Mexico is on course to become the eleventh country to report over 1,000,000 COVID-19 infections, likely to be reached this Sunday or the following Monday. While Latin America’s second-largest economy was criticized for not delivering a massive stimulus like other economies have done, led by the US, Fitch Rating, one of the Big Three credit rating agencies, affirmed the BBB- rating with a stable outlook. The USD/MXN drifted out of its support zone, but bearish momentum is likely to extend the corrective phase.

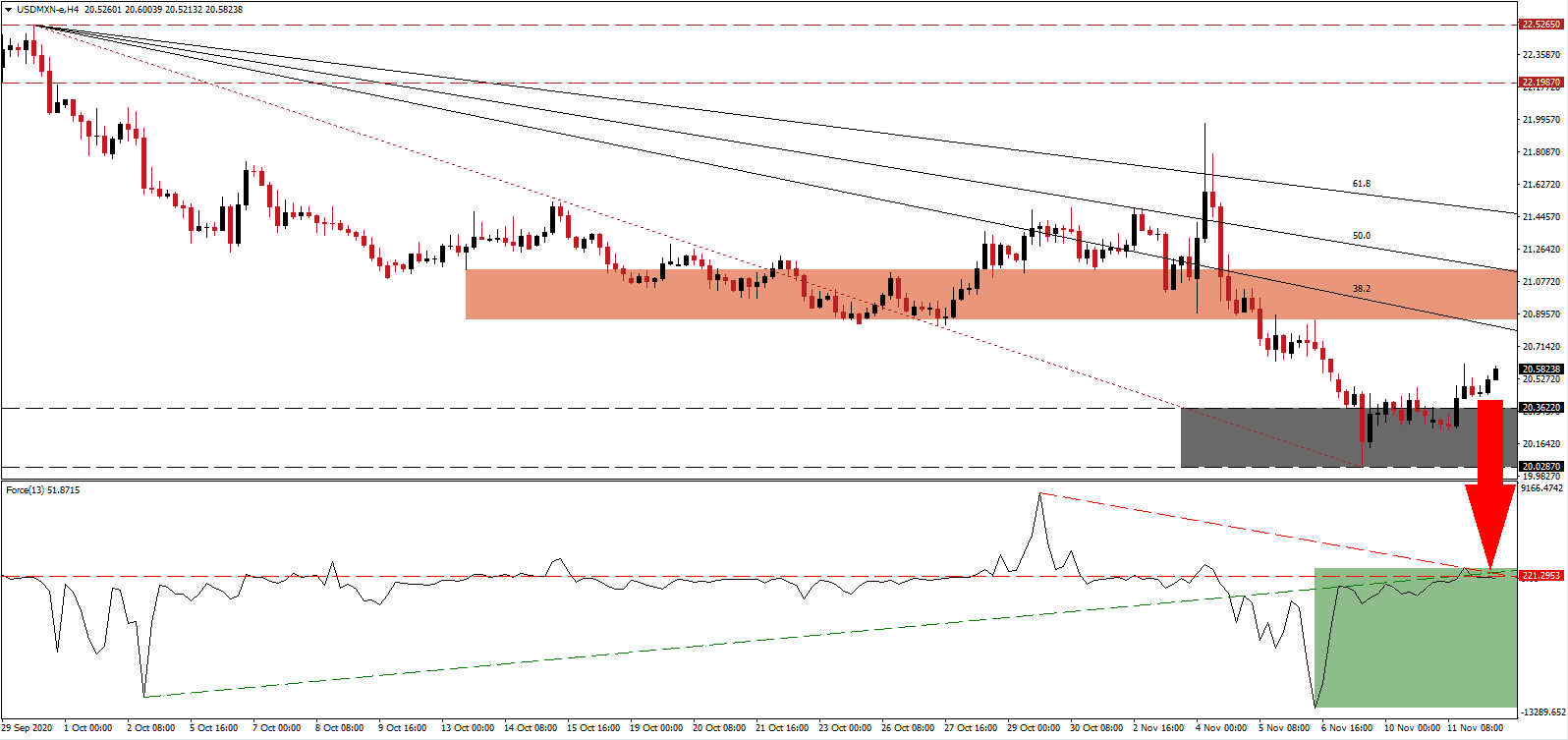

The Force Index, a next-generation technical indicator, briefly pierced above its horizontal resistance level before reversing below its ascending support level, as marked by the green rectangle. Magnifying bearish pressures is the descending resistance level. This technical indicator is well-positioned to cross below the 0 center-line, granting bears complete control over the USD/MXN.

Following the declaration of Joe Biden as the winner of the 2020 presidential election, which is contested by President Trump, many leaders rushed to congratulate Biden. Mexican President López Obrador joins global leaders from Brazil, China, and Russia, in waiting for the end of the electoral process before extending congratulations to the next president. It remains unclear how it will impact US-Mexico relations. The short-term resistance zone located between 20.8598 and 21.1477, as marked by the red rectangle, is poised for a downward adjustment and maintains the bearish chart pattern with breakdown pressures.

Retailers pin their hopes on Buen Fin, the sales event entering its tenth year unless the government imposes a new lockdown related to the second wave of the COVID-19 pandemic. The Confederación de Cámaras Nacionales de Comercio, Servicios y Turismo, announced the event would last twelve days, aiming to break the 2019 sales record of $118 billion. Chihuahua and Durango entered localized lockdowns, with more states expected to follow. While the USD/MXN may ascend a bit farther, the descending 38.2 Fibonacci Retracement Fan Resistance Level is set to force a reversal into its support zone between 20.0287 and 20.3622, as identified by the grey rectangle. A breakdown into its next support zone between 18.9748 and 19.2602 is likely.

USD/MXN Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 20.5850

Take Profit @ 18.9850

Stop Loss @ 20.9850

Downside Potential: 16,000 pips

Upside Risk: 4,000 pips

Risk/Reward Ratio: 4.00

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/MXN could attempt to extend its advance. Forex traders will receive a secondary selling opportunity amid a worsening outlook for the US dollar and the worsening COVID-19 conditions across the US. Any advance from present levels remains confined to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/MXN Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 21.1350

Take Profit @ 21.4350

Stop Loss @ 20.9850

Upside Potential: 3,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.00