The USD/JPY downward momentum performance continued for the third day in a row, even amid positive announcements about the successes of COVID-19 vaccines. The pair continues to decline, reaching the 104.36 support before settling around the 104.60 level at the beginning of today's trading, ahead of the release of important US data.

A second experimental COVID-19 vaccine developed by Moderna yielded very strong early results, giving another much-needed dose of hope as the pandemic enters a terrible new phase. Moderna said its vaccine appears to be 94.5% effective, according to preliminary data from an ongoing study. A week ago, competitor Pfizer Inc. said its vaccine appears to be 92% effective - a development that puts the two companies on track to obtain permission within weeks for emergency use in the United States.

Dr. Anthony Fauci, one of the leaders of the Trump administrations White House Coronavirus Task Force, called the results "really amazing." "The vaccines that we are talking about, and the upcoming vaccines, are really the light at the end of the tunnel," he said.

But a vaccine cannot come fast enough, as virus cases exceeded 11 million in the United States over the weekend - a million cases were recorded in the past week alone - and governors and mayors are increasing restrictions before Thanksgiving. The outbreak has killed more than 1.3 million people worldwide, with more than 246,000 of them in the United States alone.

After the announcement, stocks in Wall Street and in other global stock markets rose on the back of rising hopes that the global economy may begin to return to normal in the coming months. Accordingly, shares of Moderna rose 7.5%, while shares of companies that benefited from the stay-at-home economy declined, including Zoom, Peloton and Netflix.

On the economic side in the era of COVID-19, the Japanese Cabinet Office said in a preliminary report that Japan's gross domestic product jumped 21.4 percent year-on-year in the third quarter of 2020. That exceeded expectations with an 18.9 percent year-on-year jump after a 28.8 percent decline in the previous three months. On a quarterly basis, the gross domestic product (GDP) of the world's third largest economy grew by 5.0 percent - also exceeding expectations for a gain of 4.4 percent, after declining by 8.2 percent in the second quarter.

According to the data, capital spending decreased by 3.4% on a quarterly basis, against expectations of a 3.0% decline after a decrease of 4.5% in the previous three months. Private consumption of GDP rose by 4.7% on a quarterly basis, lower than expectations of 5.1% after declining by 3.1% in the second quarter.

As for the US economy, Joe Biden on Monday outlined his plans to reduce economic inequality and boost the US economy, but said any structural reforms would first depend on curbing the coronavirus pandemic. "Once we end the virus and provide economic relief to workers and companies, we can begin to rebuild better than before," he said. Biden spoke of his plans to invest in infrastructure, technology and clean energy jobs, and create American manufacturing jobs by encouraging companies to make their products in the United States.

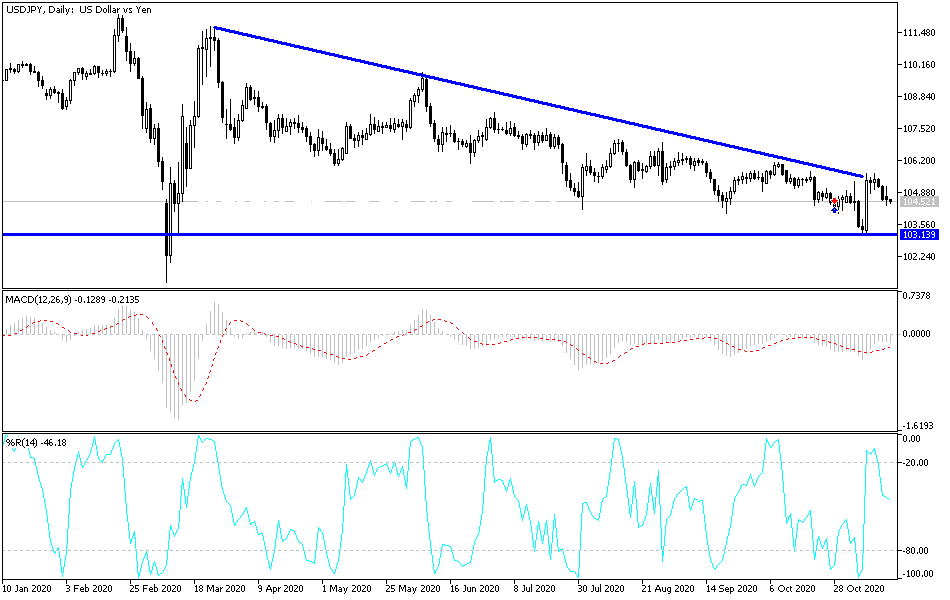

Technical analysis of the pair:

There is no change to my technical view of the USD/JPY performance, as the general trend is still bearish and stability below the support at 105.00 supports more selling operations. But it is necessary to take into account that support levels at 104.40 and 103.90 pushed the technical indicators to oversold areas. Therefore, one can consider buying and waiting for a moment to launch to the upside, which is supported by buying from every descending level. On the upside, and according to the performance over the same period of time, there will be no real opportunity to reverse the current bearish outlook without the pair testing the resistance at 106.00, 106.85 and 108.00, respectively. In the long term, the general trend is still downward.

Today's economic calendar:

There are no Japanese economic data releases today. All focus will be on the US economic data, which is represented in the US retail sales numbers, and then industrial production numbers.