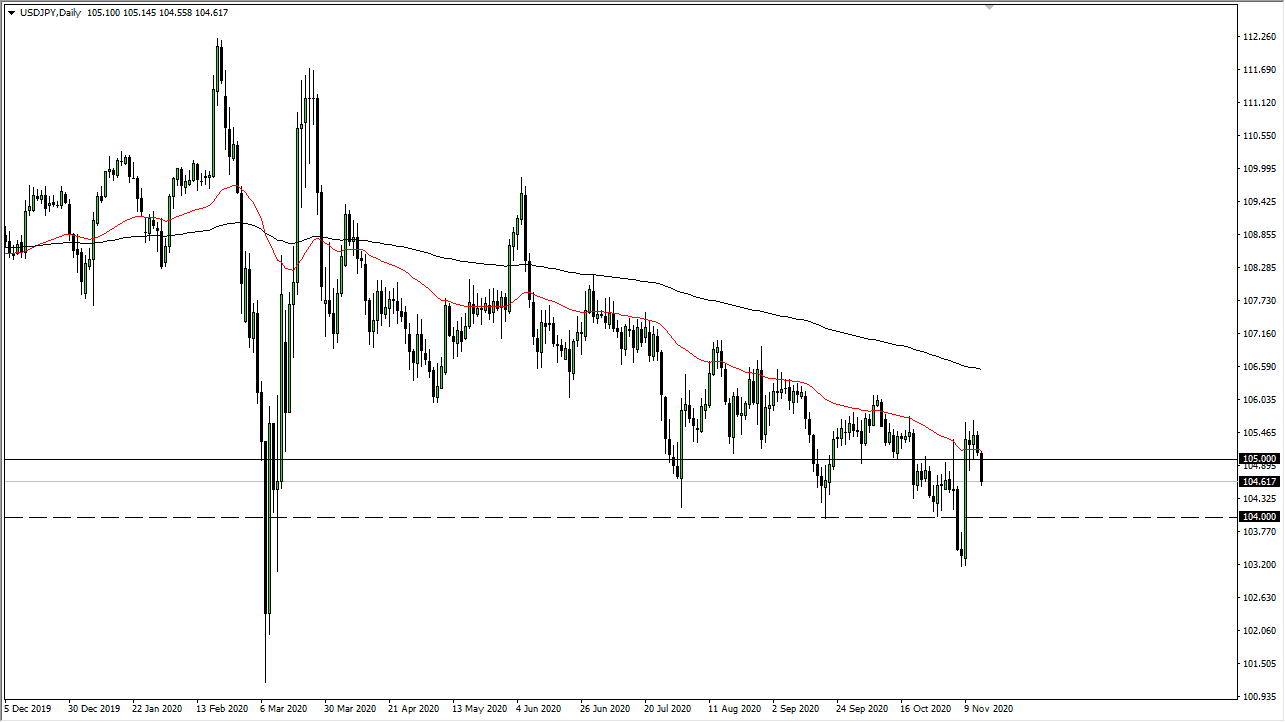

The US dollar broke down against the Japanese yen during the trading session on Friday, breaking down significantly below the ¥105 level. The initial surge higher on Monday was due to the fact that the Pfizer's vaccine trials suggest that they have a 90% efficacy rating. The theory, then, is that this was a major “risk on" event into which people were willing to jump. This means shorting the Japanese yen and thus pushing the greenback higher in this particular market. Since then, you can see that we had gone sideways for a while and then broke down. I think this has a certain amount of reflection upon the reality of the situation built into it.

With coronavirus spiking now and a vaccine several months away, we should see this market rollover in the short term. The ¥104 level is the target, followed by the lows and the ¥103.20 level. I have no interest in trying to get cute and buy this market, although you can make an argument that the Monday candlestick is something that deserves attention.The 50-day EMA has offered resistance yet again, so even though we had that massive bounce, it is the same thing that we have seen for months with this pair. It is simply a continuation of the longer-term trend so far.

Looking at the chart, even if we do rally, it will be difficult to break above the highs earlier this week. It is not until we take out the ¥106 level to the upside that I would be a buyer and start to believe in the idea of a potential turnaround of the trend. It is likely that we will continue to go towards the ¥102 level, as has been the analysis for some time. It is also worth noting that the candlestick for the trading session on Friday is closing towards the absolute bottom, which typically means there should be a follow-through. With all of the mounting risks out there, it makes sense that the Japanese yen continues to be favored overall.