The WTI Crude Oil market initially broke down significantly during the trading session on Monday, only to rally yet again. This is based on the idea that perhaps stimulus will come based on the United Kingdom and the European Union both shutting themselves down, at which point stimulus would be the savior. Furthermore, there is also concern that perhaps the United States getting more cases will perhaps cause shutdowns as well, bringing more stimulus into the marketplace. There is a problem with this fallacy, but for the short term the usual gameplaying seems to be what we are seeing.

Stimulus will not bring up the value of oil longer term. The markets have seen three rounds of stimulus and yet here we are again. The argument is always “you did not do enough stimulus”, but the reality is that stimulus only works as a short-term sugar high. The real driver of crude oil to the upside is going to be demand, which I do not see coming anytime soon. Even if you do get stimulus, people will not be out and about. What is the point of stimulus for driving crude oil prices higher if nobody’s working? It is a moronic disconnect, but Wall Street will go crazy over the prospect of stimulus driving up assets. This works for a short term, probably long enough for retail traders to try to chase it.

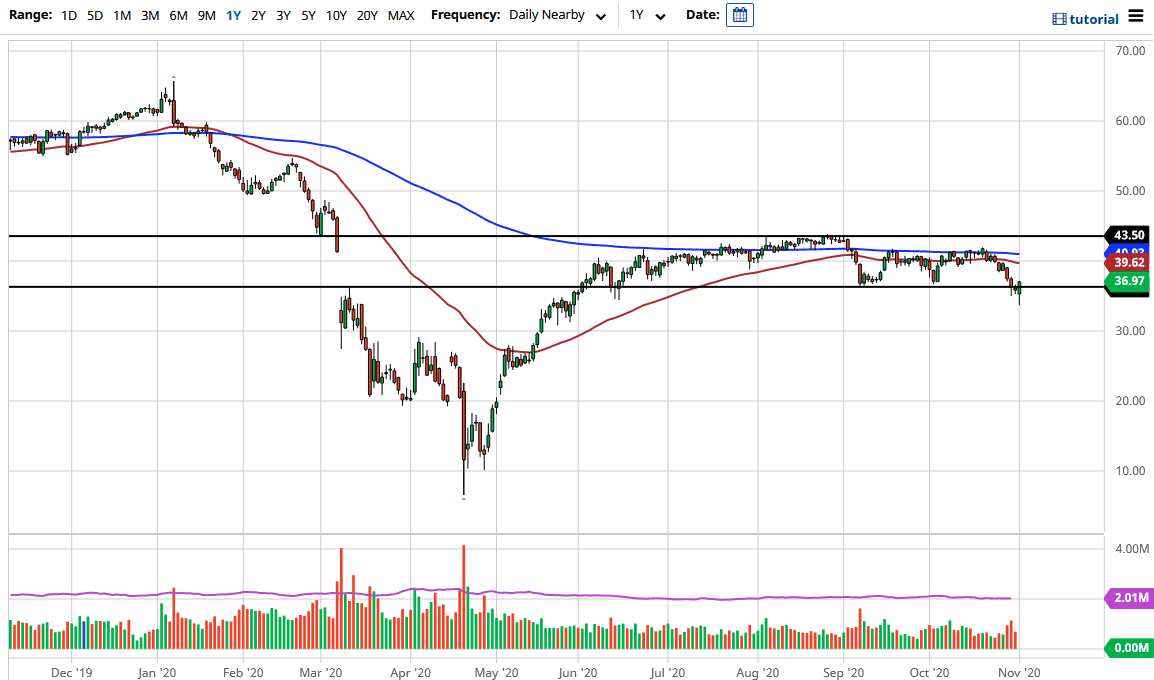

On the downside, if we break down below the bottom of the candlestick it is likely that we go looking towards the $30 level. The $30 level should be massive support, as it is a large, round and psychologically significant figure in an area that will attract a lot of attention. Even if we do rally from here, I would be very interested in shorting this market near the 50-day EMA which is near the $39.50 level. Signs of exhaustion will be jumped upon by most traders and, if we get even more noise out there from a political standpoint, oil would likely roll over. I have absolutely no interest whatsoever in trying to buy this market. This is a volatile market just waiting to happen.