The USD/JPY did not benefit much from investor risk appetite, as gains since the beginning of trading this week did not surpass the 104.76 resistance level and settled around 104.40 at the time of writing. It is expected that we will witness almost no movement today due to the Thanksgiving holiday weakening liquidity in the financial markets. Despite the important economic data released yesterday and the Federal Reserve Bank’s last MoM, the pair remained trading in a limited range between the 104.25 support and the 104.60 level.

The US dollar dropped against the euro, the pound and a group of G10 currencies, with the exception of the yen and the franc. Investors welcomed dissipating US political risks as they look to a possible strong economic recovery in 2021. Francesco Bisol, a Forex analyst at ING Bank said: “The US dollar continues to drop...the benign risk environment and the positive outlook for recovery after COVID-19 in 2021 will lead to further dollar flows."

"The US dollar has moderately weakened and stabilized at its lowest levels since mid-2018, which largely reflects risk appetite, which remains the main driver of foreign currencies and the US dollar broadly," said Ben Randall, chief analyst at Bank of America. Taking a look at the USD performance against G10 currencies, it appears that the Japanese yen and the Swiss franc are the only safe havens and weaker than the dollar, confirming the classic risk movement that tends to hamper risk asset class.

Despite Trump's loss in the US presidential election, his achievements regarding the US economy cannot be ignored. This came with the rise of the Dow Jones - the leader of the “traditional” US economy - to a record high of 30,000. As Trump stated, “I just want to congratulate everyone. The stock market averaged 30K, the highest in history. We never broke 30k. This is despite everything that happened with the epidemic.” He added: "That's a sacred number, 30,000, nobody thought they'd ever see it." Although hitting historic highs nearly 50 times throughout President Trump's administration, this was the highest in the history of the Dow Jones Industrial.

It looks like Trump himself may be behind some market optimism, if not for the reasons he was hoping for. “The reason behind the record-breaking increase in gains is that President-elect Biden has officially started his transition period, at last,” says Marshall Gettler, head of investment research at BD Swiss Group. The head of the General Services Administration (GSA), following threats to her family by some in the Democratic Party, was ordered by Trump to initiate the transition process and freed up a variety of government resources for the incoming administration.

Trump said this week that he would commit his administration to handing power to the Biden team, although he said the legal battle will continue. It also appears that the current markets’ rally came from seeing Biden pick out a variety of positions. In particular, expectations that Biden will appoint dovish former Fed Chair Janet Yellen as Treasury Secretary has reinforced confidence that the fledgling administration's financial authorities will coordinate well with the Fed to emphasize deflation and rebuilding.

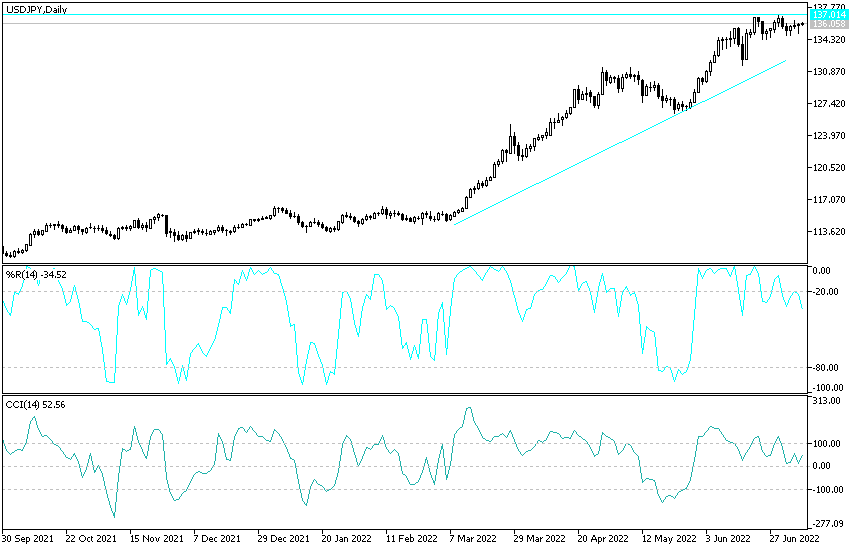

Technical analysis of the pair:

There is no change to my technical view of the USD/JPY performance. Despite the recent rebound, the general trend is still bearish, and I am still adhering to the fact that the resistance levels at 106.00 and 108.00 will be the most important to confirm a strong shift upwards to the trend. On the downside, the return of stability below 104.00 support will impede the bears' control over the performance to move towards stronger support levels and, at the same time, the technical indicators return to oversold areas again. The pair does not expect any Japanese or US economic data today that would stimulate stronger moves.