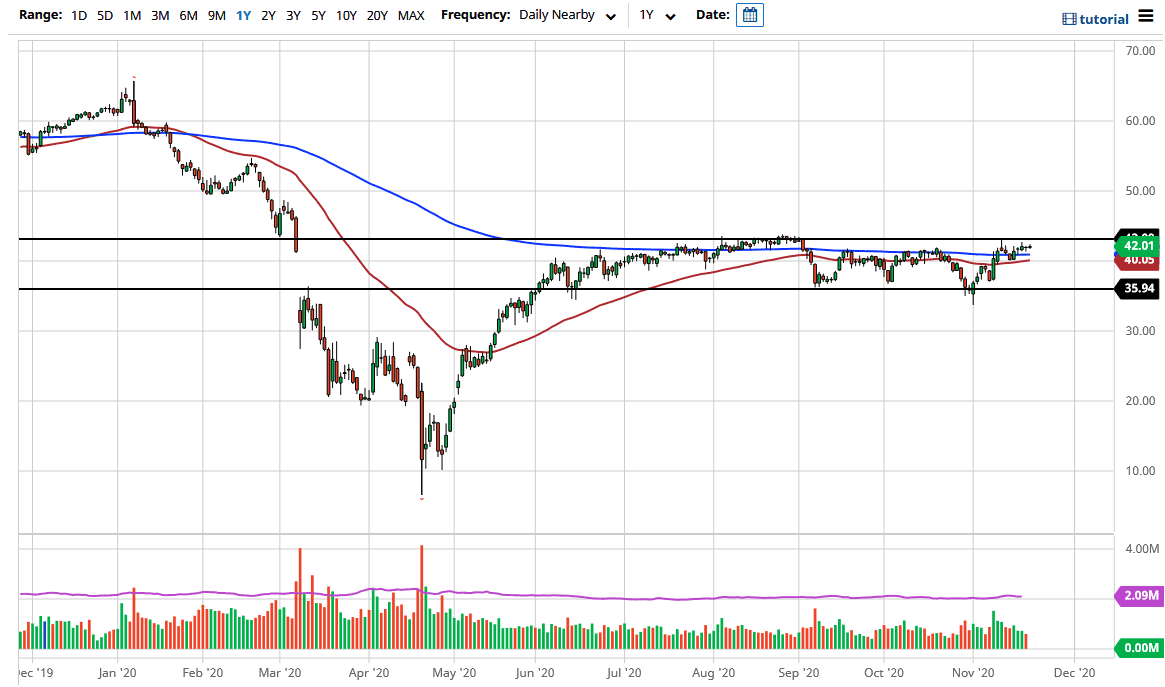

The West Texas Intermediate Crude Oil market had initially rallied during the trading session on Friday, but we continue to see the $43 level above offer resistance. This is understandable, considering that the fact that we have many moving pieces at the same time, and the market is likely to see a lot of confusion going forward.

The crude oil market has been sideways for a while, but it has to look through the possibility of whether or not the economy is going to grow between now and the release of a coronavirus vaccine. The bullish traders out there take a look at the vaccine as opening up economies, but we should never forget that there was an oversupply issue long before the coronavirus. Because of this, I think that we will continue to stay in this range, and even if we do break out it will be a somewhat limited move.

If we can get a daily close above the $43 level, then the market could go towards the $45 level, possibly even the $50 level. The 50-day EMA and the 200-day EMA are both sitting underneath offering support, just as the $40 level will. In the short term, we are simply going to bounce around between the $40 level on the bottom and the $43 level on the top. Nobody really knows what to do next; while people want to be bullish, the reality is that a lot of economies are going to be shutting down in the short term, driving down demand even further. We need a catalyst to get this market moving, but now I think we are simply killing time trying to figure out where to go next. Pay attention to the US Dollar Index, as it has a negative correlation to this market over the longer term quite often. If we see a sudden spike in the value of the US dollar, that will probably drive down the value of oil. The opposite is true as well, as it will take more of those US dollars to buy a barrel of oil.