Overconfidence while trading can be dangerous and produce staggering losses against a trader. This isn’t written because the USD/PKR has suddenly gone against the notion that its trend continues to challenge crucial short-term support levels and is making the junctures appear vulnerable. The warning about overconfidence has been written because everything has gone correctly. In other words, the bearish movement of the USD/PKR remains within a stunningly strong downward direction and has politely lowered resistance marks with an incremental methodology.

Speculators should continue to pursue selling positions of the USD/PKR and aim for lower support levels. However, traders will need to know when they have to cash in a winning position too and not let greed get in the way of bankable profits, which can sometime vanish if you are merely looking at your winnings and have not closed your speculative trade. The USD/PKR remains a high-risk endeavor which can prove unfriendly if a spike develops against an open position.

The USD/PKR has consistently produced bearish action since the last week of August. After attaining highs near the 168.5000 level, the Pakistani rupee has created a positively worthwhile selling trend in Forex against the USD. The 165.0000 mark can be viewed as an important juncture which was broken lower the end of September; since then, the USD/PKR has progressively traded to new depths.

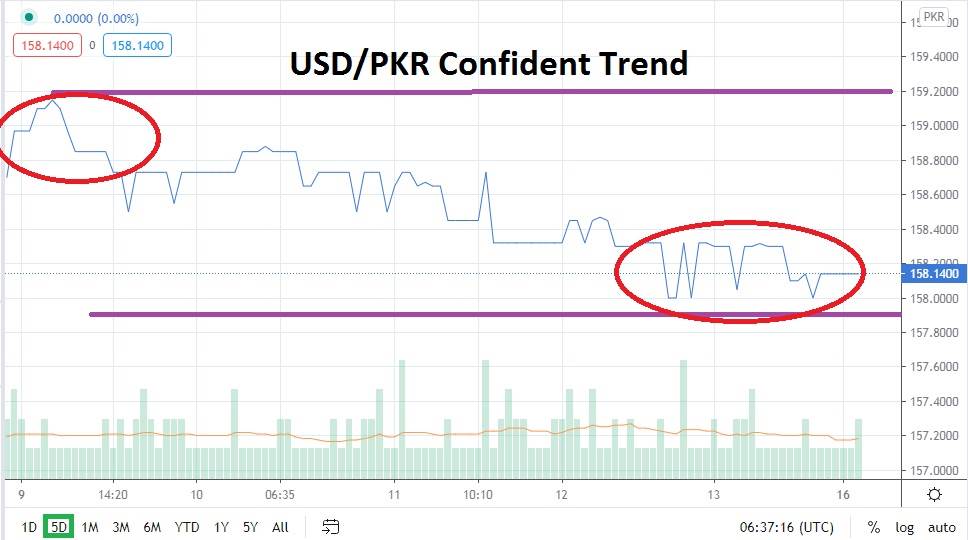

In early trading this morning, the USD/PKR is challenging support near the 158.0000 level and is hovering above it with a consistent demeanor. The ability of the Pakistani rupee to sustain its values without suffering a strong reversal higher is encouraging. This is where fear of overconfidence should be triggered; serving as a warning for speculators who may pursue selling positions and use too much leverage with the belief they are suddenly going to capture a huge stockpile of additional momentum and profits, because there are risks still involved.

Pursuing overnight positions and paying carrying charges can become costly for traders if the amount of leverage they are using is too big. The USD/PKR can still produce an unexpected reversal higher and ruin the day. With this warning in mind, traders should continue to pursue the downward trend of the USD/PKR until it proves it no longer has gas in the tank. Using limit orders to enter selling positions remains a solid tactical decision and risk management remain essential. If the USD/PKR breaks below the 158.0000 level, the Pakistani rupee could begin to challenge the 157.7500 to 157.5000 marks below.

Pakistani Rupee Short Term Outlook:

- Current Resistance: 158.4800

- Current Support: 158.0500

- High Target: 158.7400

- Low Target: 157.5800