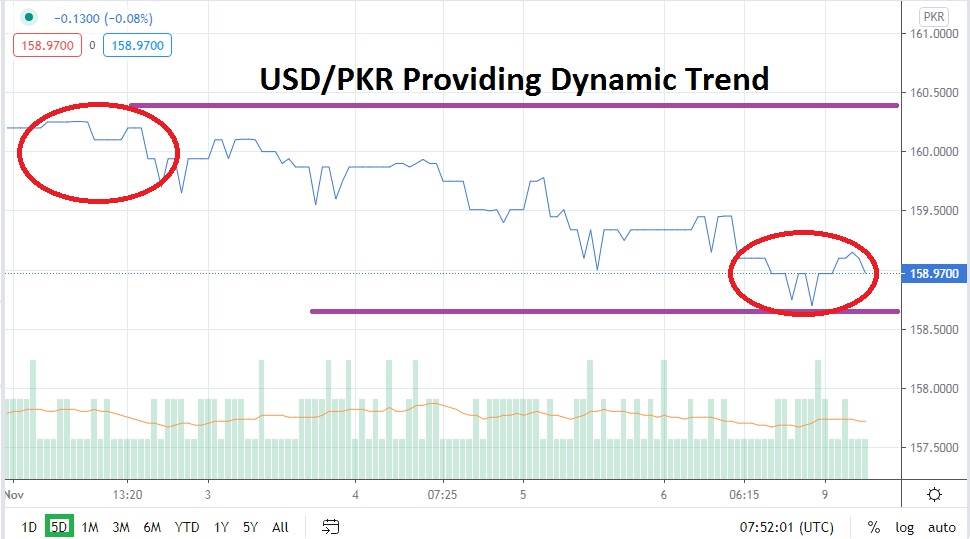

The USD/PKR’s bearish trend has continued in earnest and the forex pair is hovering slightly above important support levels which should intrigue speculators who pursue the Pakistani rupee. While it would be foolish to say the USD/PKR’s trading has been effected by the US elections in recent weeks, the outcome certainly may not diminish the bearish momentum of the pair. Key support near the 158.5000 level is tantalizingly close, and this level is significant because it was last fully engaged in March of this year with tests of its value below.

Contrarians of this strong USD/PKR bearish momentum will look at technical charts and point to the 4th of May, when the Pakistani rupee last tested the 158.5000 level. A strong reversal higher was certainly inspired then, which produced all-time high values for the forex pair. Certainly, the USD/PKR is capable of producing a violent reaction and prone to a lack of transparency which can be worrying for traders. However, the recent selling of the USD/PKR suggests the trend which has developed since the end of August may be sustained this time around.

The price action of the USD/PKR has demonstrated ability to incrementally lower resistance levels the past two months regularly. The forex pair’s dynamics have not been brutal either, which suggests the Pakistani rupee has mustered favor in a polite manner and may continue its path.

The support level of 158.7400 which is currently dominating the technical chart for the USD/PKR must be punctured lower first. Recent price action indicates more bearish momentum will continue for the USD/PKR and speculators may be tempted to target this position with take profit orders. Traders should remember that volumes within the USD/PKR are not large and the pair is susceptible to spikes even as it trends, which means limit orders should be used at all times.

The USD/PKR has delivered a terrific trend the past two months and its direction certainly was questioned when the selling first appeared technically. However, the USD/PKR’s recent ability to maintain its trend and provide an incremental decrease in resistance levels highlights the pair should be pursued by its admirers and speculative selling positions should be considered still.

Pakistani Rupee Short-Term Outlook:

Current Resistance: 159.2000

Current Support: 158.7400

High Target: 159.4600

Low Target: 158.5200