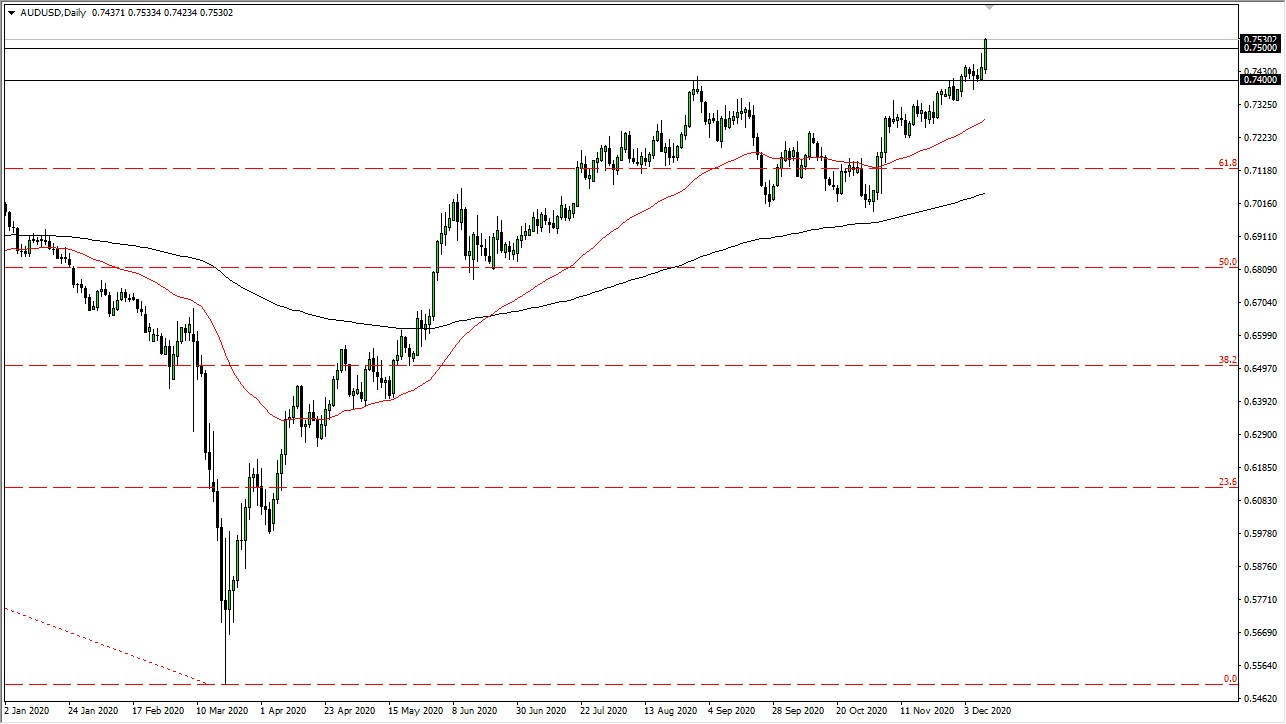

The Australian dollar rallied significantly during the trading session on Thursday to break above the 0.75 handle. This is a major accomplishment for the Aussie dollar, as it has been grinding for quite some time, and it now looks as if we have run into a significant amount of resistance in the area between the 0.74 level and the 0.75 level. We did break through that during the day on Thursday, which is a very bullish sign. In fact, we are closing towards the top of the range, which suggests that there is a bit of follow-through waiting to happen.

The size of the candlestick is much larger than the previous one for the week, which tells me that something has suddenly changed. Furthermore, the US dollar is losing strength in general, so the Aussie dollar is likely to continue to go higher. Longer term, the 0.7750 level is likely the target, perhaps even the 0.80 level. Pullbacks will eventually be bought into, as this was a major event for the Aussie dollar. Underneath, we have the 50-day EMA as well, colored in red on the chart. That is starting to turn to the upside, and I think we are going to see a lot of buyers trying to take advantage of the obvious shift in attitude yet again.

To the downside, I do not even have interest in trying to short this market anytime soon, because it has seen such a shift in overall attitude. I am a buyer of dips and looking to hold on for the bigger move. The market continues to be driven by talks of stimulus in the US, as well as the reflation trade. The reflation trade suggests that commodities will be picked up quite drastically and send the Aussie higher as a result, as it is so highly correlated to “hard assets” such as gold, copper, iron, aluminum, and the like. As long as central banks around the world continue to flood the markets with liquidity, that will probably be the favored trade. After all, the one thing that really gets hammered during these reflation trades is the greenback.