Compared to other countries, Turkey maintains relative control over the second wave of the Covid-19 pandemic. With less than 3,000 new confirmed cases daily, the domestic economy has room to extend its recovery. By comparison, Germany, with an identical population size, reports more than 23,000 infections per day. The figures are set to rise globally, but the USD/TRY is on course to extend its correction with a breakdown below its support zone, following a prolonged period of weakness.

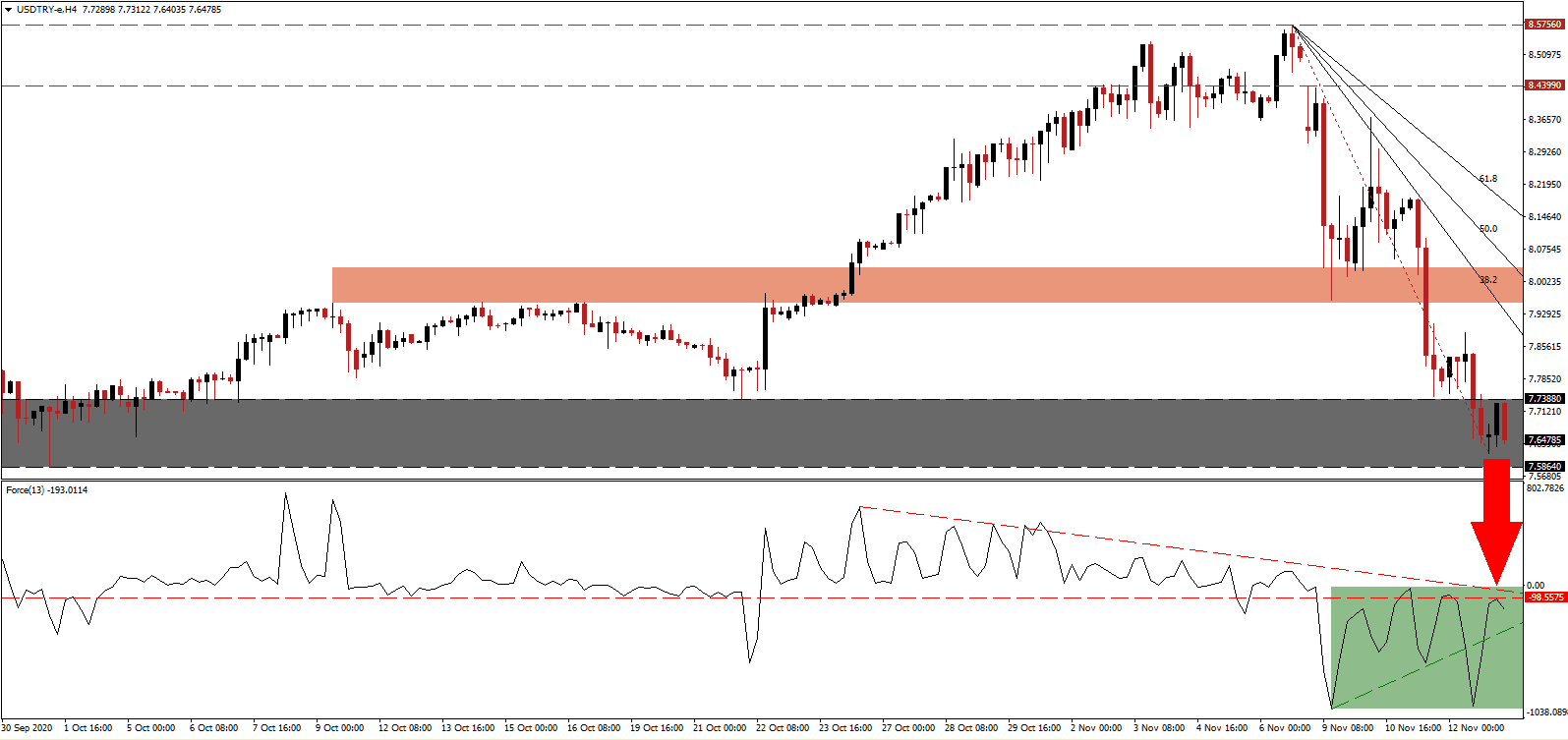

The Force Index, a next-generation technical indicator, reversed from its most recent low until the horizontal resistance level halted the advance. It was able to reclaim its ascending support level, as marked by the green rectangle, but the descending resistance level is expected to maintain downside pressure. Bears remain in control over the USD/TRY with this technical indicator below the 0 center-line.

Providing a boost to the Turkish Lira is a recent poll of economists conducted by Reuters, where the consensus estimate is for a 4.75% interest rate increase by the Türkiye Cumhuriyet Merkez Bankası (TCMB) to 15.00%. After President Recep Tayyip Erdogan appointed former Deputy Prime Minister Lutfi Elvan as the new Minister of Finance and Treasury, the country’s currency entered a massive reversal amid renewed economic optimism. The collapse in the USD/TRY through its short-term resistance zone between 7.9528 and 8.0324, as marked by the red rectangle, expanded bearish momentum.

Adding to positive progress was the speech by President Erdogan earlier this week, setting conditions for an inflow of much-needed foreign direct investment (FDI). He promised structural reforms in the financial system as he attempts to rebuild confidence in the gold-rich economy and gateway to the Middle East. The descending Fibonacci Retracement Fan sequence is favored to force a breakdown in the USD/TRY below its support zone located between 7.5864 and 7.7388, as identified by the grey rectangle. Price action will face its next support zone located between 7.1612 and 7.2646.

USD/TRY Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 7.6500

- Take Profit @ 7.2000

- Stop Loss @ 7.8000

- Downside Potential: 4,500 pips

- Upside Risk: 1,500 pips

- Risk/Reward Ratio: 3.00

Should the Force Index push above its descending resistance level, the USD/TRY could attempt a breakout. While Turkey remains on a restructuring path with a bright long-term economic outlook, the condition in the US continues to deteriorate. Forex traders should take advantage of any price spike with new net short positions. The upside potential remains reduced to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/TRY Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 7.9000

- Take Profit @ 8.1000

- Stop Loss @ 7.8000

- Upside Potential: 2,000 pips

- Downside Risk: 1,000 pips

- Risk/Reward Ratio: 2.00