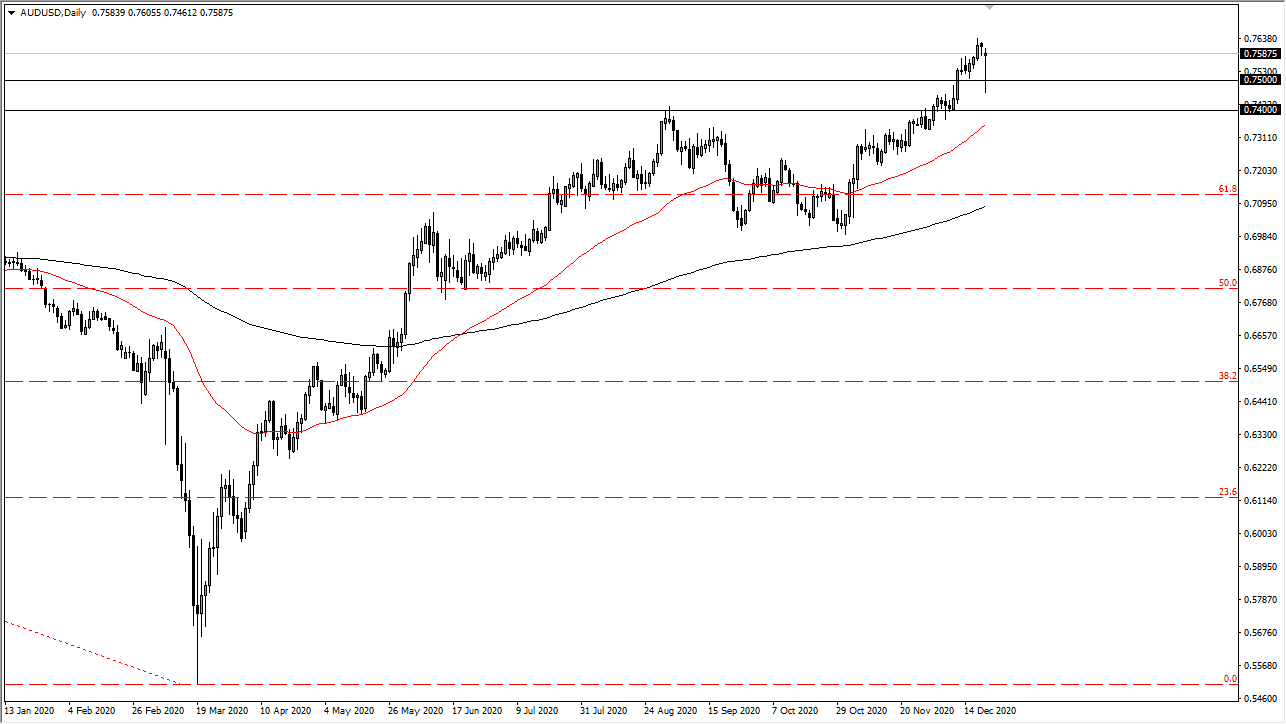

The Australian dollar has been all over the place during the trading session on Monday, due to concerns surround a coronavirus mutation in the United Kingdom. This had people jumping into the US dollar overall, which had a “knock on effect” over here as well. The massive candlestick for the trading session on Monday has been all over the place, but what is most important is that we have formed a hammer sitting right on top of the 0.75 handle. The 0.75 handle has support all the way to the 0.74 level, as well as the 50-day EMA. This is likely yet another “buy on the dips” opportunity.

Whether or not we continue to go higher right away might be a different question, but it appears that the market is still very much in an uptrend. Now that we have seen this massive turnaround, it is likely that the Aussie will continue right along its merry little way. We will see the market go looking towards the 0.80 level given enough time, but it may need to make a bit of a stop at the 0.7750 level based upon historic charts.

To the downside, if we were to break down below the 50-day EMA, then the market would look a bit more negative, but really at this point it does not seem to be likely. After all, if we could not break down the Aussie on a day when the coronavirus has shut down the United Kingdom, it is a bit difficult see when the “risk off” trade would send this market much lower. This is not to say that we cannot go down, but most of what we have seen probably had a lot to do with a lack of liquidity in this market. In other words, it is possible that we may not have fallen quite as far on a typical day. I like the idea of continuing to be bullish of the Aussie, as the reflation trade will continue to accelerate the commodity space. The commodity market will get a bit of a boost due to the stimulus in the United States, so the Aussie is used as a proxy.