For three trading sessions in a row, the USD/JPY pair has been trying to correct to the upside. But rebound gains did not exceed the resistance level at 104.76 before settling around 104.54 at the time of writing, ahead of an American holiday. Despite the announcement of successful coronavirus vaccines, President Trump's initiation of the transition process and Biden's cabinet picks, the pair did not continue to make gains that would change the general trend outlook, which is still bearish.

The Trump administration is still considering executive action that would penalize Chinese companies, which some link to the decline in Chinese stocks. Somewhat similarly, the United Kingdom appears to be close to formalizing its ban on installing new Huawei equipment and ordering the replacement of existing equipment by 2027. Australian Prime Minister Morrison has tried to send a more conciliatory note to Beijing.

Reports indicate that China has significantly increased its purchases of US agricultural products. Its corn imports from the US last month appeared to be the second-highest level ever and twice that of last year, at more than a million tons for the third month in a row. Imports of wheat, barley, sugar and pork are near double those of last year. There is also a strong demand for soybeans.

On the other hand, Janet Yellen, Biden's pick for US Treasury Secretary, does not accept what appears to be a common accusation in the US that China is responsible for American deficits around the world, despite the fact that China's coronavirus crippled global economies. Some used to make the same accusation against Japan and these days Japan suffers from a trade deficit, and the US trade deficit is greater than ever.

US consumer confidence fell to a reading of 96.1 in November, as the surge in coronavirus cases drove US optimism to its lowest level since August. The November reading was down from the revised 101.4 reading in October. This decline reflected a significant drop in consumers' expectations of income, business and the labour market. US consumer confidence is being watched closely for clues about how much US households are willing to spend. Consumer spending accounts for 70% of economic activity in the United States.

In the run-up to the epidemic, when the country was enjoying unemployment at its lowest level in half a century at 3.9%, the confidence index rose above the 130th level. It settled at 132.6 in February but fell to 85.7 in April as millions of Americans lost their jobs after the United States entered into a lockdown to try and stop the spread of the COVID-19 epidemic.

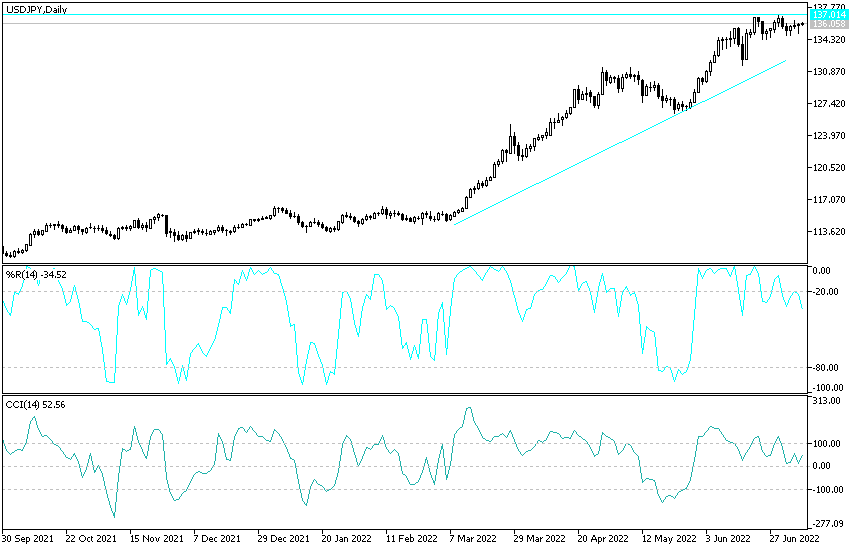

Technical analysis of the pair:

Despite the recent USD/JPY bounce attempts, the general trend is still bearish, as shown on the daily chart. There will be no real shift in direction without the pair moving towards the resistance levels at 106.00 and 108.00, respectively. On the downside, the currency pair moved below the support level at 104.00, confirming the bears' control over the performance, and warning of a move towards stronger support levels. So far, the closest support levels for the pair are 104.20, 103.75 and 102.90, respectively. Those levels push the technical indicators into oversold areas, but the currency pair lacks momentum to launch higher strongly so far.

Today's US economic data package may have a strong impact on the pair’s performance. There will be the announcement of the US GDP growth rate, unemployment claims, durable goods orders, consumer confidence, new US home sales, and then the content of the last Federal Reserve Bank minutes, ahead of tomorrow’s Thanksgiving holiday.