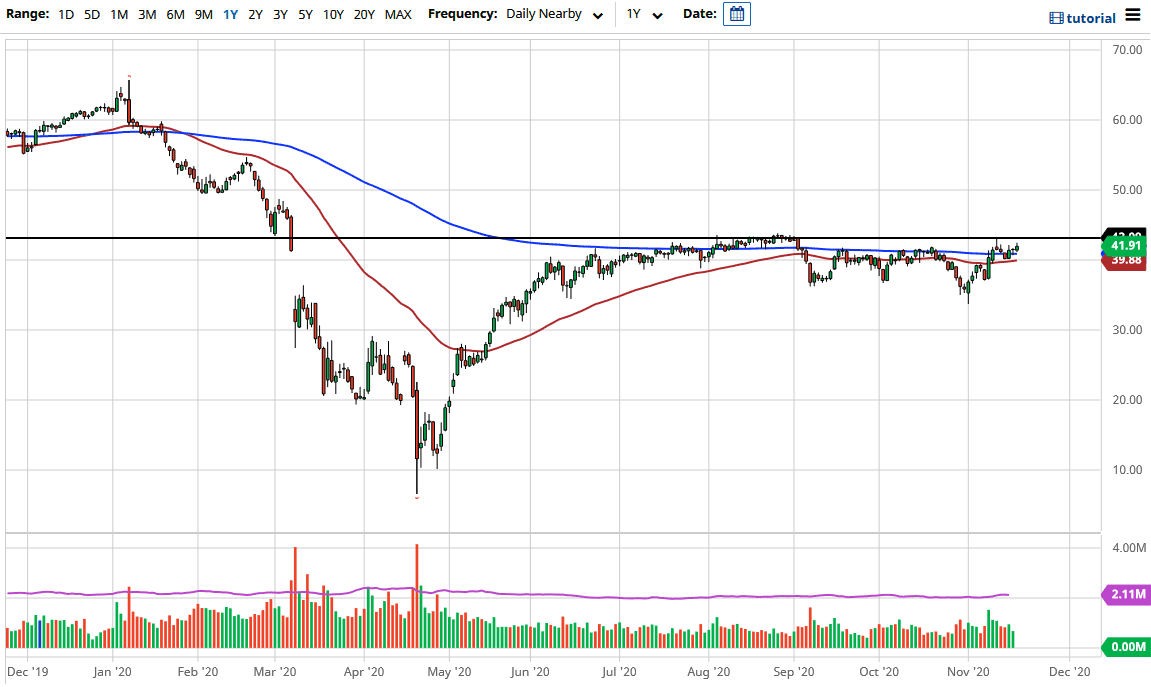

The West Texas Intermediate Crude Oil market has rallied again during the trading session on Wednesday, but continues to struggle with the idea of breaking out to the upside. The $43 level above is massive resistance, and as the inventory numbers came out less than ideal, the idea of crude oil rallying significantly from here is a bit of a stretch. Many traders are focusing on the possibility of the vaccine opening up the economy. Because of this, there are people out there willing to buy energy based on a possible stronger future.

There was a huge oversupply of crude oil before the coronavirus hit, so we will continue to see a bit of a ceiling on this market. That's why I do not trust rallies, even though it has been rather strong over the last several weeks. The $43 level seems to be a massive amount of supply, so it will be interesting to see if we can continue to go higher. If we cannot, and especially if we break down below the $40 level, then we will see a push to the downside, perhaps down to the $35 level. That is an area in which we have seen buyers previously, so I would not be surprised to see a bit of a bounce from there.

However, if we were to break down below there, it is likely that the market could drop all the way down to the $30 level, perhaps even opening up a move down to the $25 level. I do not expect this market to be easily shaken, because it has had plenty of opportunities to start selling off recently. What we are looking at here is the possibility of a move into the market by simply shortening signs of short-term exhaustion. We will continue to see a lot of choppy behavior, but we are clearly struggling to go higher. If we do break out, then the market would probably go looking towards the $50 level, but we are not quite there yet.