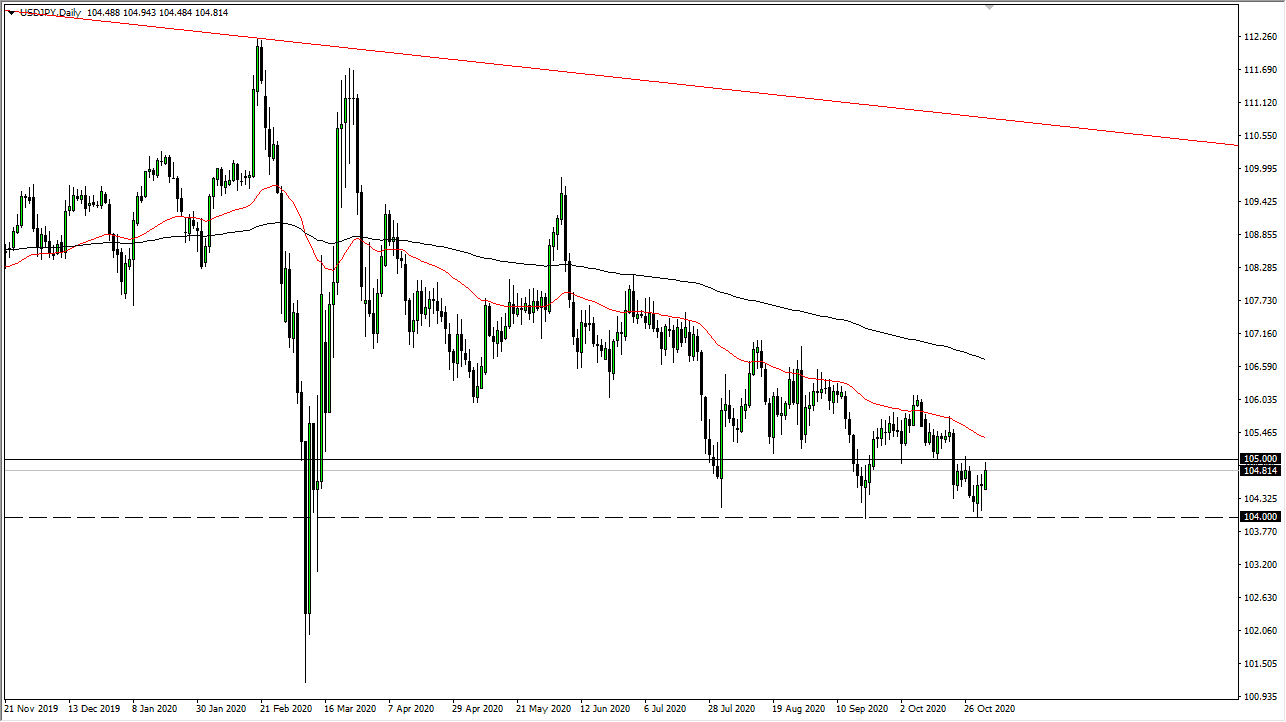

The US dollar rallied again during the trading session on Monday to reach towards the ¥105 level. That is an area which has been supporting resistance more than once, and is a large, round and psychologically significant figure garnering attention. I do think that we will drift lower and eventually break down. When you look at the longer-term chart, you can see that the ¥104 level has been supported in the past. It looks as if we are trying to form a descending triangle, to which maUSny people will be attentive.

What I find interesting is that if we were to break down below the ¥104 level, it is very likely we could go to the ¥102 level. We have seen a major bounce recently in that area, so it follows that the area gets retested. This market is certainly one that is going to be very volatile over the next couple of days, as the US elections will continue to see volatility thrown into this market, and we have the FOMC at the same time. We also have the jobs number at the end of the week, which typically moves this market as well, so there is a plethora of potential trouble.

The 50-day EMA above should be massive resistance, so many sellers will be pushing the market lower there as well. The entire area between the 50-day EMA and the 200-day EMA has been a massive zone of resistance, so it should continue to be going forward unless we see a shift in the overall markets. The only scenario in which I see that happening in the next 24 hours could possibly be a clear-cut decision in the US election, but the odds of that are slim. Furthermore, we would also have to see that the United States would be doing less or even no stimulus, of which the odds are slim to none as well. It is simply looking for a shorting opportunity that I will be doing in this market. Eventually, once we break down below the ¥104 level, things could get interesting.