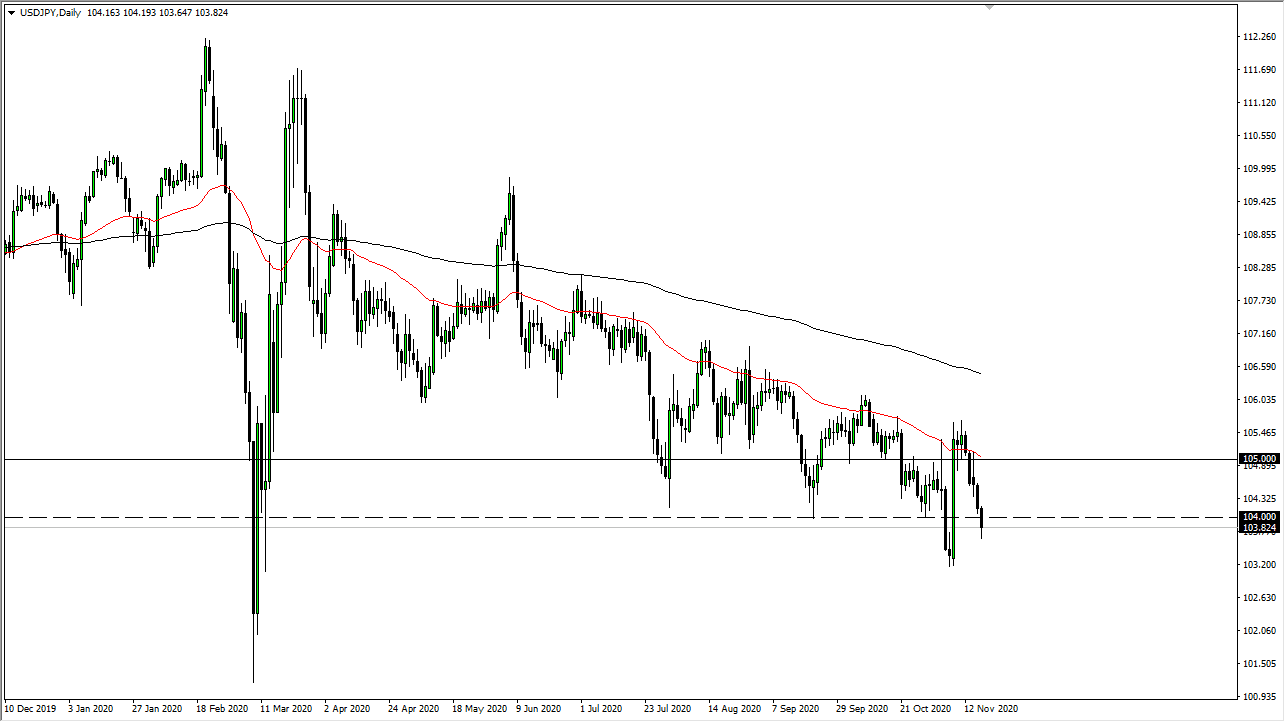

The US dollar has broken down below the ¥104 level, which is a large, round and psychologically significant figure that has offered support in the past. It is therefore likely that we will continue to see a lot of negative pressure in general, but we are getting a bit stretched in the short term. It is possible that we may get a bounce from here, but that is to be sold into at the first signs of exhaustion. Furthermore, even if we do continue to rally beyond a small little bump, there is a massive amount of resistance above at the ¥105 level. I think we will continue to see a lot of selling pressure.

Between the 50-day EMA and the 200-day EMA, there is a lot of selling pressure going back several months, so it follows that we would continue to find opportunities to short this market in that general vicinity. I would look to take advantage of exhaustive candlesticks, as we clearly have a downward bias over the last several months, not to mention years. However, one would have to think that it is only a matter of time before the Bank of Japan loses their sense of humor, perhaps stepping out to warn traders about the market, as they tend to do occasionally. This is a market that will find plenty of reasons to sell off, if for no other reason than the fact that the Japanese yen is considered to be a massive “safety currency".

Underneath, the ¥102 level has been supported, but we would need to get past the ¥103.25 level which has been relatively supportive recently as well. After all, that is where the candlestick shot straight up in the air after the vaccine announcement. Nonetheless, I think that a lot of risk-taking is probably foolish at this point, so you should look at any rally as an opportunity to pick up the Japanese yen “on the cheap.” It is not until we break above the 200-day EMA that I would be a buyer, which is something that we won't see anytime soon.