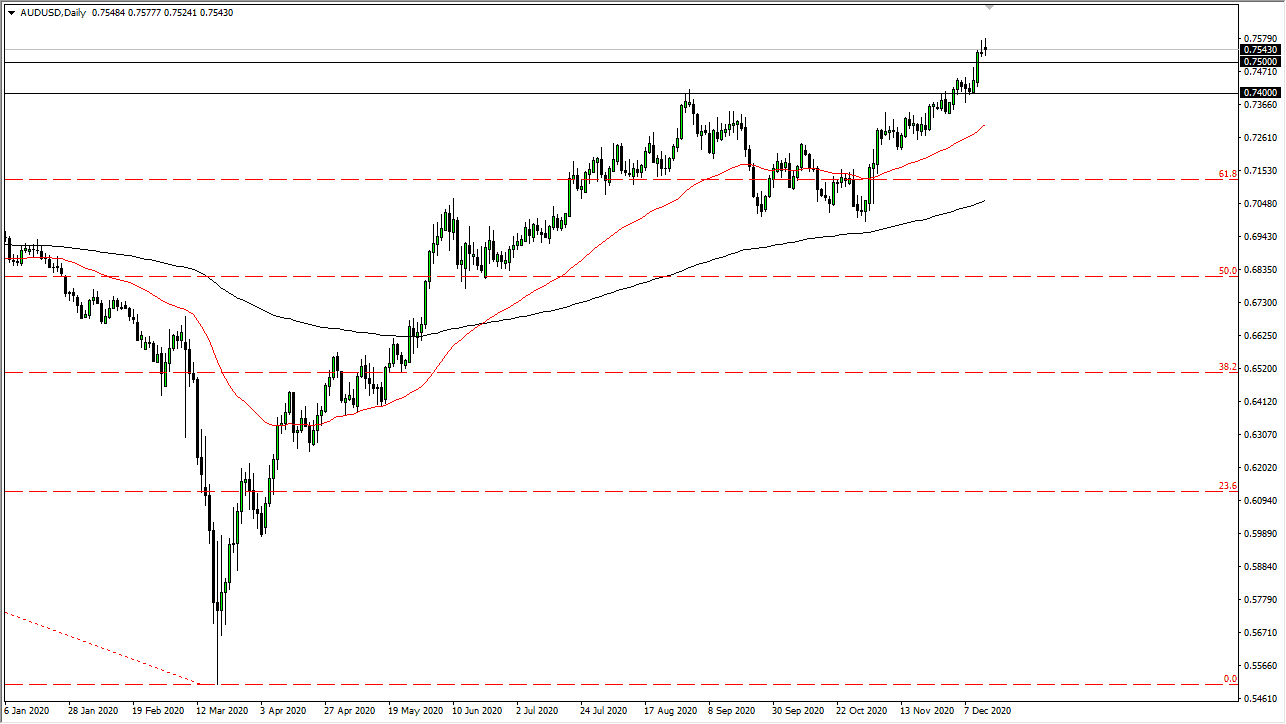

The Australian dollar continues to grind overall as we try to digest the idea of being above the 0.75 handle. That is a good sign, and it most certainly means that if we can stay above that level, there should be another leg higher. The Australian dollar is essentially waiting to see what happens with the US stimulus package, and how big it will be. The AUD is especially sensitive to this because not only will it devalue the US dollar in general, but the idea of stimulus also driving up demand for hard assets will be a specific boon for the Aussie.

Looking at this chart, there is support extending all the way from the 0.75 level to the 0.74 level, and with the 50-day EMA reaching towards the 0.74 level, we will probably find plenty of buyers on these dips. Furthermore, if we finally get some clarity when it comes to stimulus, it is likely that we will finally see that turn around and shoot to the upside. As far as selling is concerned, I have no interest whatsoever in trying to short this market, unless for some reason the Americans suddenly decide that they are not going to do stimulus at all. That seems to be very unlikely at this point, but I suppose it is always a possibility.

The most recent move of the Australian dollar has been a bit overdone, so it follows that maybe we have to go sideways in order to digest some of the gains, but the trend is still very much to the upside so there is no need to fight it. This will be especially true if we get more “post-vaccine trading” around the world, as the Aussie is a higher beta currency. Keep in mind that risk appetite in general will have an effect as well, but right now it seems like people are willing to buy things into the end of the year, in which case the Aussie will gain from that as well. The main take away is that buying dips continues to be the best way to work this market going forward.