It seems from the USD/JPY's last three trading sessions on the daily chart that bearish exhaustion is taking the pair to stronger descending levels. The currency pair plummeted to 103.65 support, its lowest level since last March, before closing last week’s trading around 103.83. The currency pair has reached oversold levels and is expected to start activating buy orders to gain the upward bounce. The US dollar got some support as the continuous rise in coronavirus cases around the world helped preserve the US currency status as a safe haven.

After recent encouraging news from Moderna and Pfizer, there are even more positive updates on the vaccine front as AstraZeneca and the University of Oxford announced that their potential COVID-19 vaccines produced a robust immune response in the elderly. The researchers expect to announce late-stage trial results by Christmas.

Amid the market monitoring of the records for coronavirus cases, the rift between the Fed and Treasury is looming large over the US economy.

Commenting on the future of the dollar, Lee Hardman, Forex analyst at MUFG said: “The US dollar on a DXY basis is very close to its one-year low so far. The decrease in appetite to sell the dollar is understandable, but we are convinced that investors will see any currency selling against the US dollar as buying opportunities."

COVID-19 reappeared in the United States and, with the elections now over, US cities and states have begun to tighten restrictions. New York announced the closure of schools and city officials warned that the renewed closure of bars and restaurants may be in the pipeline. Others in the United States took action this week as well against a backdrop of worsening expectations for government financial support for businesses and households, a bad omen for the United States and global economies.

Contrary to the expected, US economic risks are often supportive of the dollar, especially in an environment of simultaneous global downturn, due to the US currency’s status as a global reserve and America’s share in the global economy. The United States is the first export market to the Eurozone after the United Kingdom. The U.K. has not yet secured a Brexit deal, so the negative effects on growth prospects in the United States are considerations related to the US currency.

US stimulus plans face hurdles before Biden takes over. US Treasury Secretary Mnuchin says the law under the CARES Act was clear and the decision is not political, although it will certainly have consequences for the potential next administration of Joe Biden, who is expected to struggle to get spending packages without a majority in Congress after the disputed defeat of Donald Trump in the November 3 election.

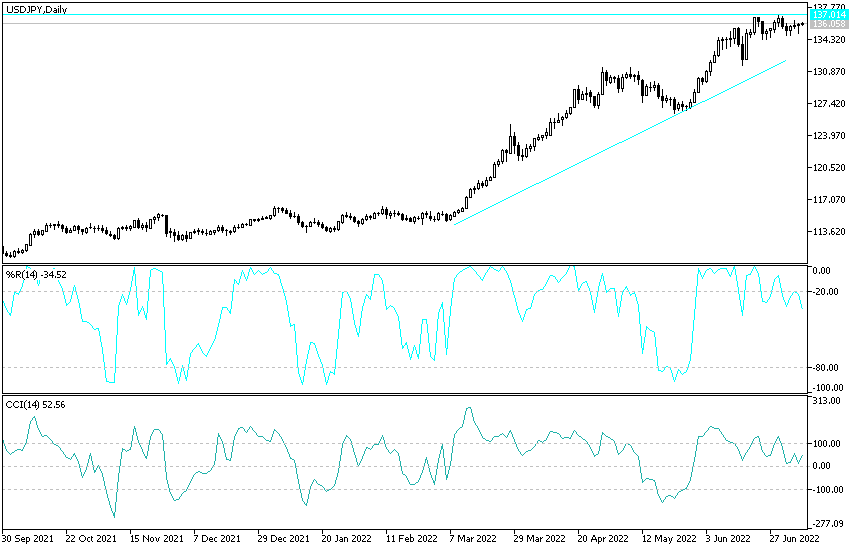

Technical analysis of the pair:

The general USD/JPY trend is still bearish. I prefer to buy the currency pair from every downward level, with the closest buying levels currently at 103.55, 103.10 and 102.65, respectively. As I expected, the 106.00 resistance will be the first support for the bulls to control the performance again. Today is a holiday in Japanese banks, and there is no important US economic data, so investor sentiment and the extent of risk appetite will affect the performance of this currency pair.