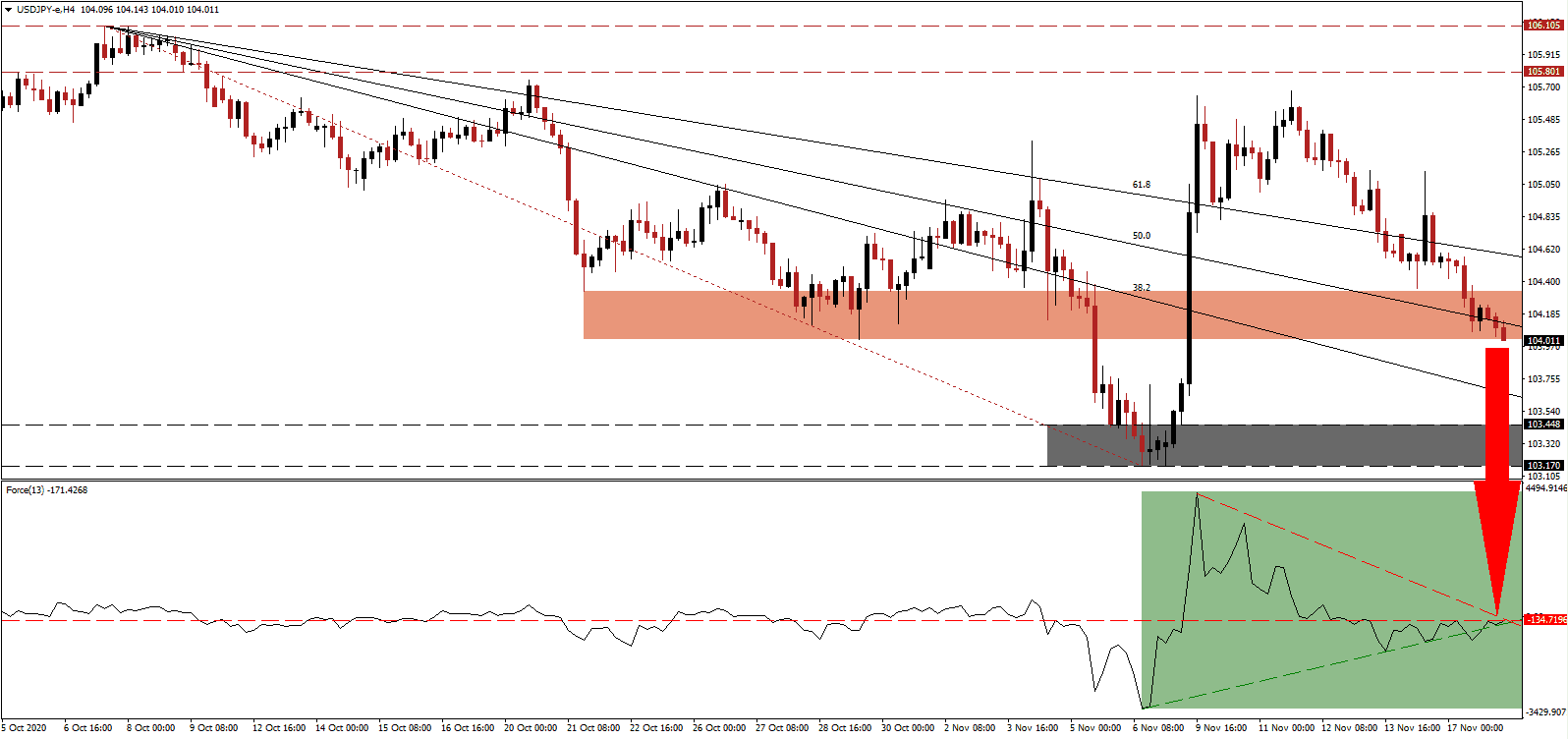

While Japan reports relatively acceptable new COVID-19 infections for its population size, it also carries out significantly fewer tests than its global counterparts in the developed world. After reporting an 8.2% drop in GDP during the second quarter, the world’s third-largest economy expanded 5.0% amid demand for electronics, the fastest pace since record-keeping began in 1980. The USD/JPY converted its previous short-term support zone into resistance from where a pending breakdown can extend the corrective phase.

The Force Index, a next-generation technical indicator, retreated from a multi-month peak and corrected below its horizontal resistance level into negative territory. It is now faced with increased bearish pressures from a developing convergence between its descending resistance level and its ascending support level, as marked by the green rectangle. Bears wait for a confirmation of it, which will grant them complete control over the USD/JPY.

After Japan announced $2.2 trillion in stimulus for Prime Minister Shinzo Abe to support the economy during the first wave of the COVID-19 pandemic, new Prime Minister Yoshihide Suga asked his cabinet to deliver the third one. Haruhiko Kuroda, the Governor of the Bank of Japan, defended the central bank’s policy, referring to it as prudence rather than monetarily-driven. The USD/JPY is on course to move below its short-term resistance zone located between 104.018 and 104.339, as identified by the red rectangle.

Exports for October in Japan declined by less than expected but posted the 23rd consecutive contraction dating back to December 2018. Imports plunged, suggesting more domestic worries ahead, in a sign that economic and monetary policies require adjustment. The signing of the Regional Comprehensive Economic Partnership (RCEP) is expected to deliver a much-needed boost. Bearish pressures in the USD/JPY magnified following the breakdown below its descending 50.0 Fibonacci Retracement Fan Support Level. A contraction into its support zone between 103.170 and 103.448, as marked by the grey rectangle, is favored. From there, price action may extend into its support zone between 101.170 and 101.794.

USD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 104.000

Take Profit @ 101.500

Stop Loss @ 104.600

Downside Potential: 250 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 4.17

A sustained advance in the Force Index above its descending resistance level could lead the USD/JPY into a temporary reversal. The upside potential remains limited to its intra-day high of 105.134 due to ongoing downside pressure on the US dollar. Forex traders should consider any advance as a secondary short selling opportunity with the medium-term conditions for the US deteriorating.

USD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 104.800

Take Profit @ 105.100

Stop Loss @ 104.600

Upside Potential: 30 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 1.50