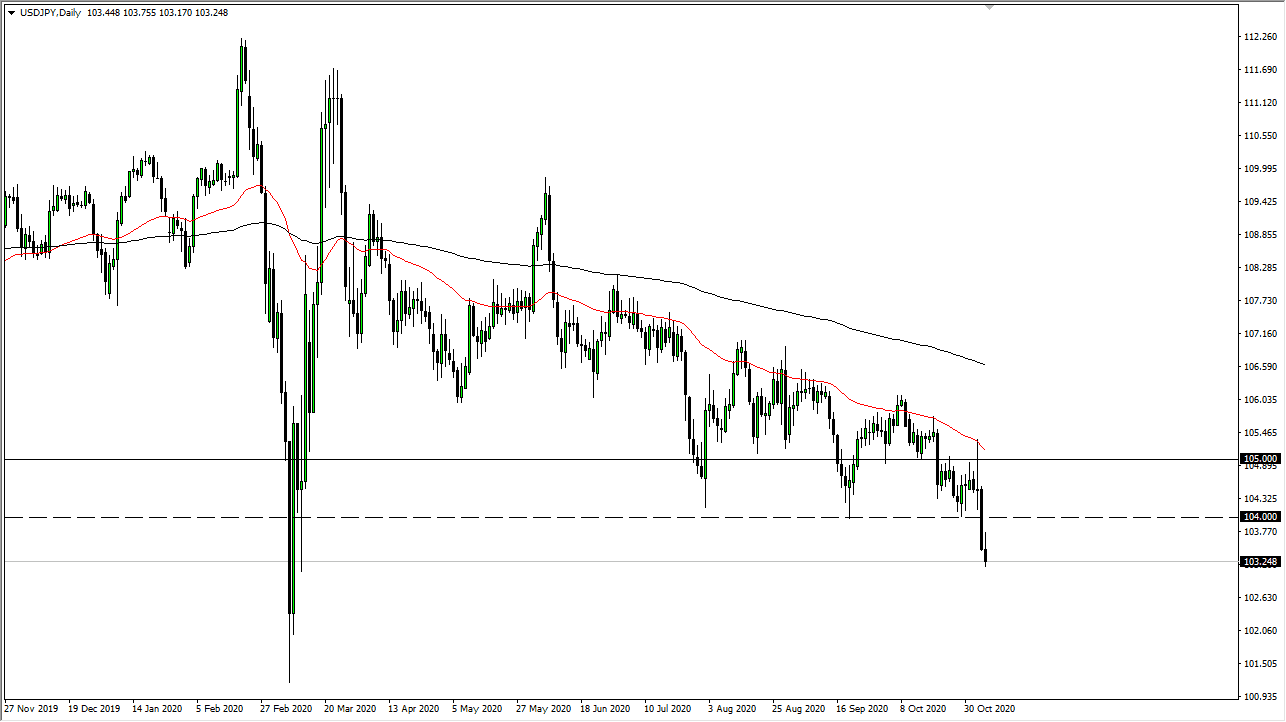

The US dollar rallied initially during the trading session on Friday, reaching towards the ¥103.70 level before pulling back and selling off again. We had just broken through the ¥104 level, and now we look ready to go lower, perhaps reaching down to the ¥102 level. This is based on the measured move of the descending triangle that we just sliced through, and the fact that we had previously bounced from that level rather significantly. This is a market that continues to be a “sell on the rallies” scenario.

Not only is the US dollar weak in general, but even if the US dollar strengthens, it may perform differently over here as the Japanese yen is the “premier safety currency.” If there is a sudden flood of people running towards safe assets, the Japanese yen tends to outperform the US dollar, even if the greenback is rallying against other currencies such as the Australian dollar, Canadian dollar, Euro, etc.

Based on the candlestick, the ¥104 level looks likely to be resistance, and the sellers will come in and push lower. Even if we break above there, the ¥105 level also offers resistance. I do not have any scenario in which I am willing to start buying this pair anytime soon, because if I am looking to buy the US dollar I will do it against other currencies that are “riskier.” You can see that we have gotten extended from the 50-day EMA, so a bounce would make sense. But it really comes down to how the US dollar behaves overall. Right now, this looks less likely to be a safety scenario and more just a simple anti-US dollar scenario. Either way, both of those setups mean that we will fall given enough time, so this is going to be one of the easier trades in general. When it gets to be too expensive you simply sell it as it offers “cheap Japanese yen.” Keep in mind that volatility probably remains high going forward.