The US dollar quickly rose again against major currencies after market pricing Biden’s victory in the US elections and the announcement of the the COVID-19 vaccines successes, relieving pressure on markets and investors. However, this was not good for the US dollar against the yen, as the currency pair retreated during last week’s trading to the 104.54 support, after an upward jump that pushed it at the beginning of last week’s trading to the 105.67 resistance from support at 103.18, the lowest level since mid-March.

Amid the continuing US/Chinese conflict, and through an executive order, the United States banned investment in 20 Chinese companies controlled by the Chinese military. This affects the stocks of the companies affected by that decision, and TikTok has also been granted a reprieve from the ban in the US. On the other hand, investor sentiment was affected by speculation that the People's Bank of China (PBOC) will begin resolving emergency measures to the Chinese money market turmoil this week that has led to repurchases to higher levels since January. Interest rates fell after officials there said they would pump 160 billion yuan into the banking system, the largest amount since late September. The People's Bank of China will pump the money through the Medium Term Lending Facility (MLF). Large operations began this month, and the scale of the People's Bank of China operation will highlight Beijing's intention.

Also, Pfizer's extraordinary results in developing a vaccine for COVID-19 have injected a new factor into the investment climate, even as many countries around the world continue to face a new and strong spread of the virus. Meanwhile, with the increasing numbers of new cases of the epidemic, the reaction to the results of upcoming economic releases will be monitored. Overall, it appears that the probability of a new contraction after a strong recovery in the third quarter in Europe is greater than in the US. It seems that the closures, curfews, and new social restrictions in Europe are more stringent than in the United States, where all 50 states witnessed an increase in cases last weekend, and some areas did not have enough hospital capacity. However, important data from the US, including the employment report for October and the expected recovery in industrial production for October after a 0.6% drop in September, point to a strong start of the fourth quarter.

New Japanese Prime Minister Suga has been blunt in his assessment that Japan is suffering from over-banking. The population shrank, there is the lowest interest rate environment in a quarter of a century, and now the pandemic is putting pressure on regional banks. Accordingly, there will be two types of legal/regulatory inducements. First, a law is expected to be approved in the next few weeks that exempts banks from anti-competitive measures. Second, regional banks that do not use the new facilities may be subject to investigation by the Financial Services Agency about the viability of the bank's decisions.

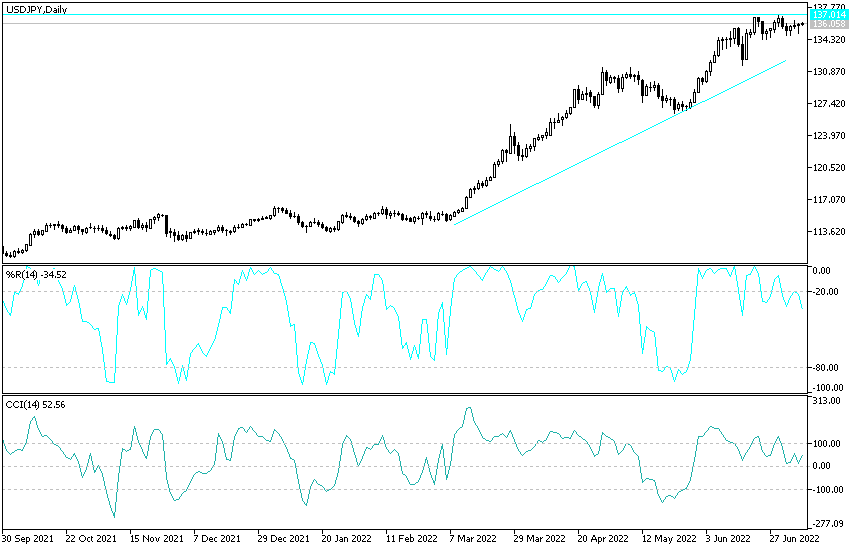

Technical analysis of the pair:

According to the performance on the daily chart, the return of the USD/JPY to move below the 105.00 support will push the pair back to its broader descending path on the long term ,and the downside pressures will increase further in the event of a move towards the 104.20, 103.75 and 103.00, support levels respectively. On the upside, according to the near-term performance, the attempt to breach the 106.00 resistance will be important for the bulls to push up. The pair will continue to be affected by investors’ risk appetite, along with the future of coronavirus vaccines and the global reaction to re-imposing restrictions to contain the second wave of the coronavirus outbreak.

Today's economic calendar:

Amid the absence of important US data, the focus will be on announcing the growth rate of Japan's GDP. Then Chinese economic data, including industrial production, fixed assets investment index, retail sales and unemployment rate.