Business optimism across South Africa expands as the COVID-19 pandemic continues to pose a significant threat globally. Despite the rise in the Business Confidence Index (BCI) published by the Rand Merchant Bank, Tito Mboweni, the Minister of Finance, cautioned against following the path of Argentina and Ecuador, both of whom defaulted on their debt this year. The USD/ZAR presently challenges its support zone, from where bearish pressures can force a breakdown extension.

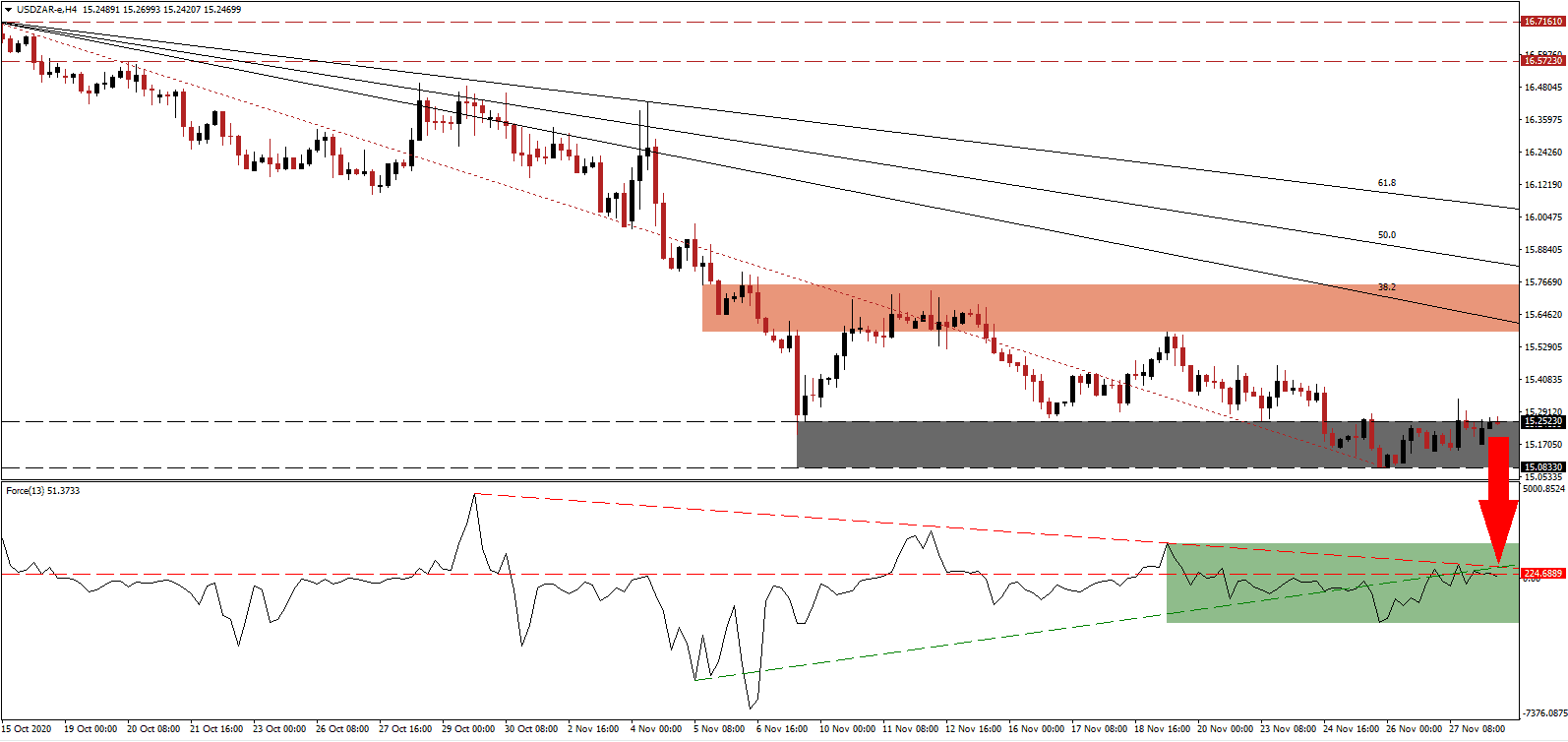

The Force Index, a next-generation technical indicator, was rejected by its descending resistance level, as marked by the green rectangle. It led to a move below its ascending support level from where a breakdown below its horizontal support level followed, converting it into resistance. Bears wait for this technical indicator to correct below the 0 center-line to gain full control over the USD/ZAR.

Since 2008, government employees witnessed a 51% surge in income, expanding the gap to the private sector. The Congress of South African Trade Unions warned that failure to raise salaries would derail its alliance with the African National Congress (ANC). After the short-term resistance zone, located between 15.5805 and 15.7539, as marked by the red rectangle, rejected a reversal in the USD/ZAR, breakdown pressures expanded. The descending Fibonacci Retracement Fan sequence maintains bearish momentum.

Amid the nationwide lockdown, local entrepreneurs in townships took advantage of the change in demand and filled a demand gap. The COVID-19 pandemic sparked a much-needed adjustment in the struggling township economies across South Africa, improving the economic outlook. The USD/ZAR faces a breakdown below its support zone between 15.0833 and 15.2523, as identified by the grey rectangle. It may extend into its next one, located between 14.5932 and 14.7294.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 15.2500

Take Profit @ 14.6000

Stop Loss @ 15.4500

Downside Potential: 6,500 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 3.25

In case the Force Index reclaims its ascending support level, the USD/ZAR could experience a minor short-covering rally. The upside potential remains limited to its 50.0 Fibonacci Retracement Fan Resistance Level. It will allow Forex traders to add net short positions amid a deteriorating long-term bearish outlook for the US dollar against improving conditions for the South African economy.

USD/ZAR Technical Trading Set-Up - Short Covering Scenario

Long Entry @ 15.5500

Take Profit @ 15.7500

Stop Loss @ 15.4500

Upside Potential: 2,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.00