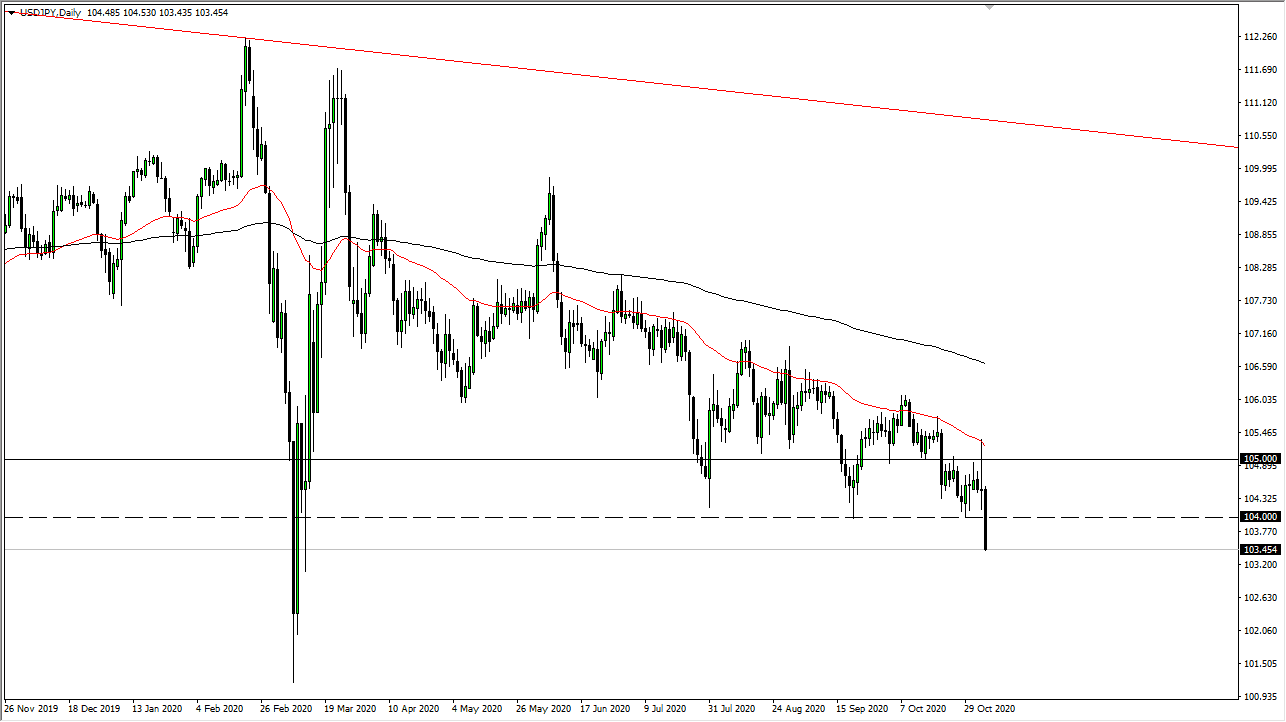

The US dollar has been crashing against the Japanese yen for some time, albeit in a slow-motion manner. We finally broke below the ¥104 level again during the trading session on Thursday, which is the first sign that we are ready to finally go lower. That being said, there are multiple reasons why this may have happened, not the least of which could be the thought of stimulus coming. But what if it is more than that? After all, the Japanese yen is considered to be a safety currency, so this incident being a bit of a “perfect storm” for this pair, because there are so many things out there that could also have people running towards the yen beyond the stimulus.

Looking at this chart, the market looks likely to see continued negative pressure like we have in the past, and when you take a bit of a longer-term look at the market, you can make an argument for a descending triangle that just was broken through. That suggests that we should go down to the ¥102 level, as that is what the measured move suggests. Furthermore, it is an area where we have seen a lot of buying pressure in the past, due to the fact that it is where we resolve the market bounced drastically.

What is even more interesting about this pair is the fact that it is highly levered to the jobs number, which of course comes out during the trading session on Friday. With this, I suspect that we will probably continue to see a lot of downward pressure, and therefore I like the idea of selling rallies, just as we have done multiple times along the way. It looks as if the 50 day EMA is also going to be resistive, so it ties in quite nicely with the ¥105 level.

Ultimately, I think this is a market that has no real direct way of buying it right now, as we have seen so much in the way of sustained downward pressure, even when the US dollar was strengthening against other currencies. With that in mind, I think it is only a matter of time before we get to the downside and the targeted ¥102 level. That being said, it is likely to continue being a grind lower more than anything else as the markets have a lot to chew through.