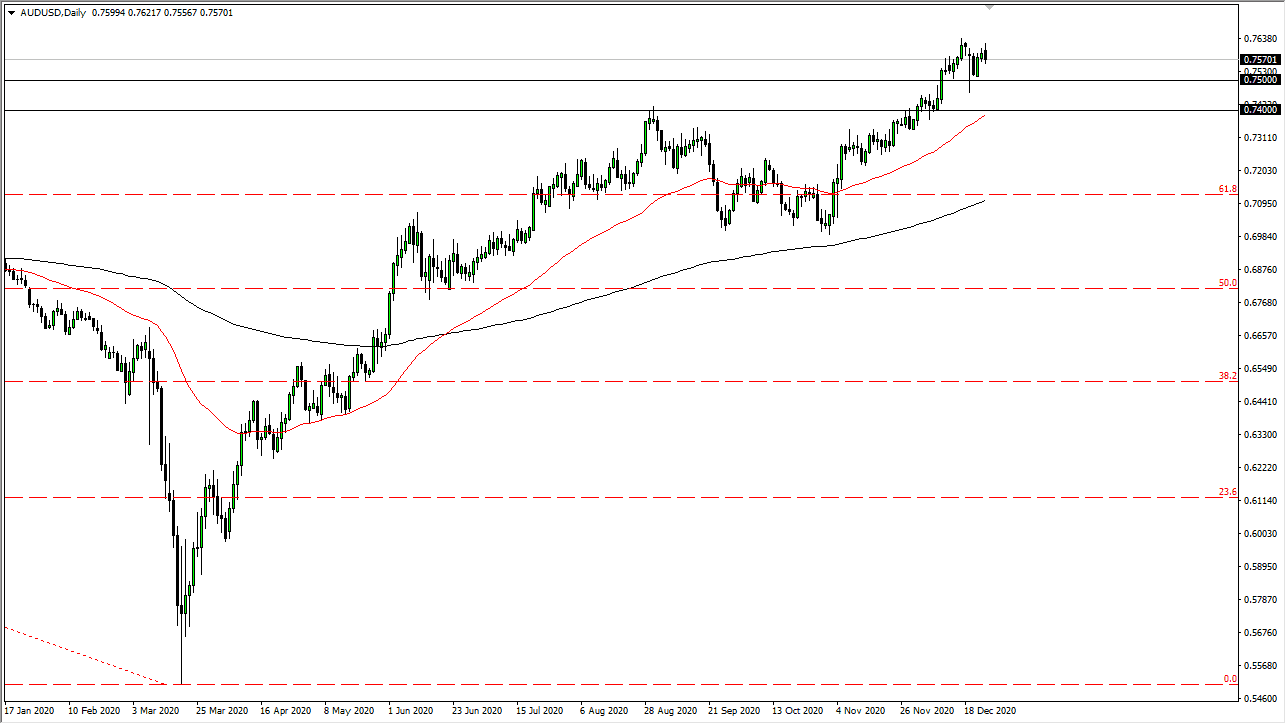

The Australian dollar initially tried to rally a bit during the Monday session, but as we are trading between Christmas Day and New Year’s Day, it is the thinnest time of year. This can lead to strange movements, but the Australian dollar has been very bullish for some time. We need to keep that in mind and continue to look for longer-term buying opportunity is if they present themselves.

To the downside, the 0.75 level is the beginning of significant support that extends down to the 0.74 handle, which is also backed up by the 50-day EMA sitting just below the 0.74 level. That continues to offer value, so the dips will be bought into, but the next couple of days are probably going to be difficult. The market will then continue the overall uptrend, and stimulus in the United States should continue to devalue the US dollar. However, if the market is breaking down below the 50-day EMA on a significant move, then it may lead into something a bit bigger. I think there are a lot of concerns out there, and that could drive up demand for the greenback.

For myself, the most important indicators will be the US Dollar Index and the 88 handle. If we were to break down below the 88 handle then I would anticipate that you could probably sell the US dollar against almost anything, the Australian dollar included. In the meantime, we have a lot of fluctuation in the same general vicinity, so it is likely that we will continue to see choppiness. The lack of volume lends itself to this type of market, and that makes the most sense at the moment. We are a bit stretched, and we are near an area that had caused some selling in the past on the long-term charts. A pullback makes sense, as it could lead into enough momentum to finally break out.