New COVID-19 infections across South Africa started to increase, while Europe and the US experience the more violent second wave of the pandemic. After France, Germany, and the UK announced new nationwide lockdowns, Business for South Africa (B4SA) warned President Cyril Ramaphosa against a hard lockdown. After meeting with the National Coronavirus Command Council, the president will address the cabinet with recommendations on November 13th. The USD/ZAR completed a breakout above its support zone, but the correction is poised to extend amid dominant bearish momentum.

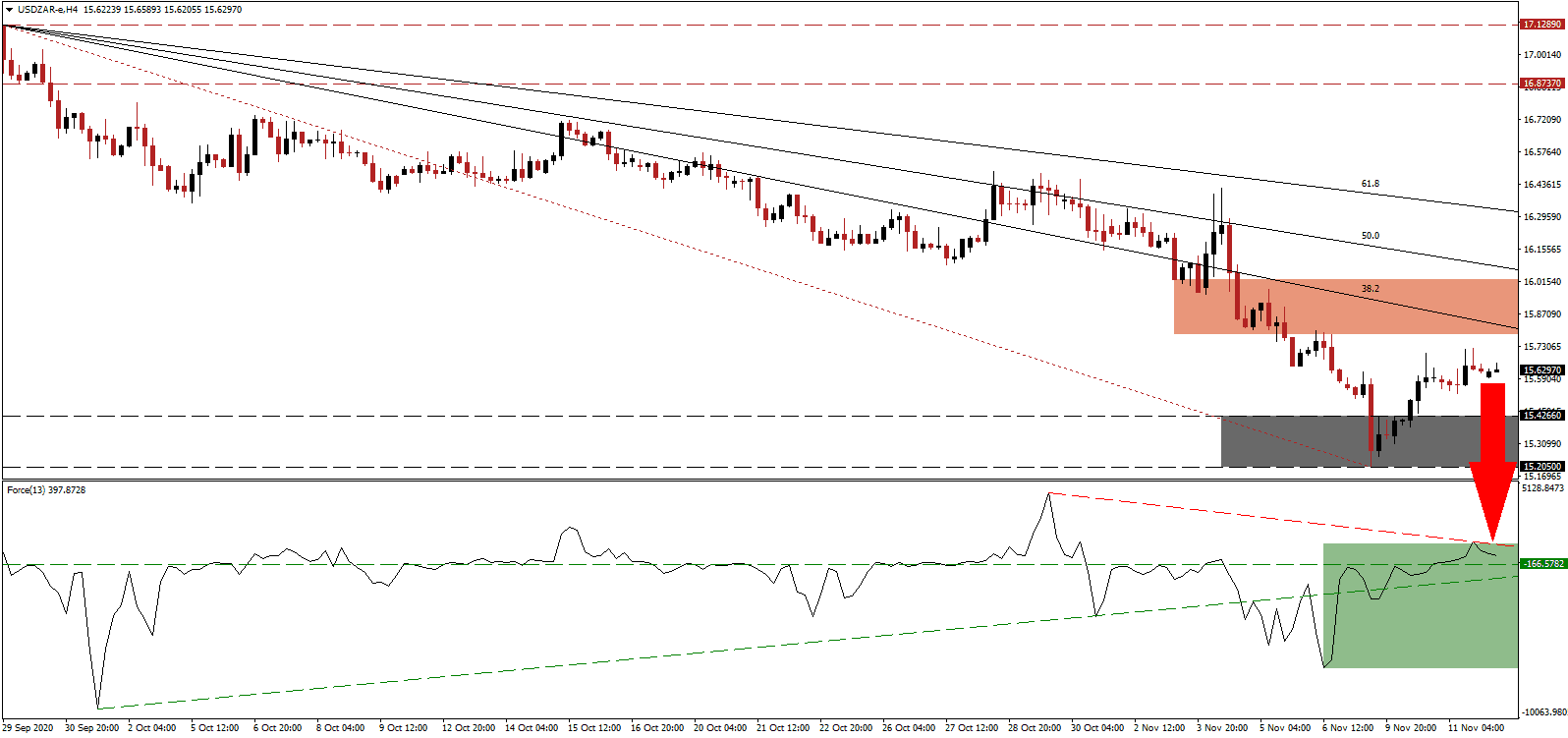

The Force Index, a next-generation technical indicator, moved above its horizontal resistance level, converting it into support. Upside pressure faded, resulting in an adjustment to the descending resistance level, as marked by the green rectangle, which is favored to pressure it below its ascending support level. Bears will regain complete control over the USD/ZAR after this technical indicator moves into negative territory.

After South Africa secured a highly controversial $4.3 billion emergency loan from the US-based International Monetary Fund (IMF) at the height of the first wave of the COVID-19 pandemic, more assistance is unlikely. Loyalists to former President Zuma oppose more financial aid. While the USD/ZAR entered a brief short-covering rally, the short-term resistance zone located between 15.7846 and 16.0205, as identified by the red rectangle, is well-positioned to enforce the long-term bearish trend.

It remains unclear how the Economic Reconstruction and Recovery Plan introduced by President Ramaphosa will receive funding. It represents the cornerstone to rebuild the post-COVID-19 economy and add much-needed jobs. Later today, the unemployment rate is forecast to rise to 33.4% for the third quarter. Despite the uncertainty and due to US dollar weakness, the descending Fibonacci Retracement Fan sequence can pressure the USD/ZAR below its support zone between 15.2050 and 15.4266, marked by the grey rectangle, and into its next support zone located between 14.5932 and 14.7294.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 15.6300

Take Profit @ 14.6300

Stop Loss @ 15.8300

Downside Potential: 10,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 5.00

A breakout in the Force Index above its descending resistance level may lead the USD/ZAR farther to the upside. Given the increasingly bearish outlook for the US dollar, Forex traders should take advantage of any advance with new net short positions. The upside potential remains reduced to its 61.8 Fibonacci Retracement Fan Resistance Level. Today’s US initial jobless claims could provide the next downside catalyst.

USD/ZAR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 15.9800

Take Profit @ 16.2300

Stop Loss @ 15.8300

Upside Potential: 2,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.67