While Mexico is the tenth most infected country with Covid-19, it also carried out the least number of tests as compared to the other nine in the Top 10 list. With the second and more violent waves of the pandemic sweeping through Europe and the US, the global economy remains under ongoing pressure. In Europe, the top three economies announced nationwide lockdowns for November, and more are expected amid pressure on the healthcare system. The USD/MXN advanced into its short-term resistance zone, followed by three rejections.

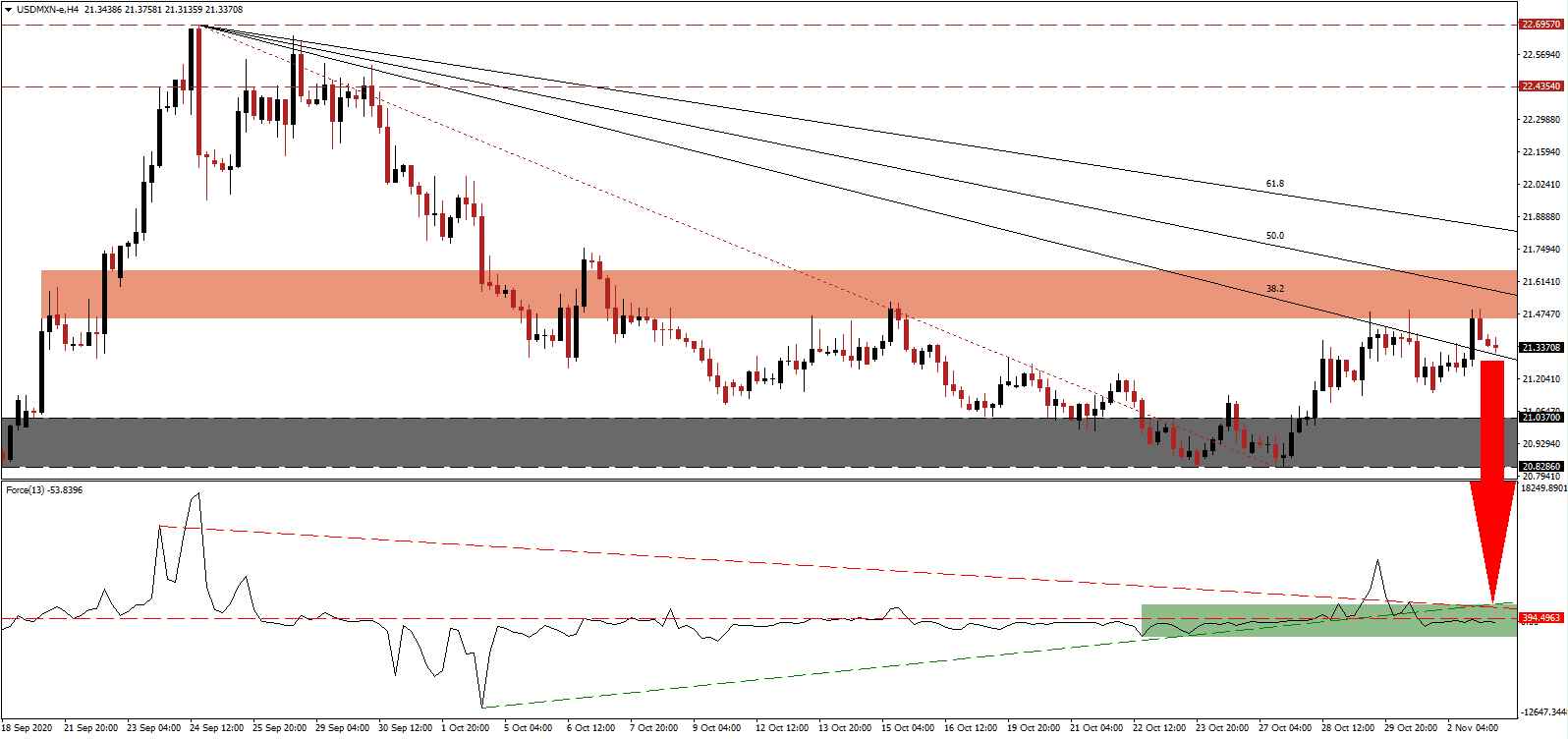

The Force Index, a next-generation technical indicator, initially spiked to a multi-week peak before retreating below its descending resistance level. A series of lower highs and the breakdown below its ascending support level, as marked by the green rectangle, added to downside pressures. Following the slide in this technical indicator below its horizontal resistance level into negative territory, bears regained full control over the USD/MXN.

Third-quarter GDP surged 12.0%, the fastest pace in three decades, following the 17.1% plunge reported in the second quarter. Primary activities expanded by 7.4%, secondary ones by 22.0%, and tertiary ones by 8.6%, per the latest data from the Instituto Nacional de Estadística y Geografía (INEGI). Strong demand from the US boosted the manufacturing sector. Following the third rejection in the USD/MXN by its short-term resistance zone located between 21.4538 and 21.6595, as marked by the red rectangle, a new breakdown sequence is favored to materialize.

Mexican President López Obrador announced a controversial law to ban outsourcing by private firms to temporary staffing agencies. The Confederación Patronal de la República Mexicana (Coparmex), the Mexican Employers' Association, released a statement opposing fraudulent outsourcing to avoid paying bonuses but added that a complete ban would harm the labor market and economy. The USD/MXN is on course to correct below its descending 38.2 Fibonacci Retracement Fan Support Level, paving the path into its support zone located between 20.8262 and 21.0370, as identified by the grey rectangle. More downside is likely, and the next support zone awaits between 19.8919 and 20.2760.

USD/MXN Technical Trading Set-Up - Breakdown Acceleration Scenario

- Short Entry @ 21.3375

Take Profit @ 19.8975

Stop Loss @ 21.8175

Downside Potential: 14,400 pips

Upside Risk: 4,800 pips

Risk/Reward Ratio: 3.00

A sustained move in the Force Index above its ascending support level, serving as resistance, may result in a fourth breakout attempt. It will present Forex traders with a secondary selling opportunity with the upside potential confined to its resistance zone between 22.4354 and 22.6957. The US Dollar outlook remains increasingly bearish, with more debt expected to be added over the next few months, while buyers remain scarce.

USD/MXN Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 22.0600

Take Profit @ 22.5200

Stop Loss @ 21.8175

Upside Potential: 4,600 pips

Downside Risk: 2,425 pips

Risk/Reward Ratio: 1.90