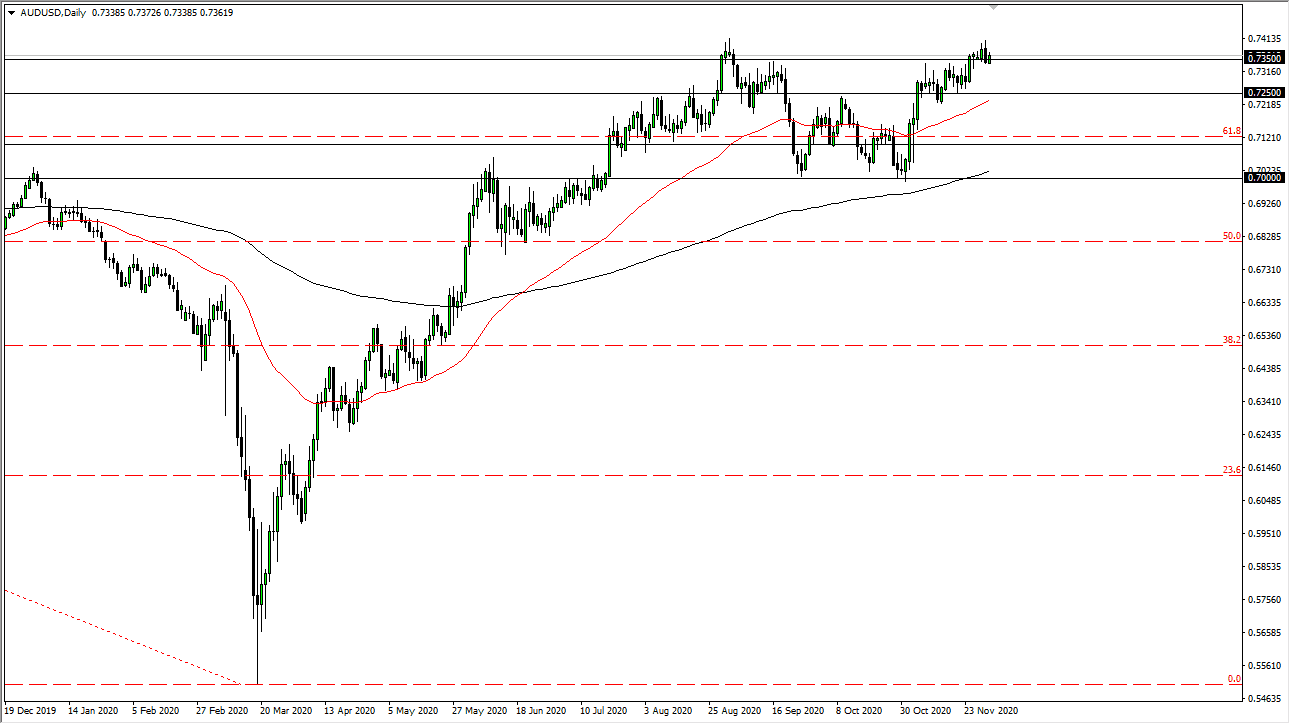

The Australian dollar rallied a bit during the trading session on Tuesday, as we continue to consolidate quite a bit. The question is whether or not we can break out to the upside. To determine this, you could take a look at the EUR/USD pair, which clearly has broken out during the trading session and shows just how soft the US dollar is in general. The Australian dollar is lagging a bit, but that should not be much of a surprise considering that we have the RBA Governor speaking later and there is a GDP figure coming out. Because of this, it is likely that the Australian dollar is simply in a holding pattern.

However, as the US dollar is typically going to move in the same direction against most currencies, it is only a matter of time before the Aussie breaks out. With that in mind, I like the idea of buying short-term pullbacks and will take advantage of them as potential value. I currently see the 0.7250 level underneath as potential support, with the 50-day EMA racing towards it as well. Nonetheless, it should be obvious that you cannot be shorting this market right now, so it is only a matter of time before we get a boost higher.

There is basically a 100-pip range underneath that is going to continue to offer plenty of buying opportunity, so I will be looking for short-term set ups that I can take to the long side. I have no interest in shorting the Aussie anytime soon, especially after we have seen the US dollar get absolutely clocked during the New York session. It appears that we are now in a new phase of the markets, and the US dollar will probably continue to struggle. It would take a major shift in fundamentals for me to start selling, and the market is starting to lean in one direction. That means we should have a major “risk-on move” coming over the next couple of weeks. Clearly, the market is trying to price in the recovery and reflation trade.