Last week’s trading was bloody for the USD/JPY performance, as the pair plunged to the 103.17 support, its lowest level in eight months, before closing trading around the 103.36 level. This came after uncertainty about who would win the US presidential elections. It was announced that Biden won by a landslide, despite Trump's doubts about the integrity of the US elections. Sharp price gaps are expected in the beginning of dealings based on that result. Financial markets and investors are more optimistic about Biden's victory, as he promised to end Trump's 4-year commercial and political wars of hostility. It will focus strongly on eradicating the COVID-19 epidemic that is hindering US efforts to revive the global economy.

Prior to that, members of the US Federal Reserve Board announced that they decided to keep the target range for the federal funds rate at 0 to 1/4 percent, as expected. The bank said in a statement that it expects interest rates to remain unchanged until labour market conditions reach levels consistent with the central bank’s assessments of the employment cap. Inflation has risen to 2% and is on its way to be moderately above 2% for some time.

The US central bank believes that economic activity and employment continued to recover, but remained well below their levels at the beginning of the year. The central bank added that weak demand and previous drops in oil prices are curbing consumer price inflation. The Fed also said that fiscal conditions remain favourable, partly reflecting policy measures to support the economy and the flow of credit to US households and companies.

Results of recent economic data showed an increase in non-farm jobs in the United States of America over the expected total number of jobs at 600,000, while 638,000 new jobs were registered. The unemployment rate also declined less than expected to 6.9% against expectations of 7.7% while average hourly wages for October missed the expected growth (annualized) of 4.6% with a record of 4.5%. Commenting on the results, Kathryn Judge, economist at CIBC Capital Markets, said: “Although the participation rate reversed the decline that occurred in the previous month, the increase in the employment rate in the household survey by 2.2 million led to a decrease in the unemployment rate to 6.9% from 7.9%." She added, "As new cases of COVID-19 infection continue to rise, the reopening of previous companies appears to be less sustainable, indicating that employment gains may slow down or possibly reverse in the coming months."

In Japan, public spending for Japanese households for September exceeded the expected change (year over year) by -10.7%, with a reading of -10.2%. Cash business earnings for the period also outperformed the estimated change of -2.2% (YoY) -0.9%.

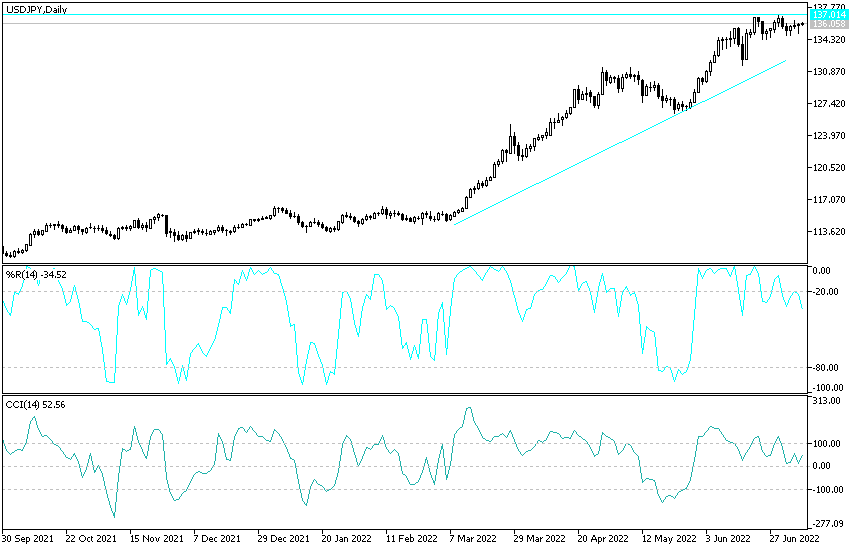

Technical analysis of the pair:

On the near term and according to the USD/JPY performance on the hourly chart, it recently retreated from its lowest levels in several months after a significant decline over the past week. Accordingly, the pair is now trading at a few levels above the 0.00% Fibonacci level, on the way upwards. It has also recovered from the oversold levels of the 14-hour RSI. Therefore, bulls will be looking to ride this recovery by targeting gains around 103.49 or higher at 23.60% Fibonacci level at 103.68. On the other hand, bears will be looking for gains at 0.00% Fibonacci at 103.177 or below at 103,000.

On the long term, depending on the USD/JPY performance on the daily chart, it appears that the pair is trading within a sharp bearish channel. This indicates a long-term downward trend in market sentiment. The pair is close to crossing the oversold 14-day RSI levels. Accordingly, bulls will target the long-term retracement gains around 104.28 or higher at 61.80% Fibonacci at 106.16. On the other hand, bears will be looking for profits around 102.17 or below at the 100.00% Fibonacci level at 101.00.