The bears continued the stronger control over the USD/JPY performance, as markets were still facing the unknown about the winner of the US presidential elections. The pair is stabilizing around 104.25 at the time of this writing, after a lightning attempt to correct upwards yesterday towards the 105.35 resistance. The most prominent issue in the US presidential election voting was the voter split. Some of them believe that former Vice President Joe Biden will be more able to deal with the coronavirus pandemic, which is the greatest source of concern for about 4 out of 10 voters. But the other side believes that President Donald Trump has surpassed Biden on the question of who would be the best to rebuild an economy besieged by nearly 11 million lost jobs and small businesses staring into a bleak winter. About 3 in 10 voters ranked the economy as the most pressing issue.

Competing concerns dominated the race between Trump and Biden, which concluded on Tuesday as the candidates waged tight races across battleground states. Biden warned that the economy cannot fully recover unless the coronavirus is contained first and companies can reopen completely. Trump argued that the economy should not be a victim of the disease and emphasized that the nation was "approaching its role."

The COVID-19 outbreak has claimed the lives of more than 230,000 Americans and has been spreading increasingly across the country in recent weeks. However, voters were divided over whether the nation had contained the spread of the virus. About half of the voters said the virus is under control at least to some extent, while nearly half said the coronavirus was out of control.

On the economic side, the services sector in the United States, where most Americans work, grew for the fifth month in a row in October. The Institute of Supply Management reported that its services activity index fell to a reading of 56.6 last month, from a September reading of 57.8. Any reading above the 50 level indicates growth in service industries such as restaurants, convenience stores and delivery companies. The index recorded sharp contractions in April and May as closures aimed at containing the coronavirus forced many businesses to close and put millions of Americans out of work. But starting June, the index began to rise again and is just below February's 57.3 level.

Business activity and new orders continued to grow in October, albeit at a slightly slower pace. The index measuring employment also grew more slowly. The price scale continued to rise as goods were in short supply, including cleaning products and personal protective equipment.

The US service sector had been growing for 122 consecutive months before falling into contractionary territory in April and May as widespread lockdowns continued.

The US trade deficit narrowed in September after hitting a 14-year high in the previous month as exports surpassed imports. Yesterday, the Commerce Department reported that the gap between what the United States sells and what it buys abroad narrowed to $63.9 billion in September, down 4.7% from the $67 billion deficit in August. September exports rose 2.6% to $176.4 billion, driven by the food and beverage category, with shipments worth $12.9 billion, the highest since July 2012. Soybean exports rose 63% in September.

To date, the goods and services deficit has jumped $38.5 billion, or 8.6%, to $485.6 billion. The total deficit in goods and services for the same period in 2019 was about $447.1 billion. Total exports are down 17.4% this year compared to 2019, while imports are down 12.4% as the coronavirus pandemic sabotages global trade this year and disrupts global supply chains everywhere.

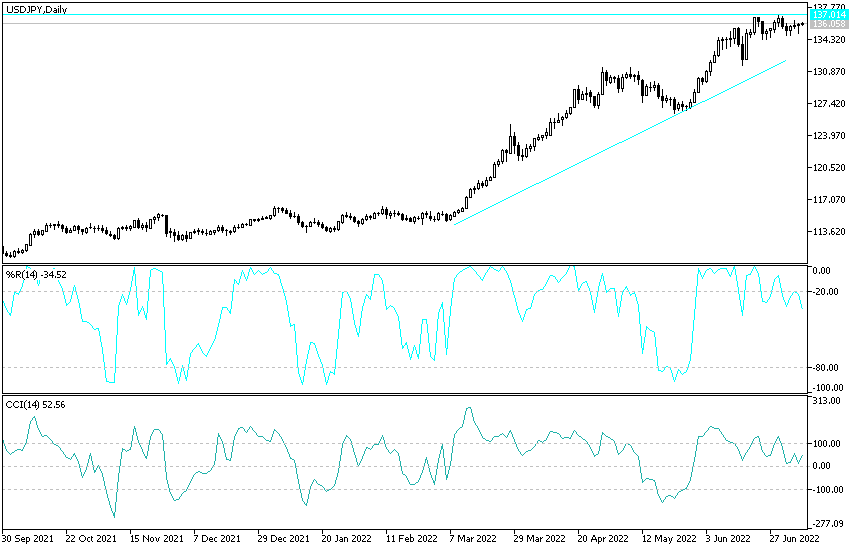

Technical analysis of the pair:

There is no change to my technical view. As I mentioned in recent technical analyses, the general trend of the USD/JPY is still bearish, and stability below 105.00 will remain supportive of the bears' control. Therefore, the pair may move towards stronger support levels, the closest of which are currently at 104.45. 103.75 and 102.90, respectively. The pair will remain in a state of cautious anticipation of the final announcement of the US presidential election results and the monetary policy decisions of the Federal Reserve Bank led by Jerome Powell today. On the upside, there will be no initial chances for a significant breach of the current downtrend, as the bulls should rush towards the resistance levels at 106.00 and 108.00 at the earliest time.