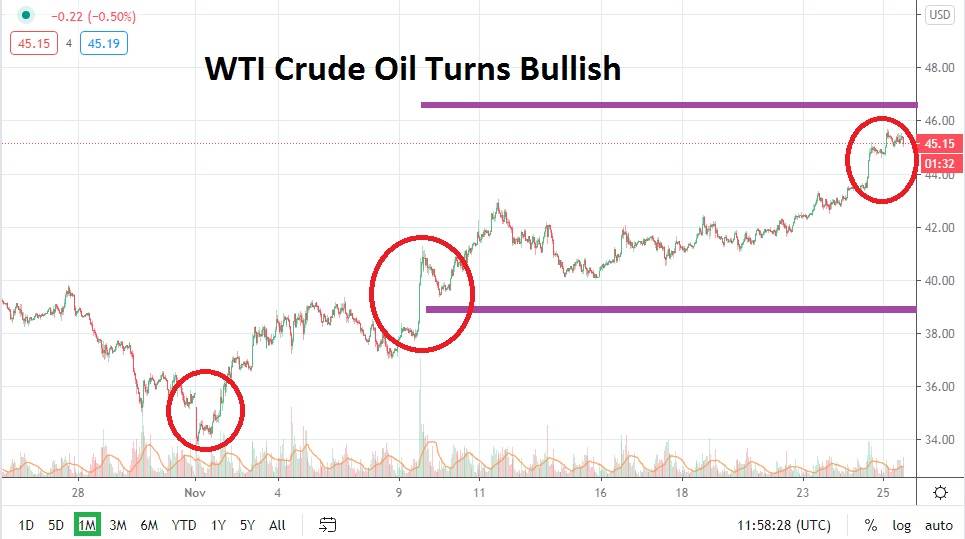

Dumb luck, coincidence or actual impetus witnessed a predicted rise in the price of WTI Crude Oil the past three weeks. Before the US presidetial election, the commodity began to touch lows not traded since late May when WTI crude oil traded near 35.50 USD. However, as November begins to come to a close, the commodity is standing on the other side of its trend line as it challenges highs it has not experienced since early March. December looks like it may be a promising speculative bullish month for crude oil.

What happened? Has the victory of President-elect Joe Biden caused a reaction in the market based on the notion his administration will take a tougher stance on oil producers in the US? Has the recent announcement of John Kerry as the envoy of Biden’s climate change team also added fuel to the notion that the White House will crack down on the shale industry?

Or, is the stellar global risk appetite that is being experienced in financial assets indicating that investors are optimistic about the economic picture because of potential coronavirus vaccines? The answer may be a combination of all the listed factors. Certainly, a quantified value on WTI crude oil’s price based on how the far environmental mandates will impact the industry is conjecture at best before any mandates are suggested and authorized.

No matter the reason, it appears WTI crude oil has seen the last of its darkest days which it experienced in spades during the month of April when it sank below 20.00 USD. The commodity has not only lived to play another day and be wagered upon by speculators, but it now is within the confines of an actual bullish trend as December begins. As WTI crude oil tests highs it has not ventured in since March, price values for the commodity may begin to target higher resistance levels.

Resistance around the 46.40 to 47.00 USD price levels could prove to be very important. If these marks are broken higher, speculative forces may begin to believe WTI crude oil has the capability to challenge the 50.00 mark. A significant amount of more optimism within the global markets may have to occur for that to take place, but if investors remain optimistic, push equity indices higher and have a firm belief that international commerce will improve long term, this could set off more speculative buying of the commodity.

A price of 53.00 USD for crude oil is not far-fetched; in fact, it sounds and looks much more viable via technical charts than a strong drawdown through support levels below the 42.00 USD mark. Certainly, crude oil could see downside pressure develop, and it is a certainty that reversals lower will occur. But a bullish trend has developed which may be difficult to curtail over the next month.

Buying WTI crude oil on slight reversals lower may prove to be the wise speculative decision in the coming weeks. The commodity has put in a flurry of gains the past three weeks, but it is still below its stronger March trading values as they beckon their targets to speculative forces within the marketplace. This perception may attract more bullish action during the month of December.

WTI Crude Oil Outlook for December:

Speculative price range for WTI crude il is 39.30 to 53.85 USD.

Support at 42.90 USD appears adequate, but if taken lower, crude oil could technically perhaps find a way to test 39.30 USD.

Resistance near 46.40 USD could see a battle, but if the 47.00 USD level is broken a strong test higher could develop and the 50.00 to 53.00 USD junctures could come into sight.