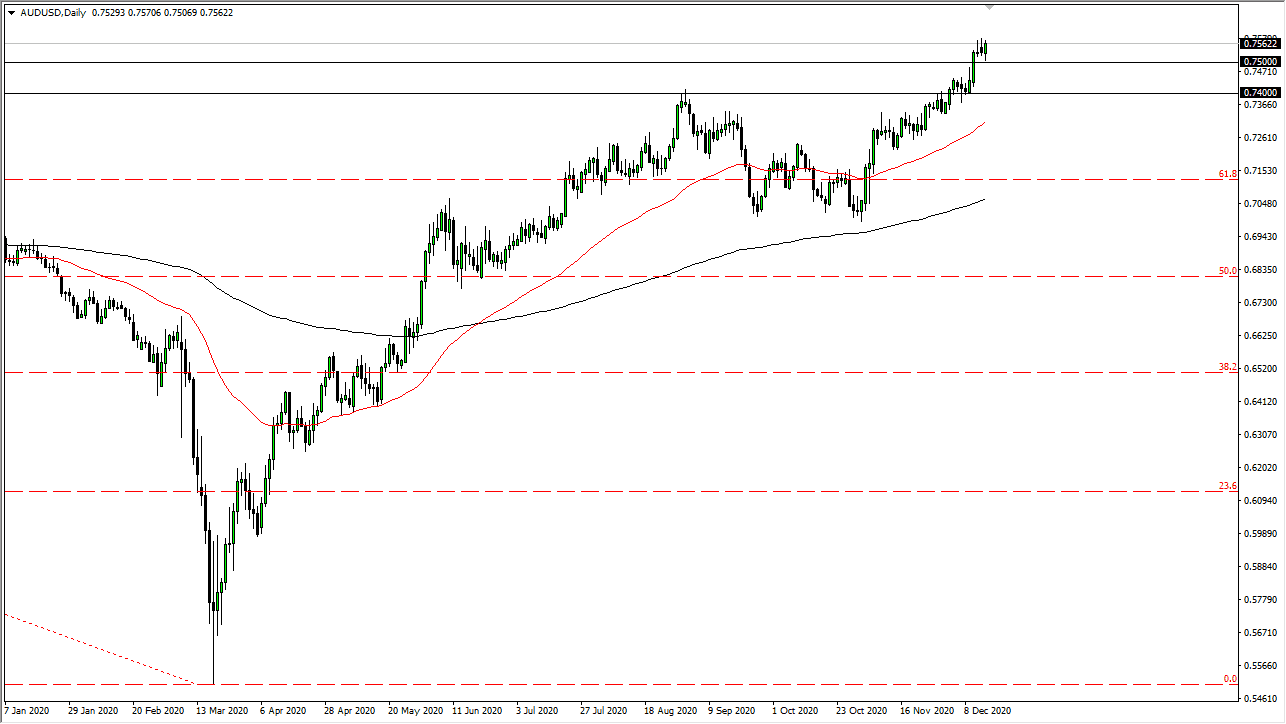

The Australian dollar pulled back during the trading session on Tuesday, only to find support again at the 0.75 level. This is an area that has been supportive more than once, so it makes sense that we see buyers jump back in here. In fact, there is a huge zone of support that extends down to the 0.74 handle, so it is almost impossible to imagine that this market is suddenly going to break down and fall apart. However, if the Federal Reserve does not show signs of loosening monetary policy on Wednesday, then we could see the market break down significantly. But the Australian dollar is highly sensitive to risk appetite, so as long as stimulus comes out and the Federal Reserve steps in line, the Aussie should continue to go higher.

Underneath, we have the 50-day EMA reaching towards the 0.74 handle, so it looks like an area that should show a certain amount of support based on the fact that we have recently seen the surge higher, as well as the 50-day EMA offering plenty of support. Pullbacks will be jumped on by value hunters, and then aim for the 0.7750 level, which has been my target for a while.

To the downside, if we were to break down below the 50-day EMA, it is possible that we could go down to the 0.7150 level, but it seems unlikely to happen. This would almost certainly be due to the Federal Reserve stepping away from supporting the economy, something that is almost impossible to happen anytime soon. To that end, it is only a matter of time before somebody gets involved and start picking this up. I anticipate that Wednesday afternoon could be a bit noisy, but the longer-term trend should still continue and send this market to the upside. We will eventually break to the upside and continue to go much higher. The US dollar will get a bid if we get a “risk off” situation, which you would see across the Forex markets.