I have mentioned a lot in recent USD/JPY technical analyses that moving in narrow ranges for a long time heralds a strong price explosion in one of two directions. But there was a cautious anticipation until the results of the US presidential elections were known. At the beginning of this week's trading, we noticed a strong bullish rebound for the USD/JPY pair, which recorded its best daily performance since last March. The pair jumped from the 103.18 support, its lowest level in eight months, to the 105.65 resistance, before settling around 105.37 at the time of this writing.

In addition to optimism about Biden's victory in the US election, investor confidence and risk appetite increased with the announcement by Pfizer Inc. of its COVID-19 vaccine which could be 90% effective, based on early and incomplete testing results. The announcement brought a huge wave of optimism to a world desperate for a way to finally control the outbreak. The announcement also coincided with the number of U.S. coronavirus cases exceeding 10 million out of the global total, which exceeded the barrier of 50 million. Coronavirus has claimed more than 1.2 million lives worldwide, including nearly a quarter of a million in the United States alone.

"We are in a position to offer some hope," Dr. Bill Gruber, vice president of clinical development at Pfizer, told the Associated Press. "We are very encouraged," he added. Pfizer, which is developing the vaccine with its German partner BioNTech, is now on its way to apply later this month for emergency use approval from the US Food and Drug Administration. Once it has the necessary safety licenses, the vaccine will be in hand.

Commenting on the announcement and its timing, Donald Trump tweeted, “The timing of this is absolutely amazing. Nothing outrageous about this timing at all, is it?” At the same time, Pfizer has insisted that its business is not affected by politics. Pfizer has estimated that it may have 50 million doses available globally by the end of 2020, which is enough for 25 million people.

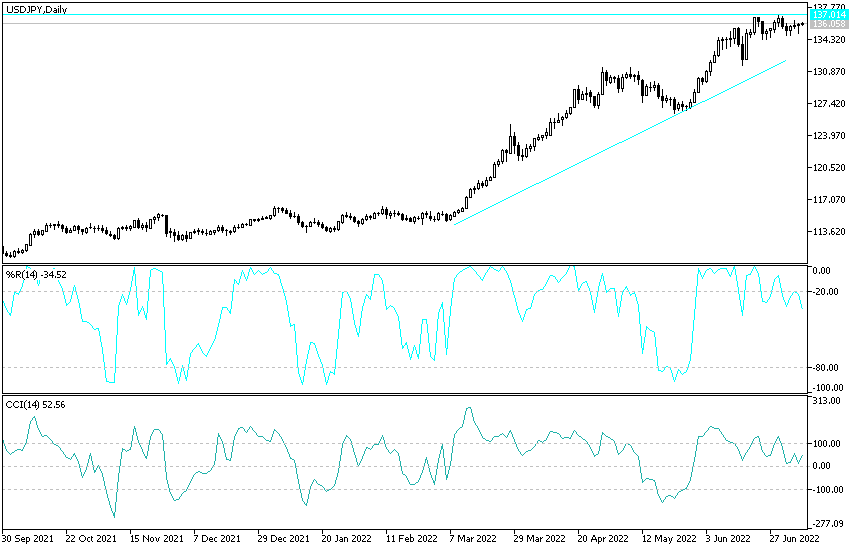

Technical analysis of the pair:

On the daily chart, a significant upward breach occurred for the USD/JPY. Should the bulls cross the 106.00 resistance, it would trigger more buying operations to push the pair towards better resistance levels, as it still has to make up for the crash in recent weeks. On the downside, according to the performance over the same period of time, any decline in the currency pair to the support level of 104.95 and below will restore the bears' control again.

Forex traders are now waiting for the US administration’s new plans to revive the US economy and fix global trade relations, especially with China. Therefore, Biden’s support for hostility with China will weaken the investors’ risk appetite, as is the case now. For the second day in a row, the economic calendar will have no important releases, whether from Japan or the United States of America.