All the gains from the bullish rebound in the USD/JPY pair during the trading week are on the verge of collapsing as it moved towards the 103.85 support, at the time of writing. This came after the pair’s gains at the end of last week pushed it to the 105.68 resistance. We noticed strong selling of the US dollar in recent trading sessions supported by the investor’s risk appetite, particularly after announcements of successful coronavirus vaccines in development. In addition, the dollar is still facing Trump's blurry position towards the US presidential elections results.

US retail sales grew by 0.3%, a smaller percentage in October, even as retailers offered early holiday discounts online and in-store. The high number of coronavirus infections across the country and the end of a weekly payment of $600 to tackle unemployment over the summer slowed Americans' spending and contributed to the slowest growth in retail sales since this spring, when shops, theatres, restaurants and workplaces closed due to the pandemic.

Economists had expected sales to increase by 0.5%, which is already a significant downturn from September's gain of 1.6%.

Commenting on the findings, Chief Investment Officer Jim Beard at Planty Moran, a financial advisory firm, said the data "points to a consumer sector that has become more cautious in its spending habits. The weak sales are likely to reflect several headwinds: the slow recovery, the recent surge in COVID-19 cases across the country...and reduced financial support for marginalized workers.”

Most of the gains were in just a few sectors that reveal how the epidemic has changed spending trends in America. Sales increased in home and garden stores, electronic and hardware stores and online retailers. These increases are likely to reflect ongoing home renovations and possibly more technology purchases by those who work from home and those families with children learning online.

So it is likely that many Americans withdrew slightly in fear of the virus: spending in restaurants and bars decreased by 0.1% in October, the first drop in six months, even before many new restrictions on indoor dining and curfews in bars were announced in recent days.

There is other evidence of growing US consumer caution: overall spending actually fell in early November, according to JPMorgan Chase, who anonymously tracks activity on its 30 million debit and credit cards. The decline was somewhat worse in states with coronavirus spikes, such as North Dakota and Iowa. Nationwide, spending is down to 7.4% less than a year ago, JP Morgan said, down 2.5 percentage points from two weeks earlier.

The drops could slow the economy in the last three months of the year, with some analysts forecasting growth of only 3% or 4% at an annualized rate, down from 33.1% in the first quarter of July to September.

To spur Americans into spending, Best Buy, Target and Walmart offered holiday deals in mid-October, unlike Amazon, which held its annual Prime Day sales event in the fall after it was postponed this summer due to the pandemic. Online shopping jumped 3.1% in October and rose nearly a third in the last year. It was hoped that retailers could attract Americans who want to start holiday shopping and avoid the crowds.

The trade report covers only about a third of total consumer spending. Services such as hair cutting and hotel accommodations, which have been hard hit by the epidemic, were not included.

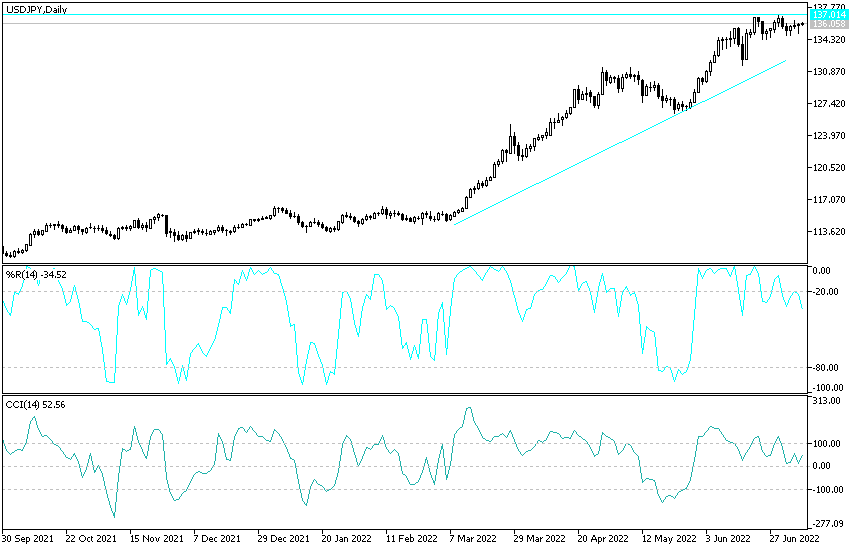

Technical analysis of the pair:

Recent USD/JPY losses pushed the technical indicators into oversold areas, so it is better to think about setting buying levels and waiting for the opportunity of an upward rebound and correction instead of activating new sell orders. Accordingly, support levels at 103.85, 103.45 and 102.80 are expected to be the best-suited for doing so at present. As I mentioned before, the resistance levels at 106.00 and 108.00 will remain the most important to confirm a strong real change in the general trend of this currency pair, which is still bearish.