The price movement and performance of the USD/JPY may remain in a very limited range in the coming hours, until the results of the US presidential election results on Tuesday. Since the beginning of today's trading, the pair has been stable between 104.65 and 104.85. In general, risk aversion continues to support the neutrality of its performance in the recent period. The US dollar and Japanese yen are among the most prominent safe havens for investors in the COVID-19 era, which is approaching a year without reaching a vaccine that eliminates the deadly disease. In addition, the results of the US elections will determine the future of global trade wars - especially with China - and the future of the US currency as well. Accordingly, you must be careful when trading on any expectations. Do not forget what happened in the 2016 elections.

US manufacturing posted strong gains in October due to a two-year high, even as coronavirus cases began to rise again in many parts of the country. Accordingly, the Institute of Supply Management, an association of purchasing managers, said its manufacturing index rose 3.9 percentage points to a reading of 59.3% last month, up from 55.4% in September. This was the highest level of this closely-watched measure of manufacturing health since September 2018. Any reading above the 50 level indicates that manufacturing is growing.

The scale fell into recessionary territory from March through May, as much of the country was locked down in an effort to contain the coronavirus.

Of the 18 industries covered in the report, 15 industries recorded growth in October, with strong growth in processed metals, food and beverages, chemicals, computers and electronics. Commenting on the findings, Timothy Fury, chair of the ISM Manufacturing Survey Committee, said that manufacturing was supported by strong demand resulting from lockdowns in areas such as home construction and auto sales.

But economists are concerned about the country heading into widespread lockdowns, as it did in the spring. Many parts of Europe are already doing so due to the high number of infections. "Manufacturing has rebounded strongly with fewer restrictions on economic activity and stimulus efforts, but the way forward will be more difficult as the economy continues to face the pandemic," says Joss Faucher, chief economist at PNC Financial. "The inability of Congress to pass more stimulus will be a big downside risk,” he added.

The strength in October reversed gains in key areas such as employment and inventory, both of which moved from deflation to growth in October. The new orders component of the index was also strong, rising to the highest level since 2004.

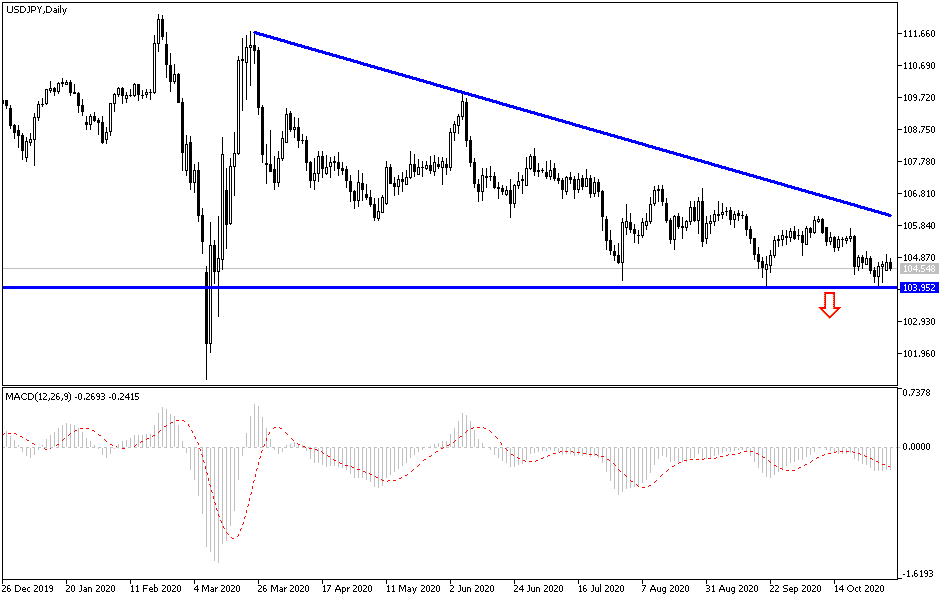

Technical analysis of the pair:

There is no change in performance results and no change in expectations. As I mentioned before, the performance of the USD/JPY on the daily chart is still bearish and there will be no initial opportunity for an upward correction without breaching the 106.00 resistance as a first stage. But the most important for the bulls has always been the 110.00 psychological resistance. On the downside, stability below the 105.00 support will remain supportive to the downside path. Therefore, support levels at 104.45, 103.80 and 102.90, respectively, may be the next targets for the bears.