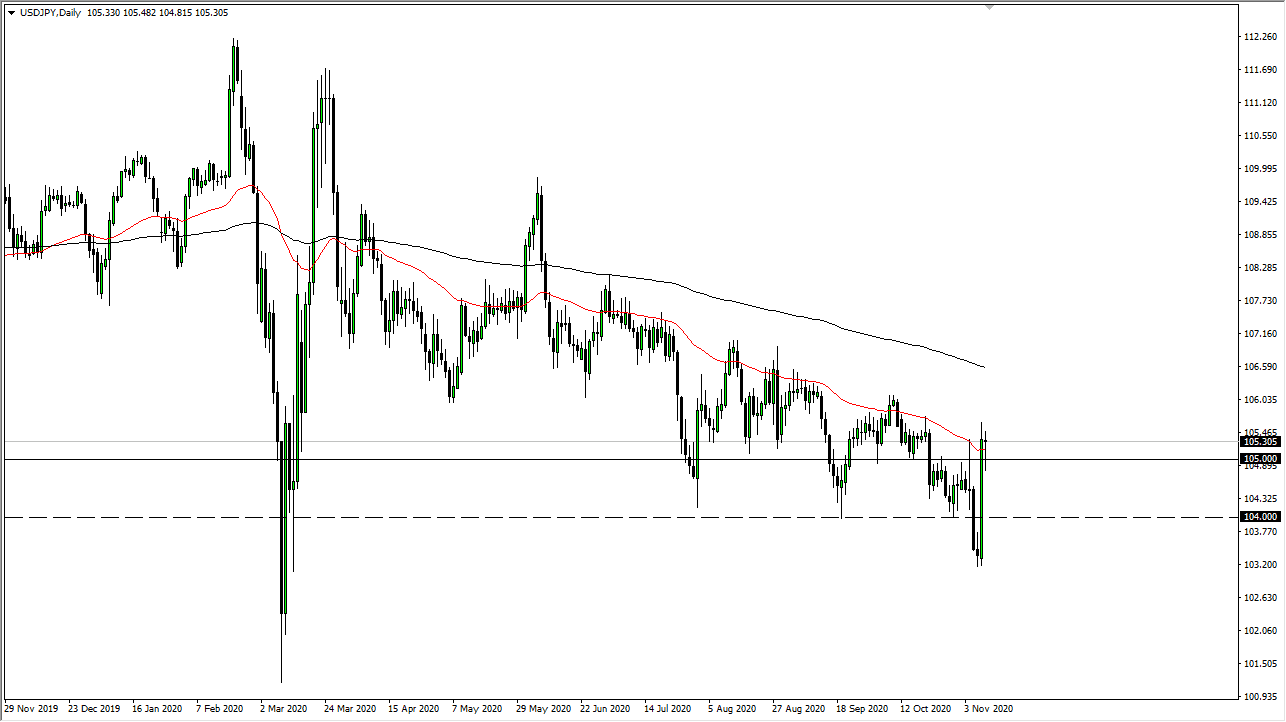

The US dollar has fluctuated during the trading session on Tuesday as we continue to see a lot of back and forth against the Japanese yen. This market has seen an explosive move to the upside, so now it needs to take a breather if the buyers will remain in control. I do not think that is the way forward, but I recognize that we could see an extension due to the behavior of some of the risk appetite-based markets around the world.

The candlestick has shown volatility in this area, considering that the 50-day EMA is sitting right here; that has been an area of contention for some time. The market is likely to see traders looking to go back and forth in this area to settle the longer-term outcome. This is a market that will favor more downside than up, but the large candlestick that formed on Monday must be taken into account as the world celebrates the idea of a coronavirus vaccine. If that vaccine comes to fruition, it is likely that we will see this pair continue to push towards the 200-day EMA. This pair is very risk sensitive in, and we are only one random comment away from spooking the market.

If we break down below the bottom of the candlestick for the trading session on Tuesday, that would be a negative sign which could send this market much lower, perhaps testing the lows again. We are still very much in a downtrend, despite what happened on Monday. That could be the first shot across the bow for a trend change, but that is a bit premature to assume. I am still looking for signs of weakness that I can fade, but I have yet to see it. If we can break above the 200-day EMA, we should have some time to ride out a nice long-term uptrend.