The USD/JPY had a distinguished performance at the beginning of this week. The market has been optimistic following the media networks' announcement of Biden’s victory in the US elections, as well as the development of a vaccine for COVID-19, which is considered the biggest threat to the future of humanity and the global economy at present. The recent rebound gains pushed the pair towards the 105.64 resistance, and over the course of two trading sessions in a row, settled between 104.82 and 105.48. The pair stabilized around 105.25 at the time of this writing, amid the US holiday of Veteran's Day. Accordingly, limited movements are expected for the currency pair today.

After the controversial US elections and expectations, President-elect Joe Biden will inherit a weak economic recovery under threat from a renewed virus, and likely with a divided Congress that will hamper his ability to meet the challenges.

However, despite the hurdles, the former vice president and senator will follow a fundamental shift in US economic policy. He pledged to take many drastic measures to undo restrictions by the Trump administration on domestic spending and economic development, and is in favor of large investments in education, infrastructure and clean energy. He wants tougher regulations to rein in big tech companies and to fight climate change.

To help pay for it all, the president-elect will go for hefty tax increases by reversing many of the tax cuts approved by President Donald Trump.

Biden is already distinguishing himself from Trump in his approach to the pandemic, which economists generally view is the most serious threat to recovery. Trump saw the impact of the pandemic on the economy in terms of government-imposed closures. He argued that fighting the pandemic by imposing lockdown restrictions is damaging to the economy, a sentiment echoed by the World Health Organization. However, even when some states reopened, many consumers remained wary about eating out, going to the movies or flying.

"We will focus on doing everything possible to control COVID-19, so we can reopen our businesses safely and sustainably," Biden said yesterday.

In an ominous tone, the president-elect warned that "we are still facing a very bleak winter," as confirmed cases rose by nearly 120,000 a day - four times as fast as last spring. This trend, along with the cold weather, will severely restrict some economic activities. This slower growth may in turn lead to increased calls for more stimulus spending. Economists such as Fed Chairman Jerome Powell are warning that the economy needs more bailout aid from Congress.

So far, President Donald Trump has refused to concede the presidential election, citing widespread voter fraud that allegedly rigged the election. He has taken credit for the development of Pfizer's coronavirus vaccine, which was developed under Trump's Operation Warp Speed initiative. Pfizer's first step will be to apply for "emergency use permission" by the Food and Drug Administration, likely later this month, which would allow for limited distribution before it seeks full FDA approval for its wider use. Neither step can be guaranteed.

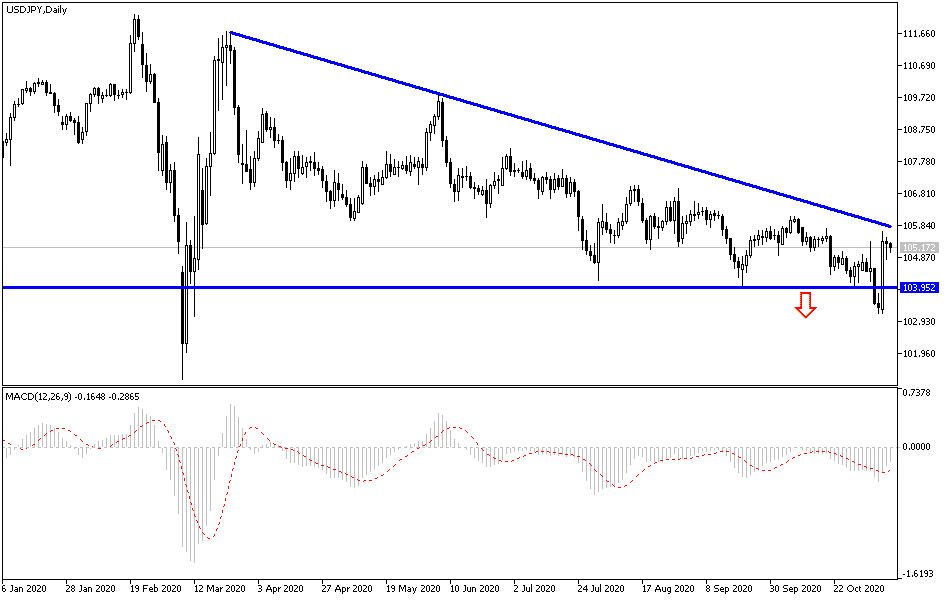

Technical analysis of the pair:

In the near term, the USD/JPY is moving in an upward correction range that awaits more momentum for stability above the 106.00 resistance, which supports the bulls' control of the performance. In return, any drop in the currency pair below the 104.85 support will undermine the efforts of the current bullish rebound and push the currency pair back to the same downtrend range, which still dominates the currency pair on the long run. Bulls still have a long way to go to fully control performance.