Amid the ongoing COVID-19 pandemic that forced the global economy into a recession, depressed the labor market and spiked total debt levels past sustainability, rating agencies slowly react. Fitch Ratings downgraded the Long-Term Foreign-Currency Issuer Default Rating (IDR) of South Africa from BB to BB- with a negative outlook. One of the reasons was the likelihood that the GDP in 2022 will remain below pre-pandemic levels in 2019. The USD/ZAR is stable inside its support zone from where bearish pressures suggest a breakdown extension.

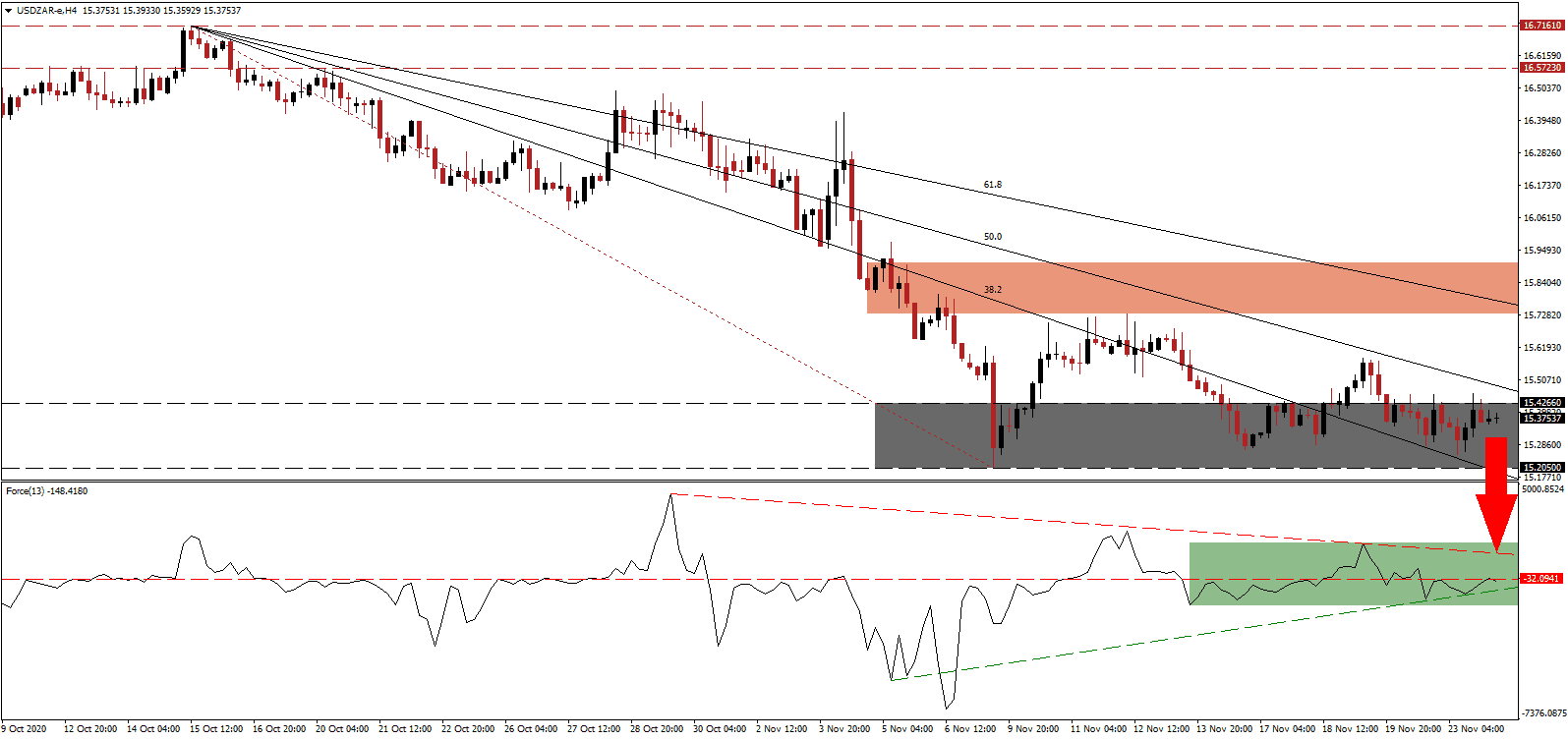

The Force Index, a next-generation technical indicator, continues to record lower highs and confirms the dominance of bearish pressures, visible by the descending resistance level. After a brief advance above its horizontal resistance level, as marked by the green rectangle, it reversed and can now challenge its ascending support level. Bears remain in control over the USD/ZAR with this technical indicator in negative territory.

South African Reserve Bank (SARB) Deputy Governor Fundi Tshazibana, during an emerging market central bank conference hosted by the Institute of International Finance (IIF), confirmed challenges ahead. They include a slow and uneven economic recovery, fiscal issues, and the risk of short-term foreign investors due to rating downgrades. A pending downward revision to the short-term resistance zone, presently located between 15.7317 and 15.9070 as marked by the red rectangle, can provide the next breakdown catalyst.

While the ruling ANC seeks to use surpluses from the government unemployment and compensation fund to rescue debt-burdened utility Eskom, the Government Employees’ Pension Fund (GEPF) announced plans to diversify offshore to increase returns. It may deprive several domestic companies of much-needed capital. The descending 50.0 Fibonacci Retracement Fan Resistance Level is well-positioned to force the USD/ZAR below its support zone located between 15.2050 and 15.4266, as identified by the grey rectangle. Price action will face its next support zone between 14.5932 and 14.7294.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 15.3750

Take Profit @ 14.6000

Stop Loss @ 15.6000

Downside Potential: 7,750 pips

Upside Risk: 2,250 pips

Risk/Reward Ratio: 3.44

A breakout in the Force Index above its descending resistance level may pressure the USD/ZAR into a temporary reversal. With the US presidential transition on its way and president-elect Biden assembling his team, the outlook for the economy and the US dollar gather bearish momentum. Forex traders should sell any advance while the upside potential remains limited to its intra-day high of 15.9783.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 15.7500

Take Profit @ 15.9500

Stop Loss @ 15.6000

Upside Potential: 2,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.33