 level, and then possibly even beyond. The USD/JPY will continue to see an overall downward attitude come into play, which has been so firmly ensconced in the pair. Every time we had a sudden burst higher, we have simply sold off into it, and I expect that to continue.