Risk appetite and the USD recovery were strong factors in a long-awaited upward rebound for the USD/JPY. The pair jumped to the 104.64 resistance after the pair collapsed to the 103.65 support recently and stabilized around the 104.50 level, awaiting stronger incentives to complete the current correction opportunity. Positive news about coronavirus vaccines continue coming to financial markets.

Pharmaceutical company AstraZeneca said that their trials showed strong efficacy in their COVID-19 vaccine, which increases chances of obtaining a relatively inexpensive and easy-to-store product that may become the preferred vaccine for the developing world. The results are based on an interim analysis of trials in the United Kingdom and Brazil of a vaccine developed by the University of Oxford and made by AstraZeneca. No hospital admissions or serious cases of COVID-19 have been reported among those who received the vaccine.

AstraZeneca is the third major pharmaceutical company to provide late-stage data on a possible COVID-19 vaccine as the world awaits scientific breakthroughs that will eliminate the epidemic that has led to 1.4 million deaths. However, unlike other vaccines, the Oxford-AstraZeneca vaccine does not need to be stored in extremely cold temperatures, which makes it easier to distribute, especially in developing countries.

The Oxford-AstraZeneca vaccine is 90% effective in preventing COVID-19 in one of the tested dosing regimens, though less effective in some other countries. Earlier this month, rival drug companies Pfizer and Moderna reported preliminary results from late-stage trials that showed their vaccines are approximately 95% effective. While the AstraZeneca vaccine can be stored at 2° to 8° C (36° to 46° F), Pfizer and Moderna products must be stored at temperatures close to minus 70° C (-94° F).

The World Trade Organization said global merchandise trade rebounded strongly in the third quarter after falling amid the COVID-19 pandemic. Accordingly, the Good Trades Barometer, a real-time measure of trends in global trade, rose to 100.7 in the third quarter from 84.5 last August. An indicator reading greater than 100 indicates higher out-of-trend growth, while a reading below 100 indicates less out-of-trend growth. The index indicated a strong rebound in trade in the third quarter as the lockdown eased, but growth is likely to slow in the fourth quarter as pent-up demand exhausts and restocking completes.

The World Trade Organization has noted that renewed closures in Europe and North America could lead to another round of business closures and financial distress. According to their projections, global merchandise trade will decrease by 9.2 percent this year. This will require a sharp recovery in the third quarter, after the 17.2 percent annual decline recorded in the second quarter.

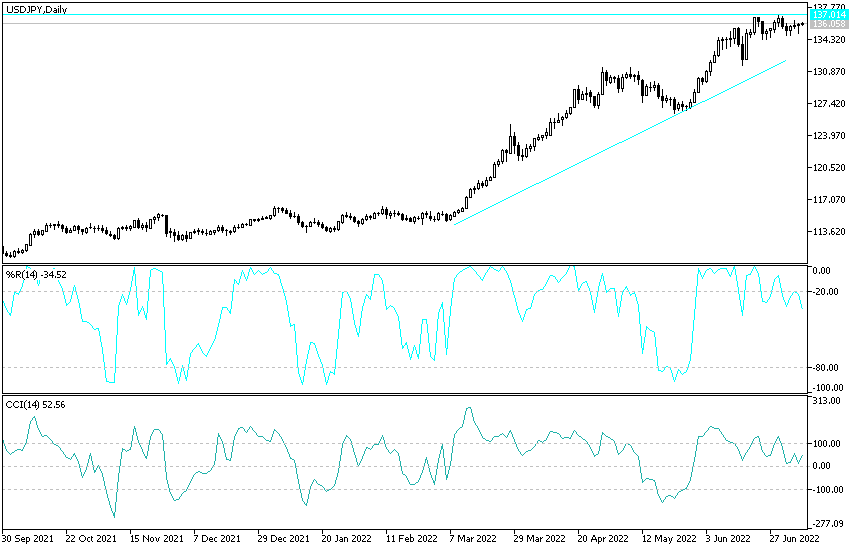

Technical analysis of the pair:

Despite recent corrective attempts, the USD/JPY is still within the range of its descending channel. As mentioned in recent technical analyses, there will be no real upward bounce for the pair without testing the resistance levels of 106.00 and 108.00. At the same time, it is awaiting a test of the 105.25 resistance to increase expectations towards the aforementioned resistance levels. On the downside, a drop in the currency pair below the support level at 104.00 will remain a catalyst for bears to control performance. I still think that moving below that level will support technical indicators' move to oversold areas, and Forex traders will begin to think about setting buying levels.

In addition to the extent of investors risk appetite, this currency pair will react to the announcement of US Consumer Confidence and Richmond Industrial Index.