Unlike Europe and the US, Singapore maintains control over the COVID-19 pandemic. New infections in the former two countreis surge during the second wave, but Singapore reports few cases. It presently has only 63 active COVID-19 patients, none of which are critical. It allows the city-state to focus attention on restructuring its economy reposition itself for growth in 2021 ahead of most of its peers. The USD/SGD has reached its support zone from where a pending breakdown can ignite more downside.

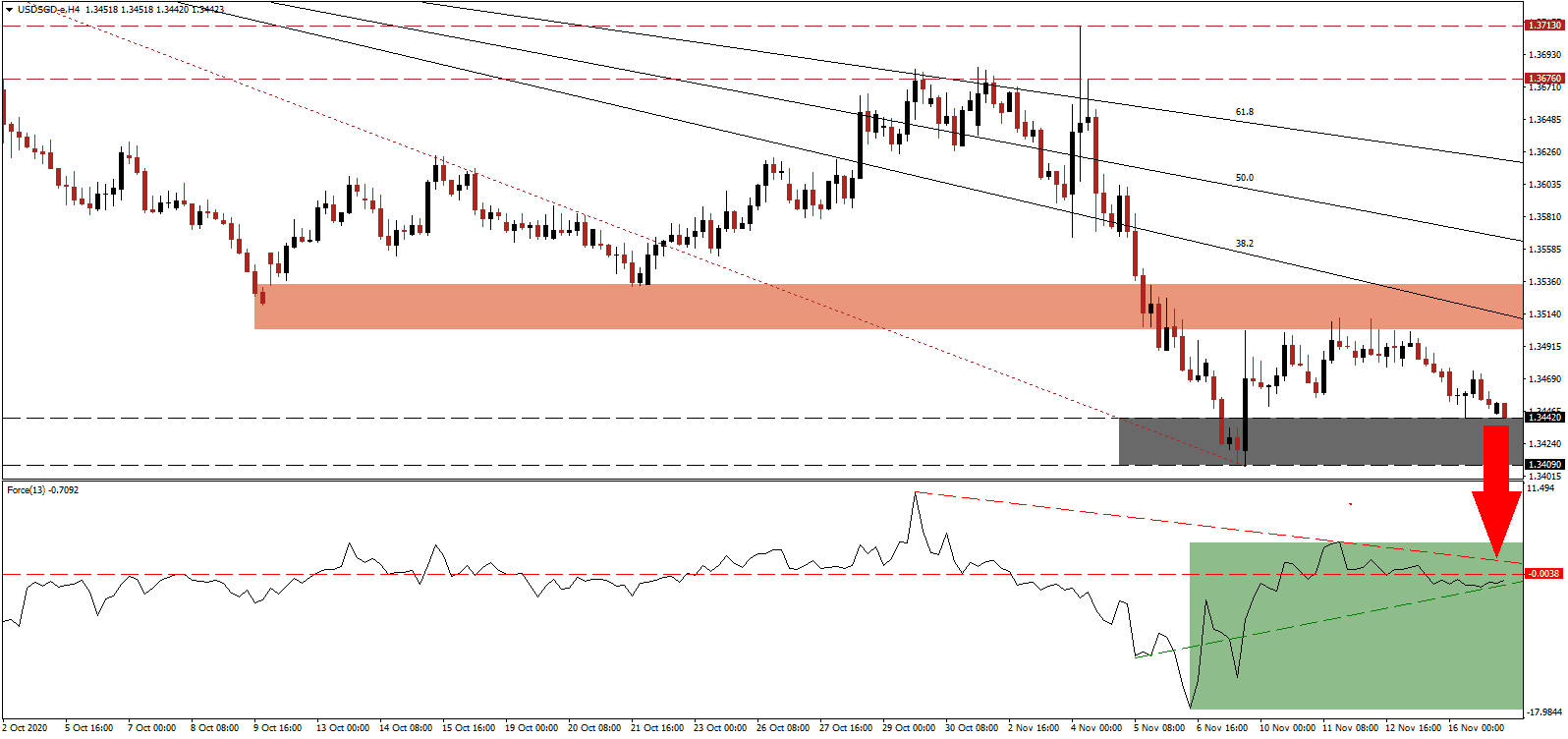

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, but the ascending support level applies upside pressure. More dominating bearish momentum provided by its descending resistance level, as marked by the green rectangle, counters it. Bears remain in control of the USD/SGD with this technical indicator below the 0 center-line.

Singaporean Prime Minister Lee Hsien Loong confirmed that the country would run a budget deficit through 2021 and maybe beyond to continue to deal with the fallout from the COVID-19 pandemic. Singapore announced five aid packages worth almost S$100 billion, roughly 50% financed from past reserves. After the USD/SGD was rejected by its short-term resistance zone located between 1.3503 and 1.3534, as identified by the red rectangle, breakdown pressures expanded.

Adding a long-term boost to the export-oriented economy of Singapore was the signing of the Regional Comprehensive Economic Partnership (RCEP), which includes fifteen mostly Asian economies. The launch of the ASEAN Smart Logistics Network (ASLN) preceded the signing of RCEP, which is now the world’s largest trade bloc, projected to account for 50% of global trade by 2030. The descending Fibonacci Retracement Fan Sequence is well-positioned to pressure the USD/SGD into a breakdown below its support zone located between 1.3409 and 1.3442, as marked by the grey rectangle. Price action will face its next support zone between 1.3254 and 1.3305.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3445

Take Profit @ 1.3255

Stop Loss @ 1.3490

Downside Potential: 190 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 4.22

A sustained breakout in the Force Index above its descending resistance level may allow the USD/SGD to enter a brief reversal. Given the deteriorating medium-term outlook for the US economy, together with the long-term bearish one for the US dollar, Forex traders should sell any advance. The upside potential remains limited to its 50.0 Fibonacci Retracement Fan Resistance Level.

USD/SGD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 1.3510

Take Profit @ 1.3550

Stop Loss @ 1.3490

Upside Potential: 40 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.00