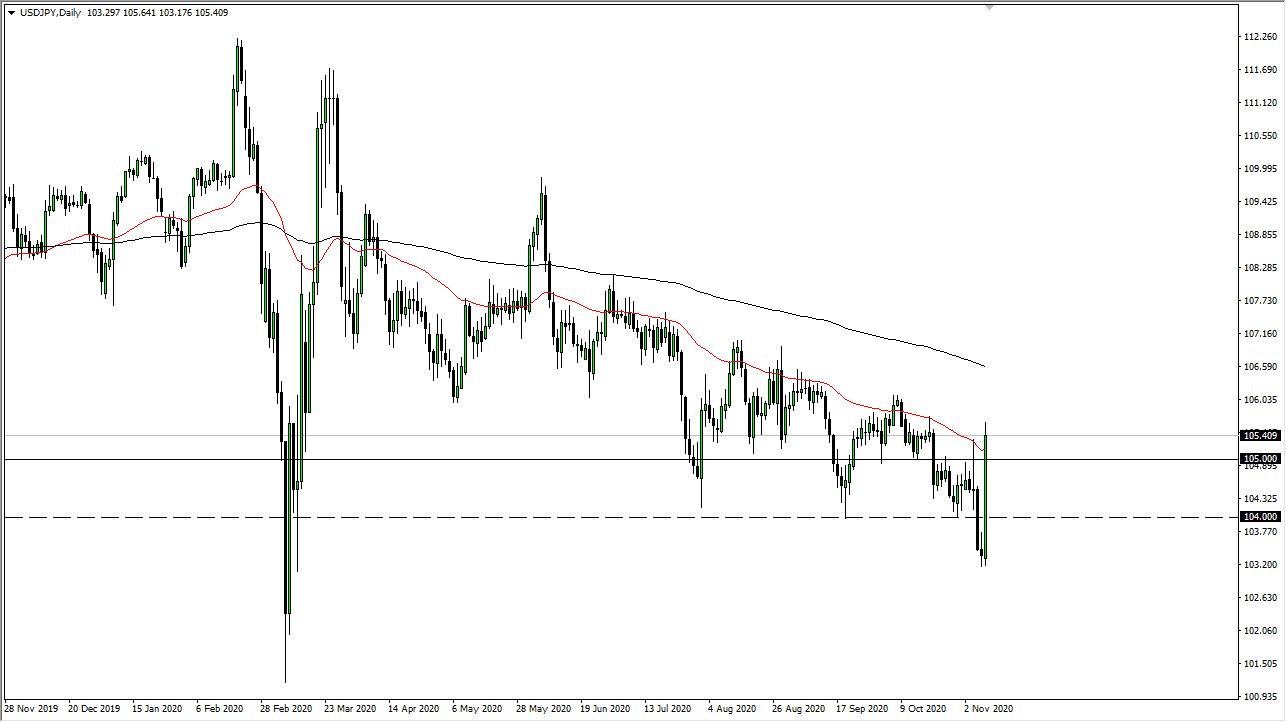

The US dollar exploded to the upside during the trading session on Monday, reaching above the ¥105 level, as it was announced that Pfizer is close to releasing a coronavirus vaccine with over 90% efficacy. However, we have reached the “zone of resistance” between the 50-day EMA and the 200-day EMA, an area that has been large for quite some time.

Looking at the size of the candlestick, you can see this is a market that continues to see volatility. But the fact that we were given back some of the gains late in the day tells me that the short-term rally might be just that: short term. While this could be a potential “game changer” longer term, the vaccine is months away and we will likely continue to see choppiness in the short term. The market has been in a downtrend for some time, so there would need to be a major change in order to see a difference. I do not necessarily see that happening anytime soon. If we were to break back down below the ¥105 level, it would be a sign of weakness that I would jump all over to the short side.

On the other hand, if we can turn around and break above the 200-day EMA, which is closer to the ¥106.60 level, then we will likely go to much higher levels. We would then have the prospect of a trend change, but we would need a massive shift in the overall attitude of traders around the world to suddenly get that “risk on.” Looking at this chart, the rest of the week is going to be crucial and I continue to look for selling opportunities, but I will be cautious about putting money to work until I see that break down below the ¥105 level. We are still very much in a downtrend, which has not changed despite the fact that we have seen such a large candlestick. The next couple of days are going to be crucial, and we need to pay close attention.