Mexico continues to struggle with the COVID-19 pandemic, where a lack of testing shows Latin America’s second-largest economy sliding down the ranks of most-infected countries. Cautious optimism about a Biden presidency prevails, based on hopes that relations between Mexico and the US will improve, delivering a much-needed boost to bilateral trade. The USD/MXN bounced marginally higher after reaching the bottom of its support zone, but dominant bearish pressures suggest a pending breakdown.

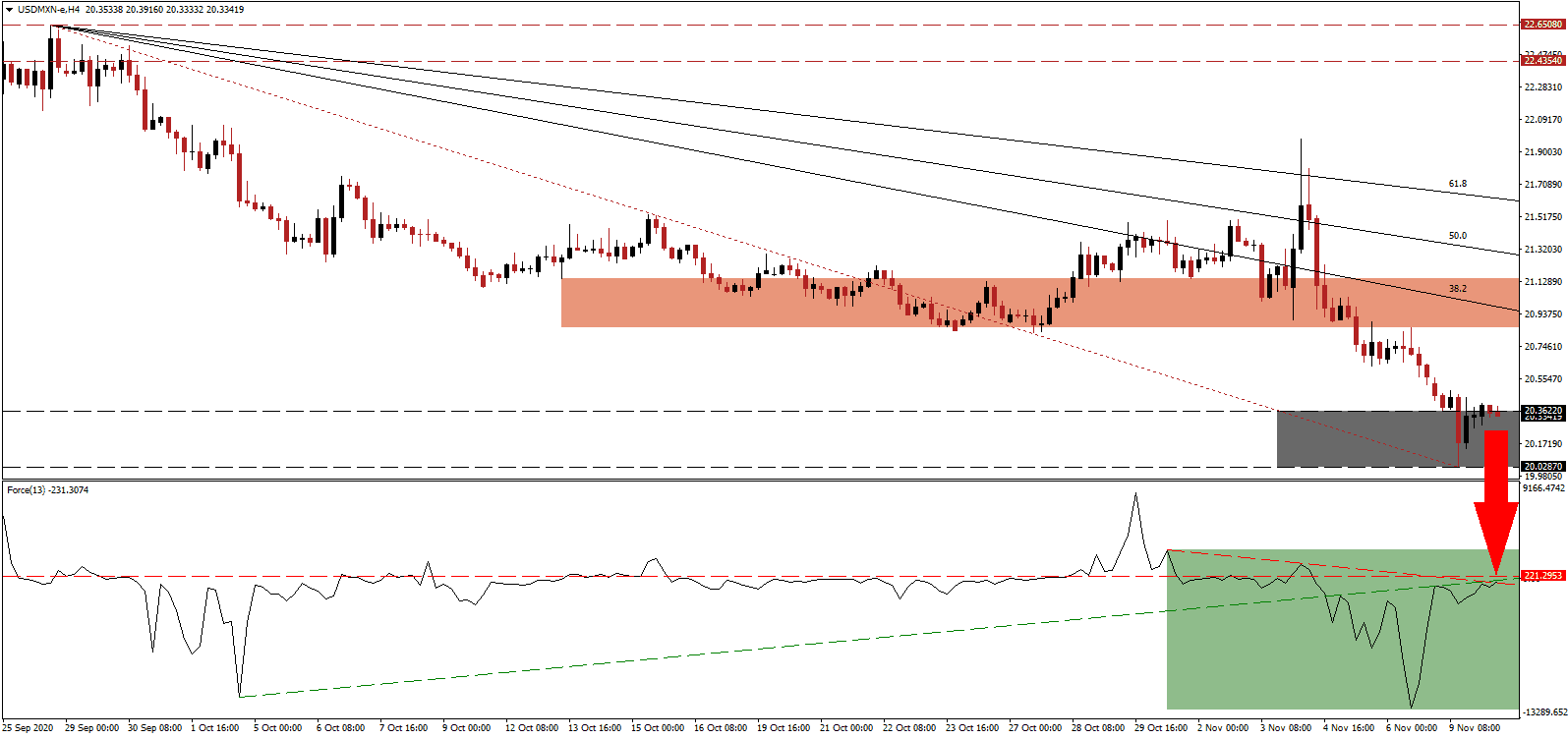

The Force Index, a next-generation technical indicator, reversed after setting a new multi-week low and has now pierced its descending resistance level. It presently challenges its ascending support level located below its horizontal resistance level, as marked by the green rectangle. With this technical indicator below the 0 center-line, bears maintain control over the USD/MXN.

Amid the second wave of the COVID-19 pandemic sweeping across Europe and the US, Mexico is unlikely to avoid it. Despite the lingering risk of more issues, GDP estimates were revised slightly higher during the latest survey by the Banco de México. The average forecast in October calls for a 2020 contraction of 9.44%, down from 9.82% and 10.0% in September and August, respectively. The breakdown in the USD/MXN below its short-term resistance zone between 20.8598 and 21.1477, as identified by the red rectangle, increased bearish momentum and expanded downside potential.

With the global economy struggling, food prices continue to soar, adding more stress to the poor, especially across Latin America. Mexican President López Obrador blames neoliberalism for economic issues rather than the COVID-19 pandemic. Per his remarks, over the past 36 years of neoliberalism, Mexico witnessed unprecedented theft, exceeding that of the colonial period. His policies focus on making adjustments away from it. The USD/MXN is on course to move below its support zone located between 20.0287 and 20.3622, as marked by the grey rectangle. With the descending Fibonacci Retracement Fan sequence enforcing the bearish chart pattern, an extension into its next support zone between 18.9748 and 19.2602 remains a distinct possibility.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 20.3300

Take Profit @ 19.0000

Stop Loss @ 20.6500

Downside Potential: 13,300 pips

Upside Risk: 3,200 pips

Risk/Reward Ratio: 4.16

A sustained breakout above its ascending support level, serving as resistance, could lead the USD/MXN into a temporary price spike. The upside potential is reduced to its 50.0 Fibonacci Retracement Fan Resistance Level. Given the expanding bearish pressures on the US Dollar amid a combination of debt and an uncertain economic outlook, forex traders should sell any rallies.

USD/MXN Technical Trading Set-Up - Limited Retracement Scenario

Long Entry @ 21.9000

Take Profit @ 21.3000

Stop Loss @ 20.6500

Upside Potential: 4,000 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 1.60