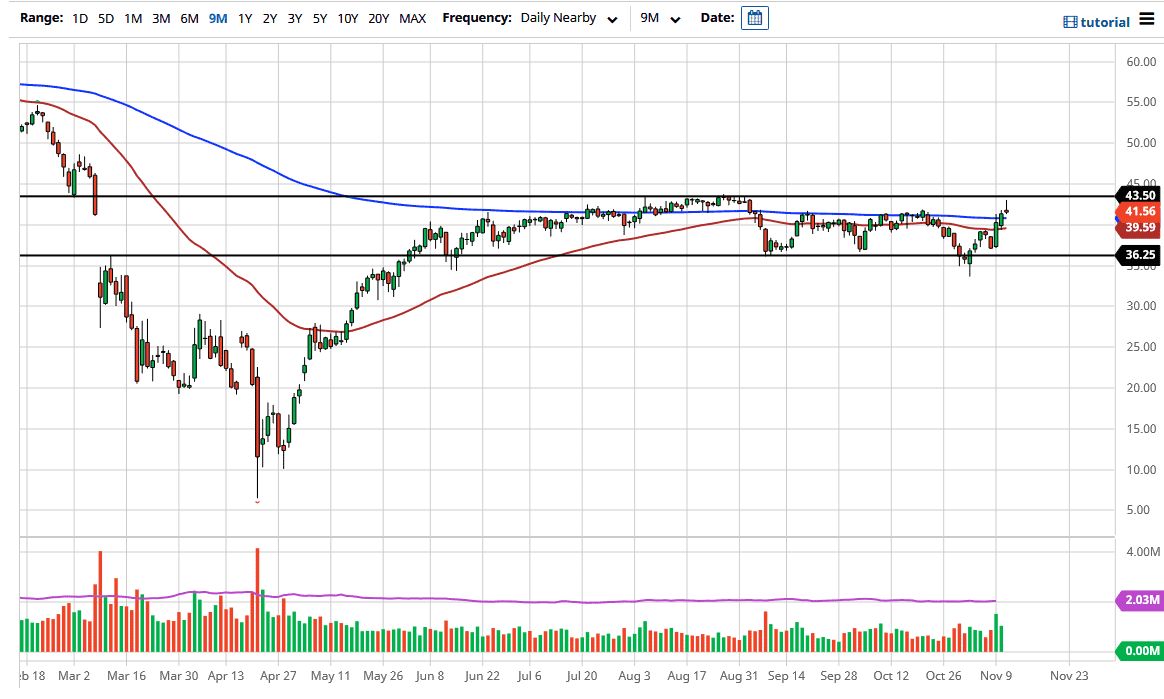

The West Texas Intermediate Crude Oil market rallied during the trading session on Wednesday, reaching towards the top of the range and the $43.50 level before pulling back. The market has gotten ahead of itself, so this should not be a huge surprise that we are starting to sell off into the close of the day.

Looking at the chart, you can see that the shooting star has formed in what would essentially be the “perfect place.” If we break down below the bottom of this candlestick, it is likely that we go looking towards the 50-day EMA. Looking at the moving averages, you can see that both the 50-day and the 200-day EMA indicators are perfectly flat which means that we are still range bound, regardless of the explosive move that we have seen over the last couple of days. The market will probably find it difficult to go higher because the coronavirus numbers are getting worse, which could slow down many of the world’s economies. Stimulus is going to be smaller than originally thought in the United States, which will have a strong effect on how people are betting the oil markets.

To the downside, the $36.25 region down to the $35 region is a major support level, so if we were to break down below that it would be an extraordinarily negative signal. I do not think that happens during the day here, but a move towards that general vicinity makes sense. Looking at this chart, I do not see any real drive to go in one direction or the other for the longer-term move, and we are simply settling in this area to try to figure out where to go next. The market is likely to vacillate, as we have no real direction to follow. I believe that we simply look at this range as the same one that we had been in previously. Pay attention to the US dollar, as it does have a relatively strong inverse correlation these days.